This is a guest post from Simon Thillay, Head of ASO at App Tweak. Simon leads an international team of ASO Experts servicing top apps across a variety of categories and countries, and contributes to advancing ASO knowledge with practical research and frameworks such as A/B/B testing or Brand Defense Cost Modeling in Apple Search Ads. A seasoned speaker at mobile growth conferences, he is also a co-author of The Advanced ASO Book – 2022 and hosts many online webinars.

Ever since the launch of Apple Search Ads (ASA), bidding on brand names has become common practice for most advertisers. Many app names have a higher search volume than generic keywords: AppTweak found that in September 2022, only 6 of the 100 most searched keywords on the US App Store were generic terms.

In this context, brand defense campaigns have also quickly become a standard practice in Apple Search Ads to prevent competitors from appearing at the top of search results. With such campaigns comes the risk of ASA cannibalization, and in this article, we take you over how this cannibalization occurs and two different methods that can help you assess the efficiency of brand defense campaigns and arbitrate whether to continue bidding on your brand name or indeed go after other keywords.

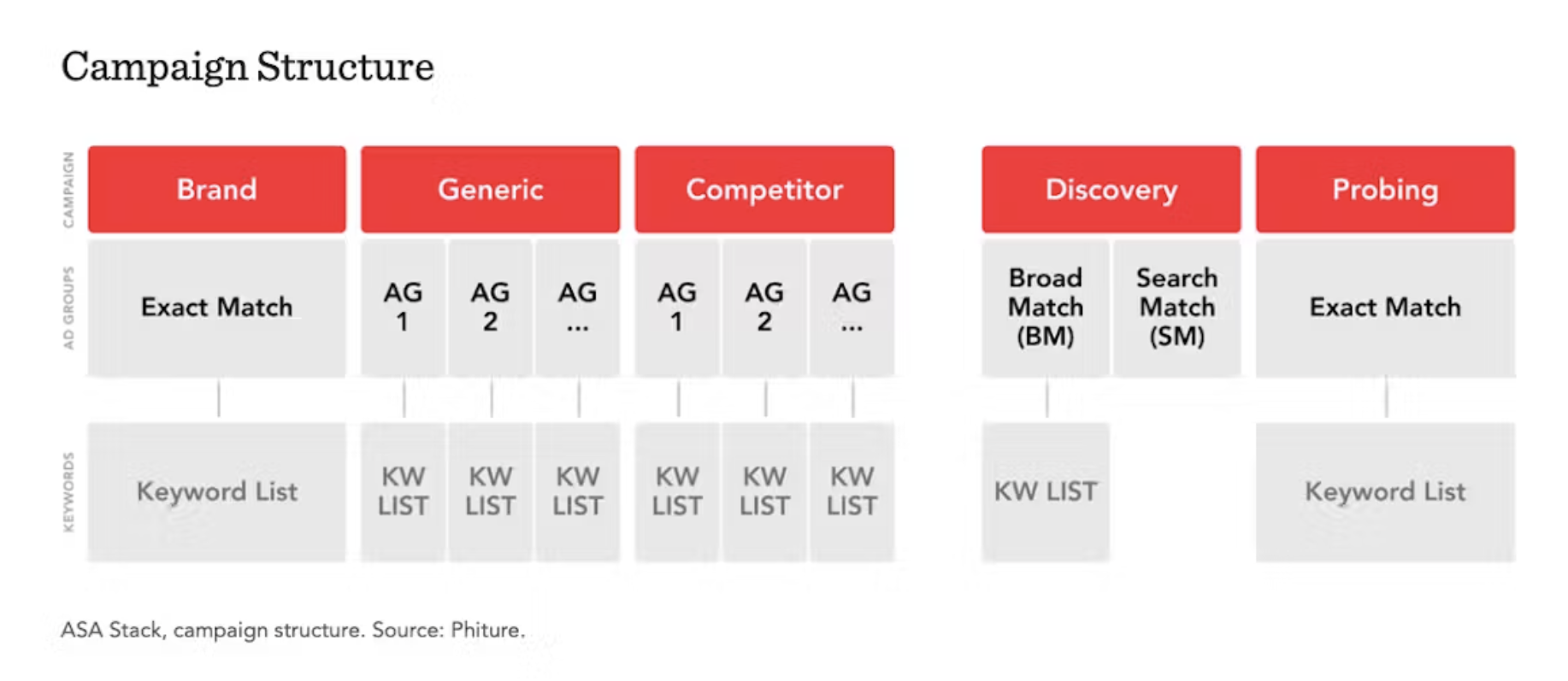

Campaign structure for ASA per Apple recommendations, as reproduced in Phiture’s ASA Stack and the Advanced App Store Optimization book.

