Disclaimer: This article is largely influenced by the awesome podcast about subscriptions between Thomas Petit and Eric Seufert. If you haven’t listened to it, I really recommend you do.

When deciding on what kind of subscription you should use or what offers to show, you’re often left blindsided. Would introductory pricing work better than a trial? What if you shorten your trial to just 3 days? Recently, I’ve been trying to wrap my head around these questions, and after some time considering different approaches, I’ve decided to create a framework based on the value a regular user sees in apps across a whole array of verticals.

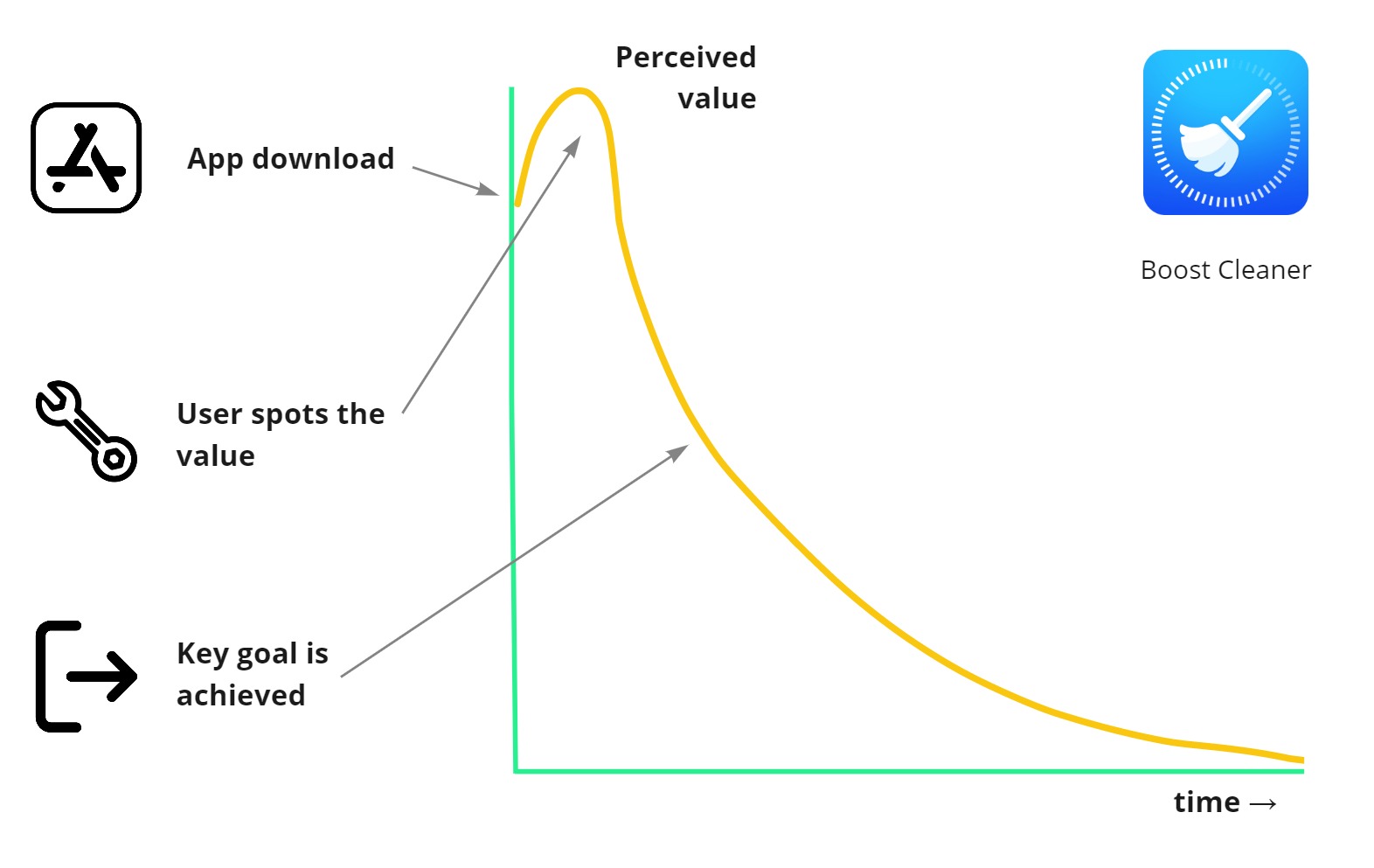

Let’s take the Boost Cleaner app as the first example. When you need to clean your iPhone’s photo storage, you probably want to do it automatically. You download the app, assess its value based on the first two-three screens, and then decide if it’s worth it to pay. The value you see in the app will probably only go down from that point. Either you pay and the job is done—or the offer simply costs too much. If you selected a trial subscription, this is the moment where you’d cancel.

What does all this mean for you as a publisher? If you’re delivering value from the first moment, the trial-period is probably less effective than introductory pricing or even unlocking the functionality by one-time purchase. That’s because the majority of your users will cancel the trial subscription after successfully finishing their goal.