Comparing brand defense campaigns to a prisoner’s dilemma

In truth, most advertisers would likely prefer to avoid bidding on their own brand name, but are still quickly swayed to do so when under the threat of losing installs from their most performing search term. This has led paid UA experts like Eric Seufert from MobileDevMemo to compare advertising on Apple Search Ads to a prisoner’s dilemma. That is to say, advertisers will assume that if they don’t, other apps will bid on their brand names and enter the bidding process, despite the certainty that such campaigns will result in at least some cannibalization.

Practically, one way to try and avoid this prisoner’s dilemma would be to enter into a gentlemen’s agreement with competitors and renounce bidding on their brand terms in exchange for them to do the same with yours. Unfortunately, while this can be a very good tactic in the short term, the passage of time and unfolding developments are likely to threaten this strategy’s success in the long term (just like a real prisoner’s dilemma). This is because of the risk involved of (any one) competitors breaking their word, but also because new entrants in the market could take advantage of this situation.

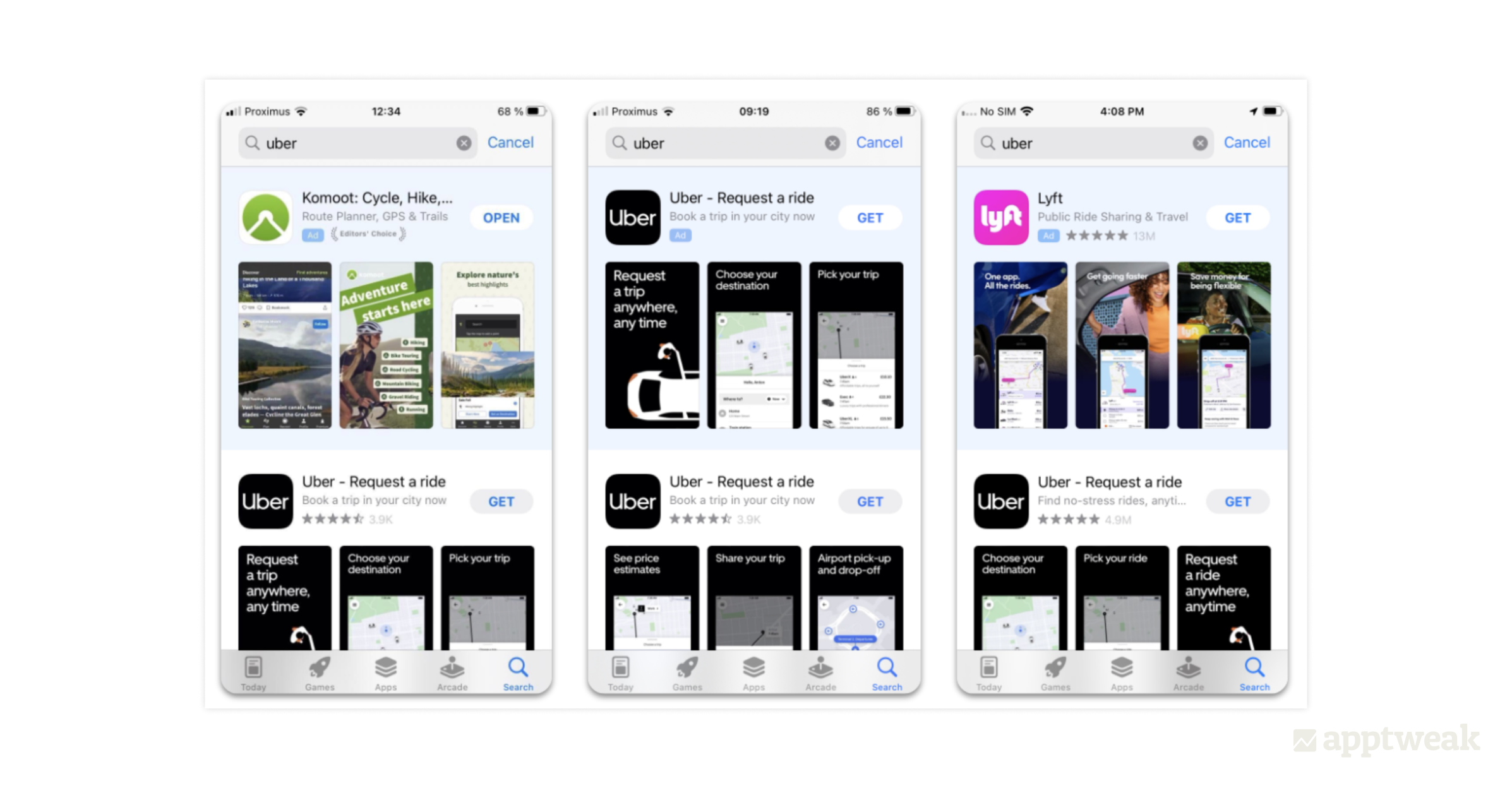

Cannibalization in ASA: a conversion differential challenge

When examining the inner workings of this prisoner’s dilemma, a proper description would be that cannibalization in Apple Search Ads occurs when a user, who downloaded an app through an ad, would have downloaded the same app (presumably from the first organic search result position) if a different ad had been shown to them. Basically, this means that cannibalization is likely if the ad appearing on your brand keyword is mostly irrelevant. On the other hand, defending your brand name is likely much more necessary when other apps bidding on it have real chances to convince users to download their apps instead of yours. In short, cannibalization is more likely when the attacker’s conversion rate for your brand keyword is much lower than your own.

Uber defending its brand is more likely to lead to cannibalization of organic installs if winning an auction against Komoot than against Lyft

Unfortunately, two key data points that Apple doesn’t provide advertisers are the identity and share of voice of other bidders for a particular keyword or their conversion rate. As a consequence, it is impossible to measure cannibalization or to set up (near) real-time bidding strategies based on which other apps are bidding on your brand name. Nevertheless, two different methods can help you assess the efficiency of brand defense campaigns and arbitrate whether to continue bidding on your brand name or go after other keywords:

1. Correlation analyses with on/off brand defense campaigns

The first method to measure the amount of cannibalization your brand defense campaigns have induced is to stop them for a couple of weeks and compare Apple Search Ads and ASO performances. By working with a data science team, you can aim to establish two baselines respectively for your campaign installs and overall Search installs (measured in App Store Connect) to compare with real data observed in weeks when brand defense was on pause. At this point, the gaps between the three curves can be interpreted as the amount of cannibalized installs and truly protected installs induced by the brand defense campaign.

Turning brand defense campaigns off and on multiple times may help you fine tune your estimation of the share of cannibalized installs. However, it may also require taking into account whether the identity and Share of Voice of other bidding apps is the same between periods studied for your baseline.

2. Estimating attackers’ conversion rate for your brand name

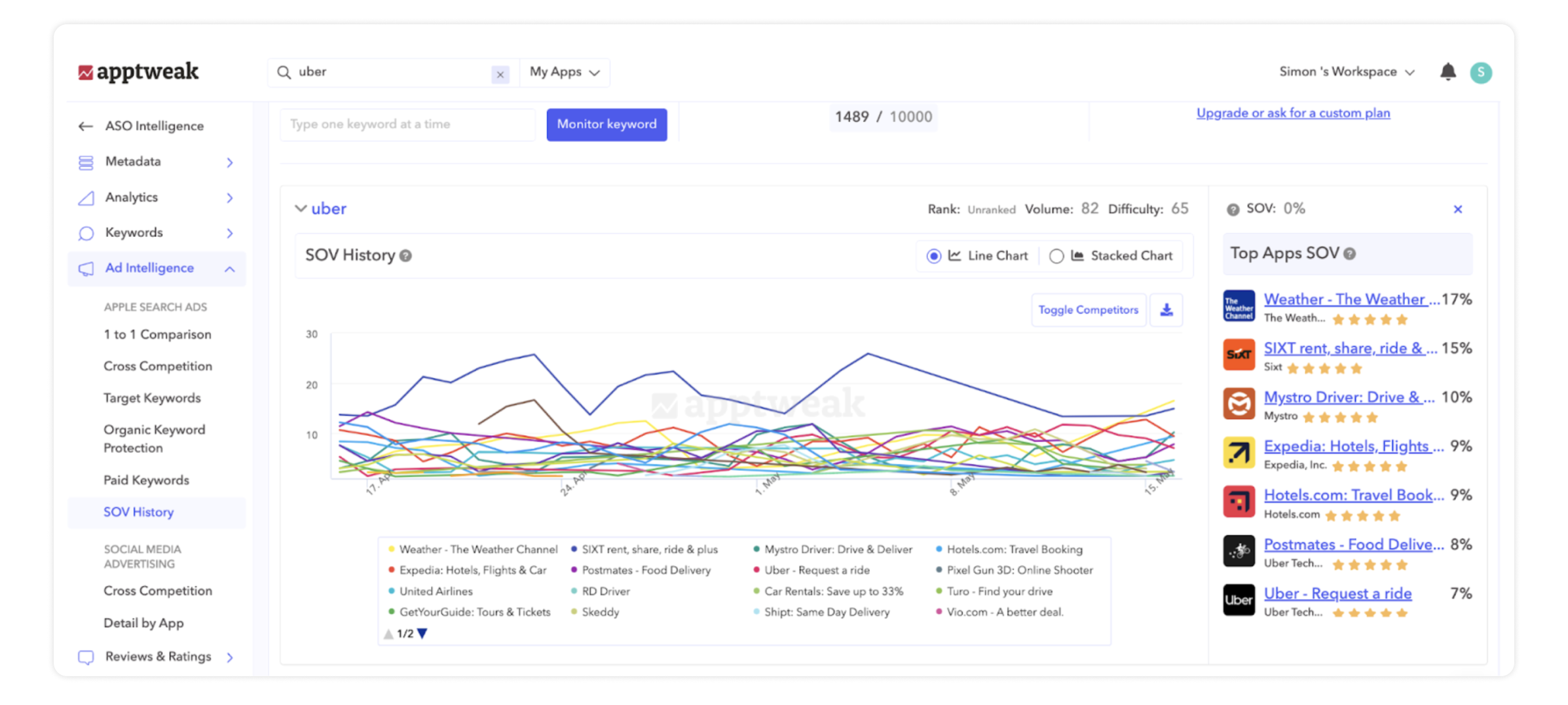

A second method is to identify which apps are bidding on your brand name and try to estimate what their conversion rate for the keyword may be. While Apple does not disclose Share of Voice data of other apps for a particular keyword, ASO tools such as AppTweak can provide Share of Voice estimates of the various apps bidding on any particular term.

AppTweak’s Share of Voice history feature for Apple Search Ads can help reveal who were the most active bidders on the term “Uber” in the past 30 days.

From there, you can start examining their app product page and ASO performance to formulate hypotheses as to what their conversion rate on your brand name may be. When doing so, consider the following elements:

- Your app’s conversion rate (measured as the ratio of downloads divided by unique impressions) can be assumed to be higher than the conversion rate of any of your competitors for your brand name.

- The attacker’s brand notoriety tends to positively impact their ability to “steal” downloads. This is because users will be more easily convinced to download a different app than the one they searched for when presented with an alternative they are already familiar with.

- The attacker’s perceived product similarities are also key in how well they may convert on your brand name. Here, consider not only how much their product offers the same benefits as yours, but also how alike they appear to be for store visitors who won’t always explore product pages.

- If you have bid on an attacker’s brand keyword recently, your campaign’s conversion rate can serve as an anchor for your hypotheses.

- Last but not least, remember that apps’ positions in search results for a particular keyword tend to also reflect how well they convert for the term. Indicators such as search rankings and relevancy scores can, therefore, help refine your conversion hypotheses.

These considerations will only help you formulate hypotheses as to what the conversion rate of other apps bidding on your brand name are. Coming up with a few conversion rate hypotheses (for instance one low, medium, and high conversion rate scenario) for each app and then calculating a weighted average of all conversions in each scenario is enough to project the amount of downloads that you would lose to competitors if you were to stop your own campaign.

Formulating a cost per protected install (CPPI)