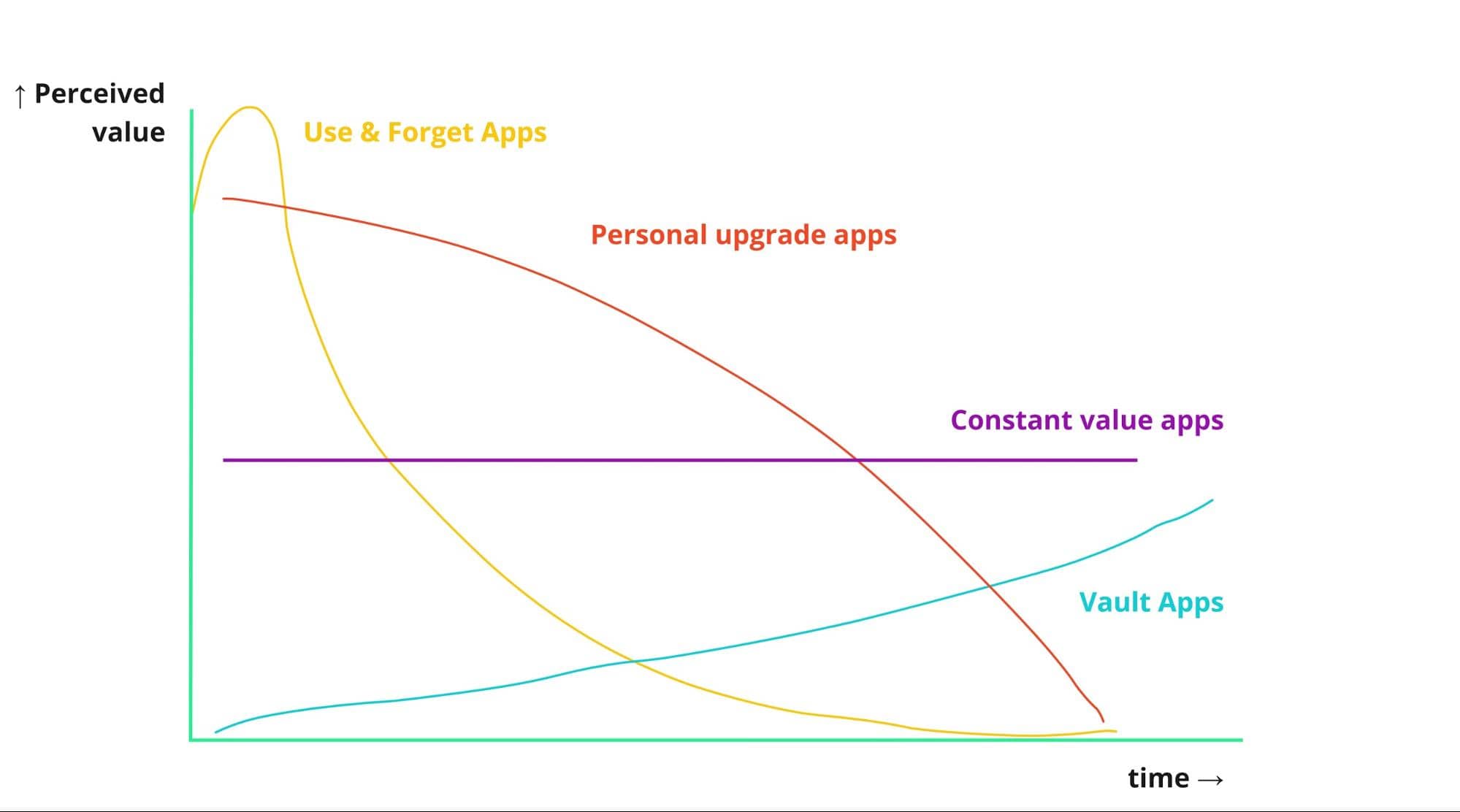

Four App Subscription Strategies

To better understand subscription strategies, I analyzed some popular apps across several app categories and came up with four different approaches to pricing and offers, based on the type of the app and its use case. It’s not an exhaustive list; app value varies a lot even within one category (based on user segment), and with time. Nonetheless, take these as a way to make the most from your monetization efforts in 2021.

Bear in mind that these graphs do not represent user-retention, although it might seem similar, but rather user’s willingness-to-buy which correlates with perceived value. The sequence of the offers in each category reflects my experience with promotion. As usual, however, they need to be tested carefully first.