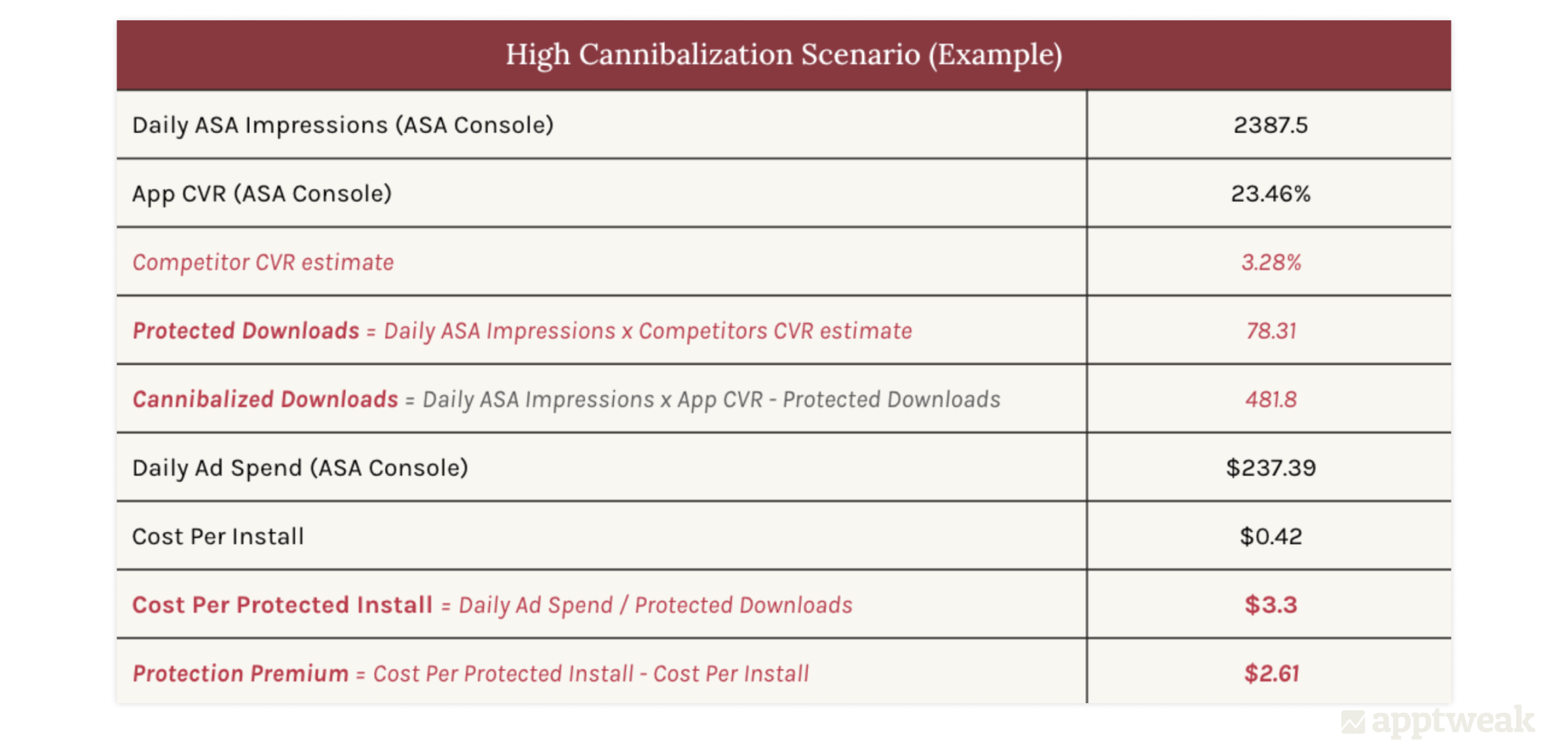

At this point, you can now break down the average daily installs you received from your brand defense campaign into cannibalized installs (average daily unique impressions x competitors CVR hypothesis) and protected installs (your average daily installs – cannibalized installs). From there, you simply have to divide your total campaign spend by your protected installs to calculate your estimated cost per protected install.

Example of a cost per protected install calculation with a high cannibalization hypothesis.

This cost is meant to reflect the efficient cost of your brand defense campaign and can be compared to the cost per Install for other campaigns. This makes it possible to arbitrate between them more efficiently and adjust for when brand defense is more efficient and when scaling on other keywords or targeting new ones is preferable.

Monitor your brand search results

While the process presented in this blog is meant to help make data-driven decisions instead of relying only on “gut feeling” for whether to engage in brand defense campaigns with Apple Search Ads or not, remember that it cannot provide definitive learnings that can be applied forever. New apps may start bidding on your brand name every day, while frequent attackers may improve their campaign conversion rates, especially if leveraging custom product pages (CPPs).

Therefore, it is essential to keep monitoring your brand search results and update your estimations frequently to guarantee your budget attribution is based on relevant data.

Before you go

- Want to stay on top of your app growth strategy using Apple Search Ads? Reach out to us, and we’ll help you.

- The Apple Search Ads (ASA) Stack is a framework designed to help ASA practitioners of a mobile product or service to develop and evolve a strategy for Apple Search Ads. Check out the full framework here.

- We reissued the ASA Stack in March 2023, and you can read a redux of all the major changes here.