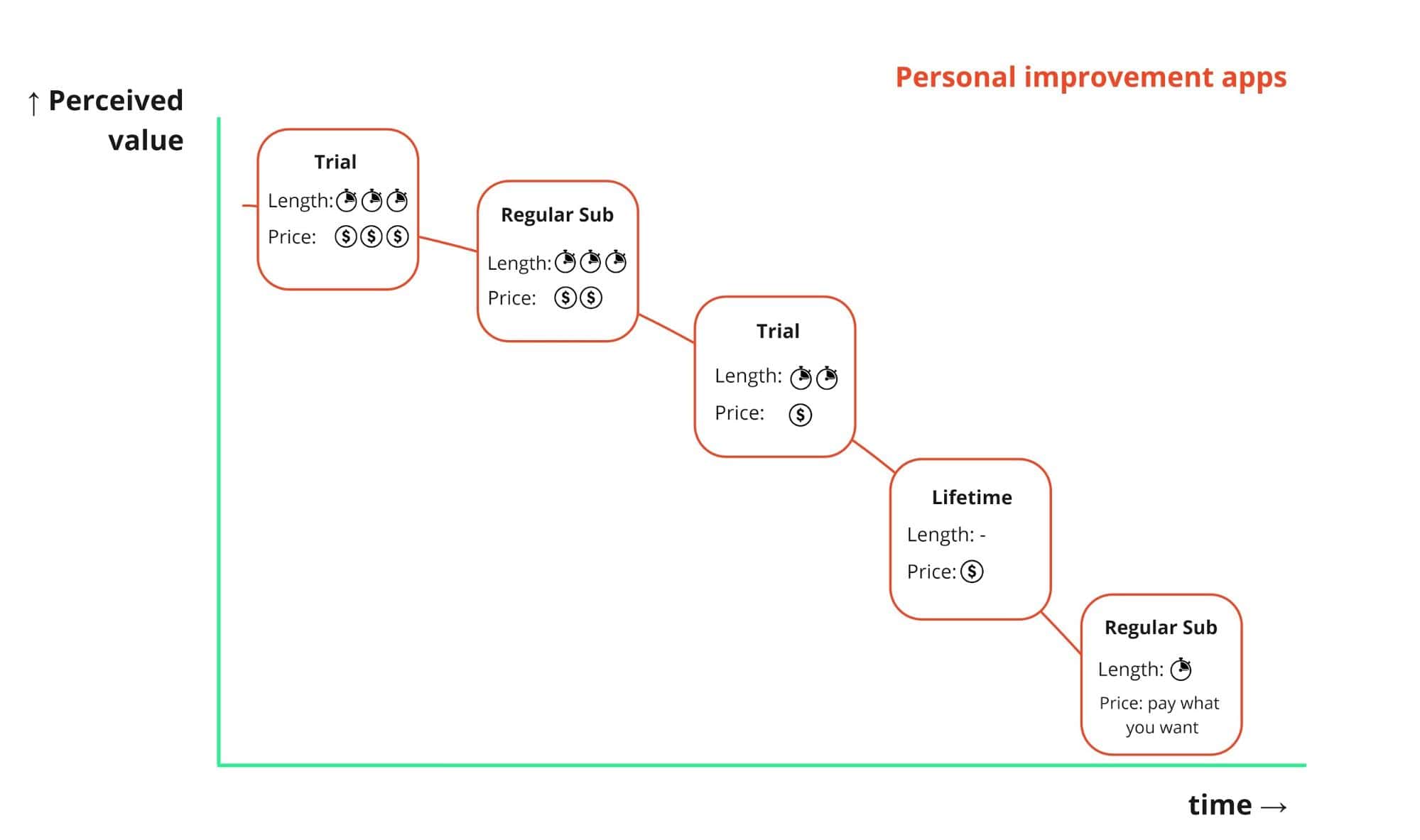

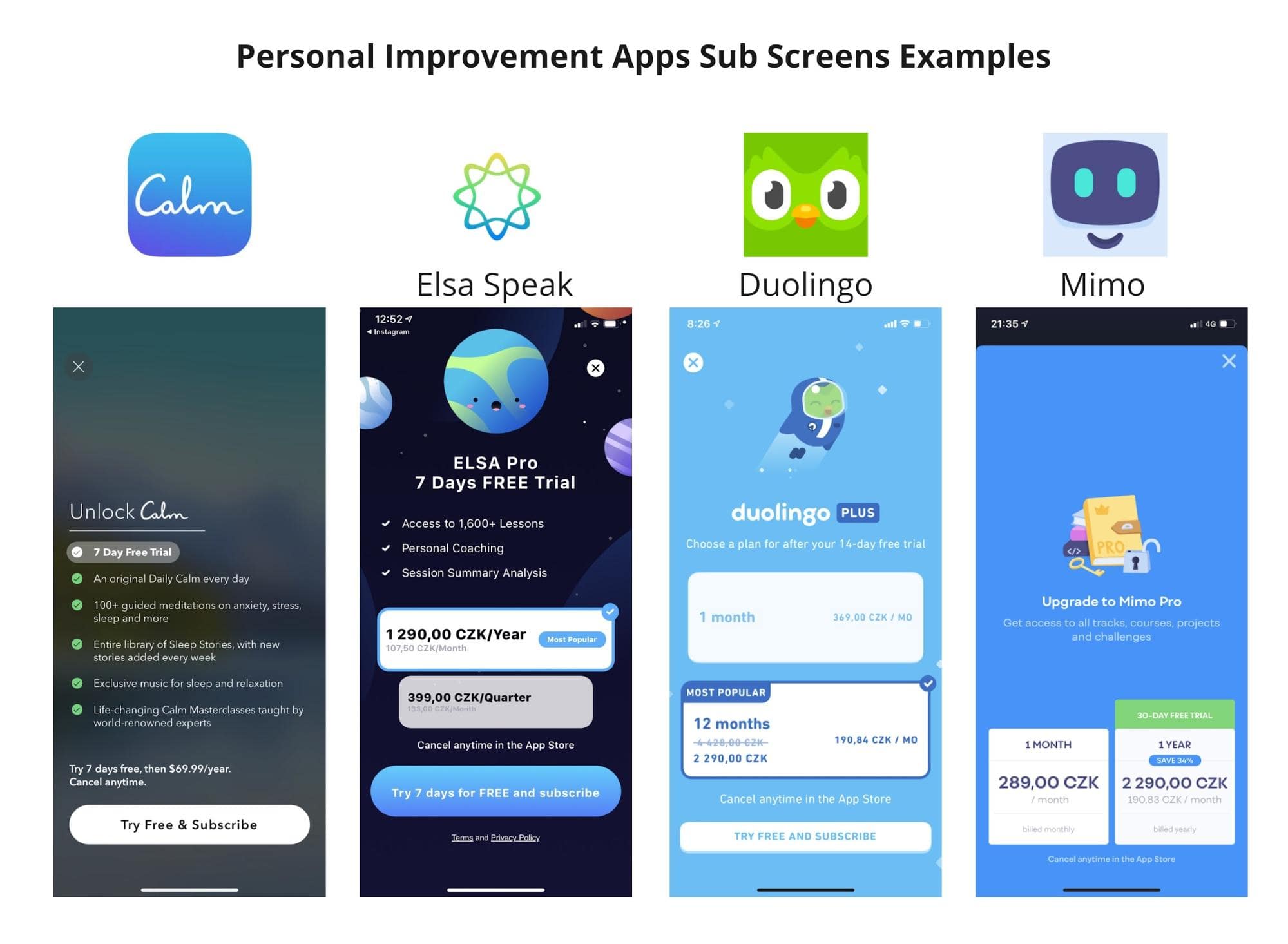

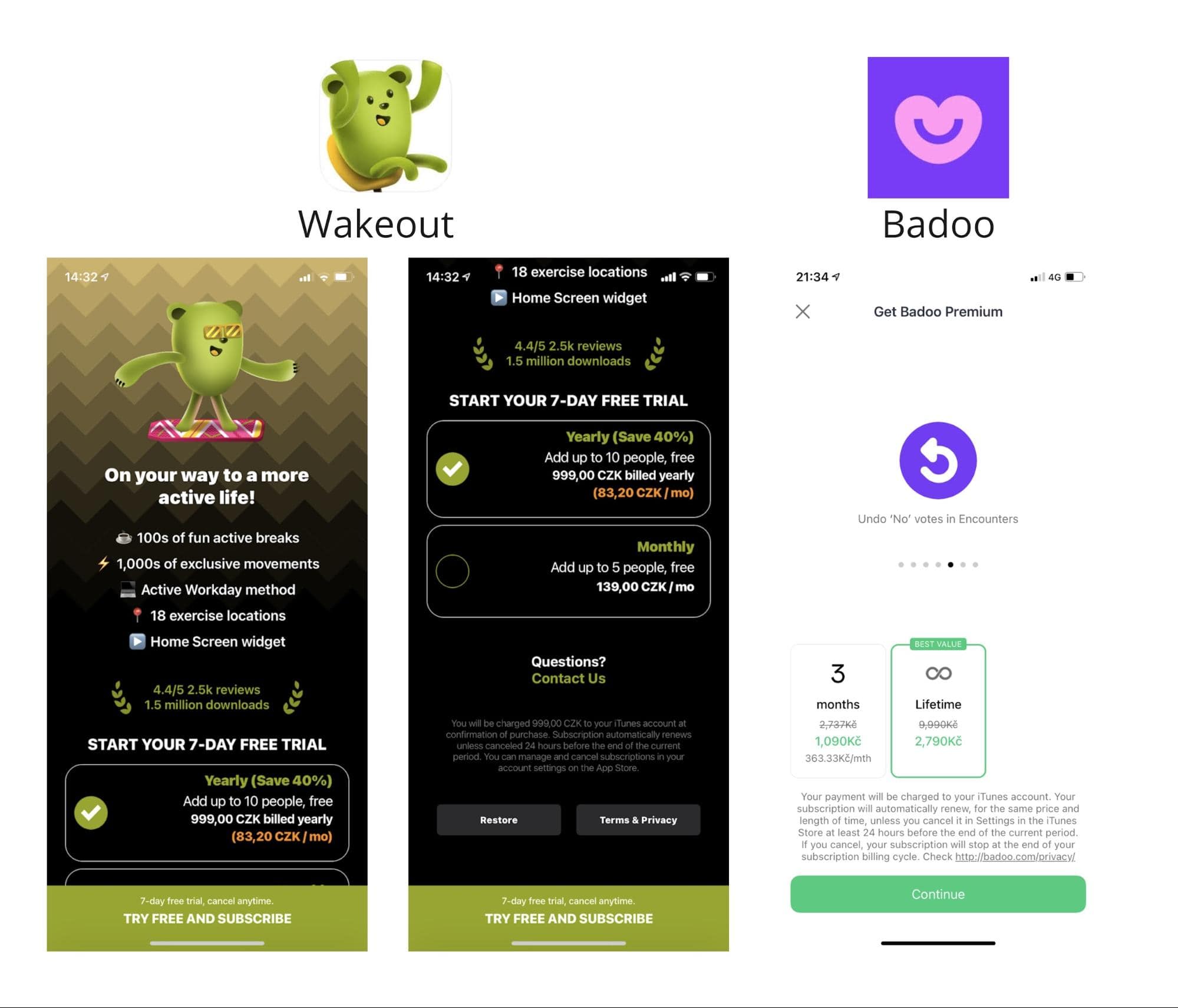

Personal Improvement Apps

The first category is the user-supplied content apps, including dating (Tinder, Bumble) and learning apps (Duolingo). On these apps, content is engrossing at the beginning but deteriorates with time as the user consumes the most interesting parts, or just becomes tired of it altogether.

What makes this category different from other content-based apps like Netflix (discussed in Constant Value Apps) are the high mental-processing requirements. Users sign-up with the intention of being better versions of themselves, and all that requires effort. Learning, thinking—it’s more than just “passive” consumption. Conversely, however, this also makes users stop using the app.

Strategy: Users see the app value at the beginning—so make use of it. You probably won’t get anyone to convert to a longer or more expensive deal if it’s not at the beginning. If a user is on a monthly subscription and active, try to switch to longer-term subscriptions. As you deliver value from day one, you can try switching trials or introductory pricing with the same long-term commitment.

As time passes, users might see less and less value delivered, especially when on Freemium. If you’re outside the regular purchase-window (say 90% percentile of usual purchase-time), then offer a one-off lifetime purchase for a very reasonable price—or even offer users to pay what they want. If you do that successfully, you might be surprised how much people are willing to pay for your app.

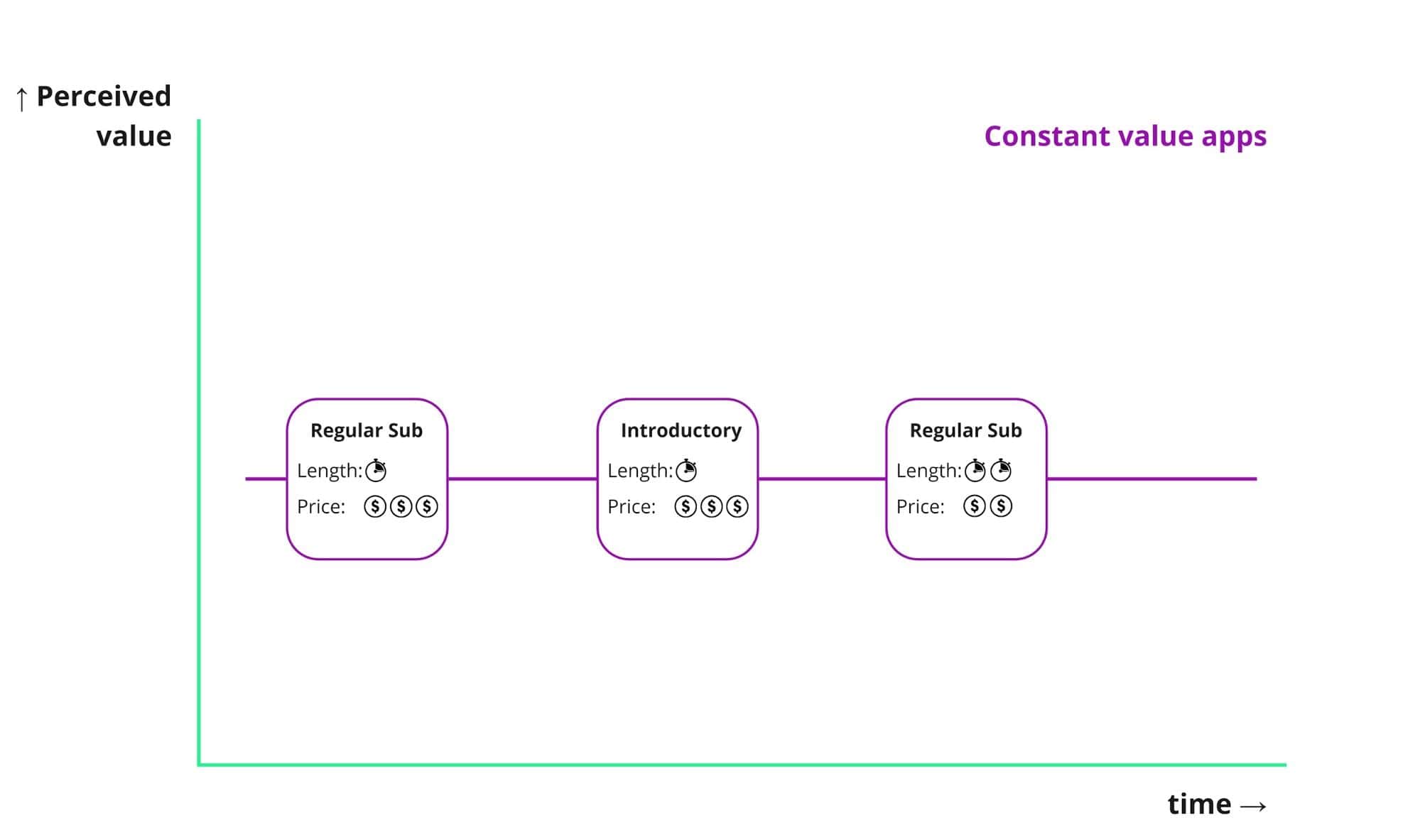

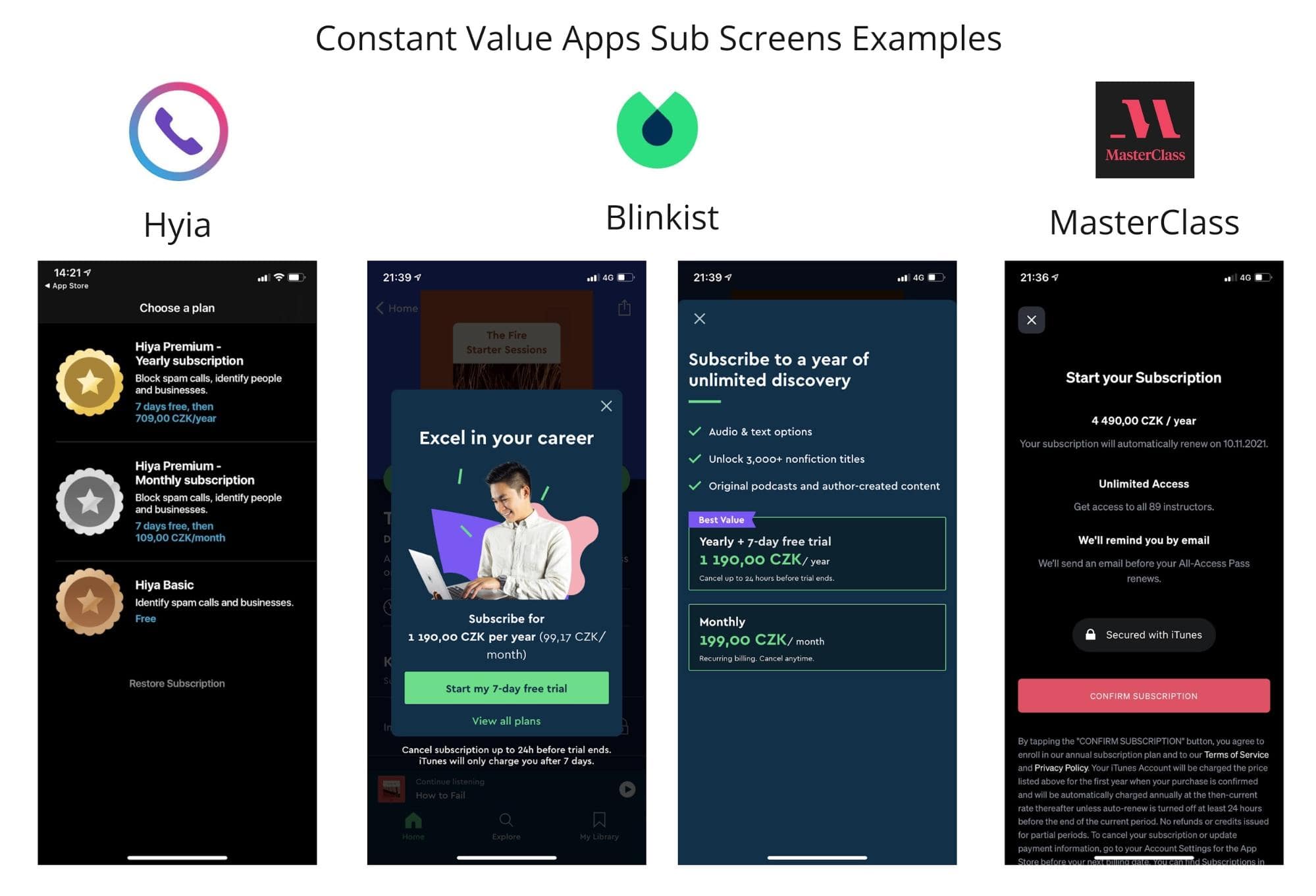

Constant Value Apps

This kind of app brings value that is more or less stable at the time. Think of the type of content that the NBA app has: it won’t get any better or worse if it works. Your team may be losing, but you’ll probably keep the subscription anyway. The same goes for your Google One storage—it’ll maintain its value over time.

Companies know that you’ll stick around unless they screw up, so why should they offer any discounts? Look at Netflix or HBO, for example: no long-time subscriptions, no sales. One of the features of the Constant Value apps is that content is unique, and hard to find somewhere else.

Strategy: Focus on monthly subscriptions: longer-term subs bring lower LTV (because of the usual sales connected with it). A trial (2-4 weeks) might be an option, but you might be better off with an introductory trial as you are providing value from day one. If you do sales, it can be less substantial (up to 25% instead of 50%). MasterClass is a good example. Even on CyberMonday, they only offered a “buy one, get one free” subscription.

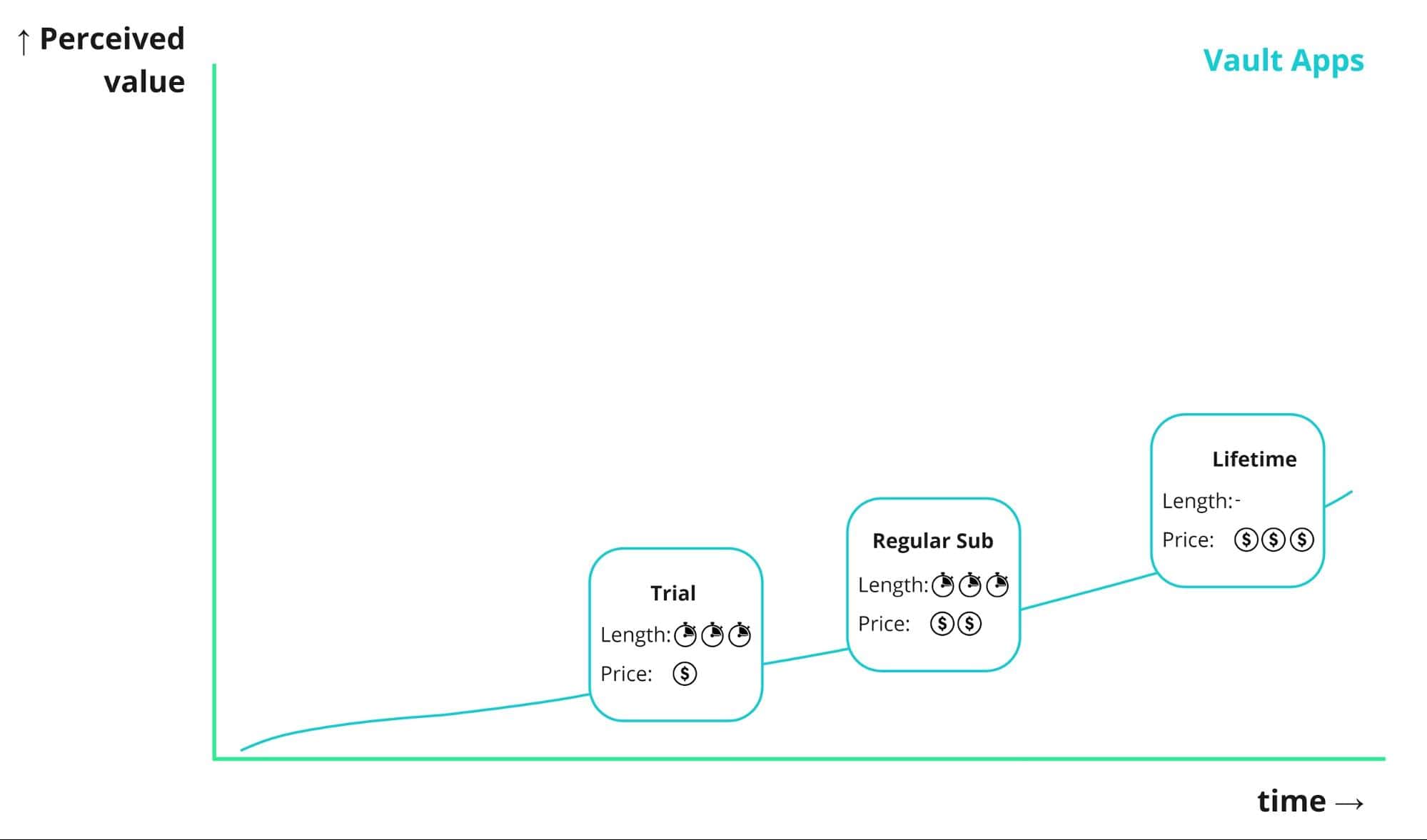

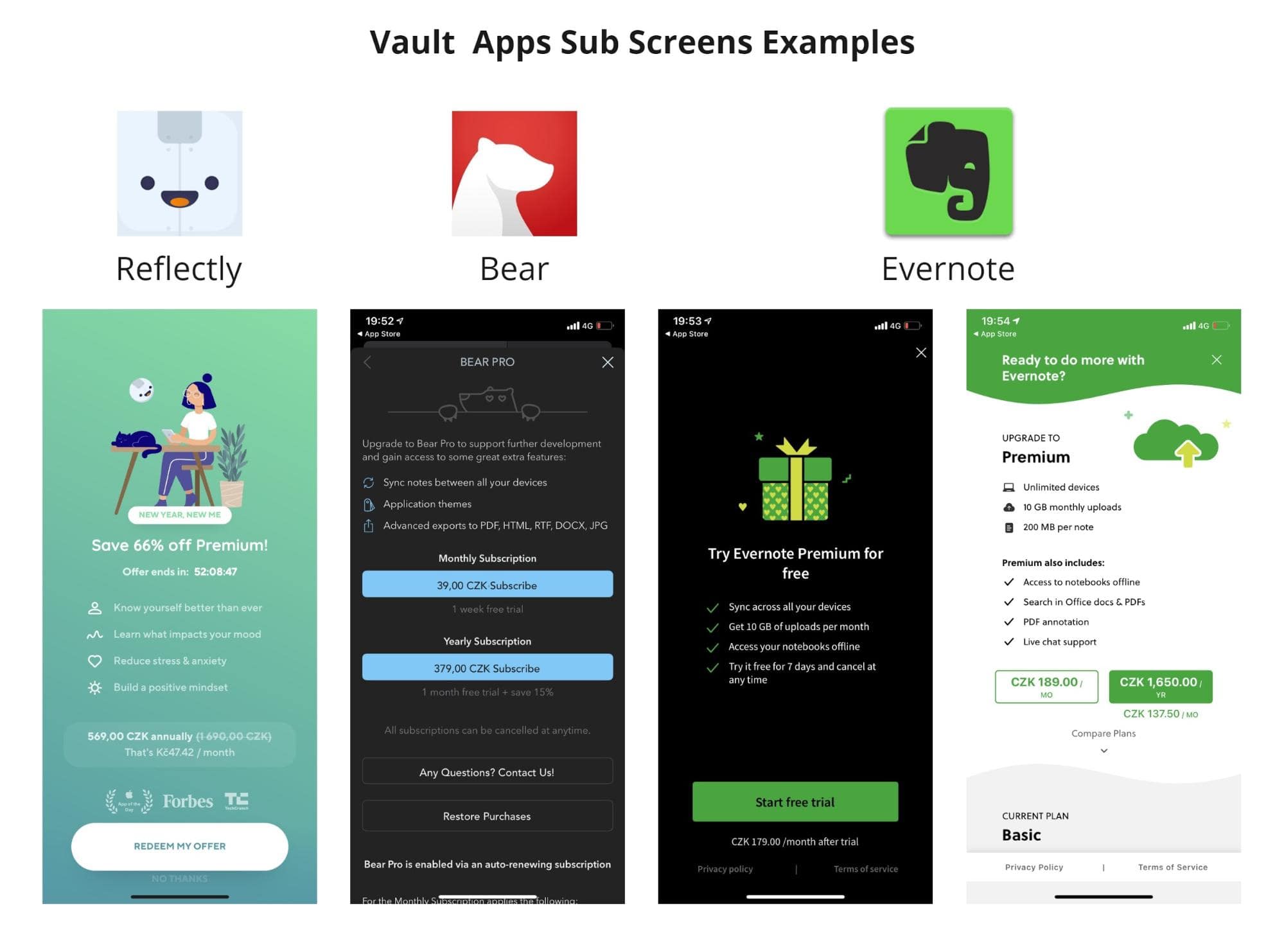

Vault Apps

With these apps, value grows over time. These are apps that need you to learn how to use on a regular basis in order to create higher value for you. Good examples are Reflectly, Dropbox, Evernote, Bear, and Google Photos. They may have low value at the beginning (when you have only five photos/files/notes saved), but when you’re locked in, you’re less likely to churn in order to not lose access to your content. The more people participate, the better: imagine transferring Dropbox contents to Google Drive. It’s definitely possible—just not pleasant and easy for a regular user.

Strategy: Go nice and slowly is my advice here. Users might see some value in the app, but competition is only one back button away, and you need to prove yourself first. Optimize for annual (it’s best with trials) and bother users less with promotion in the first few days/weeks. If you have considerable added costs with every user (like storage for large files), do introductory pricing with low subscription costs at the beginning. The longer you can lock users into a subscription at first, the better. Allow me to exaggerate for a moment: imagine pricing your appr for $1 the first year, and then $49 the second year.

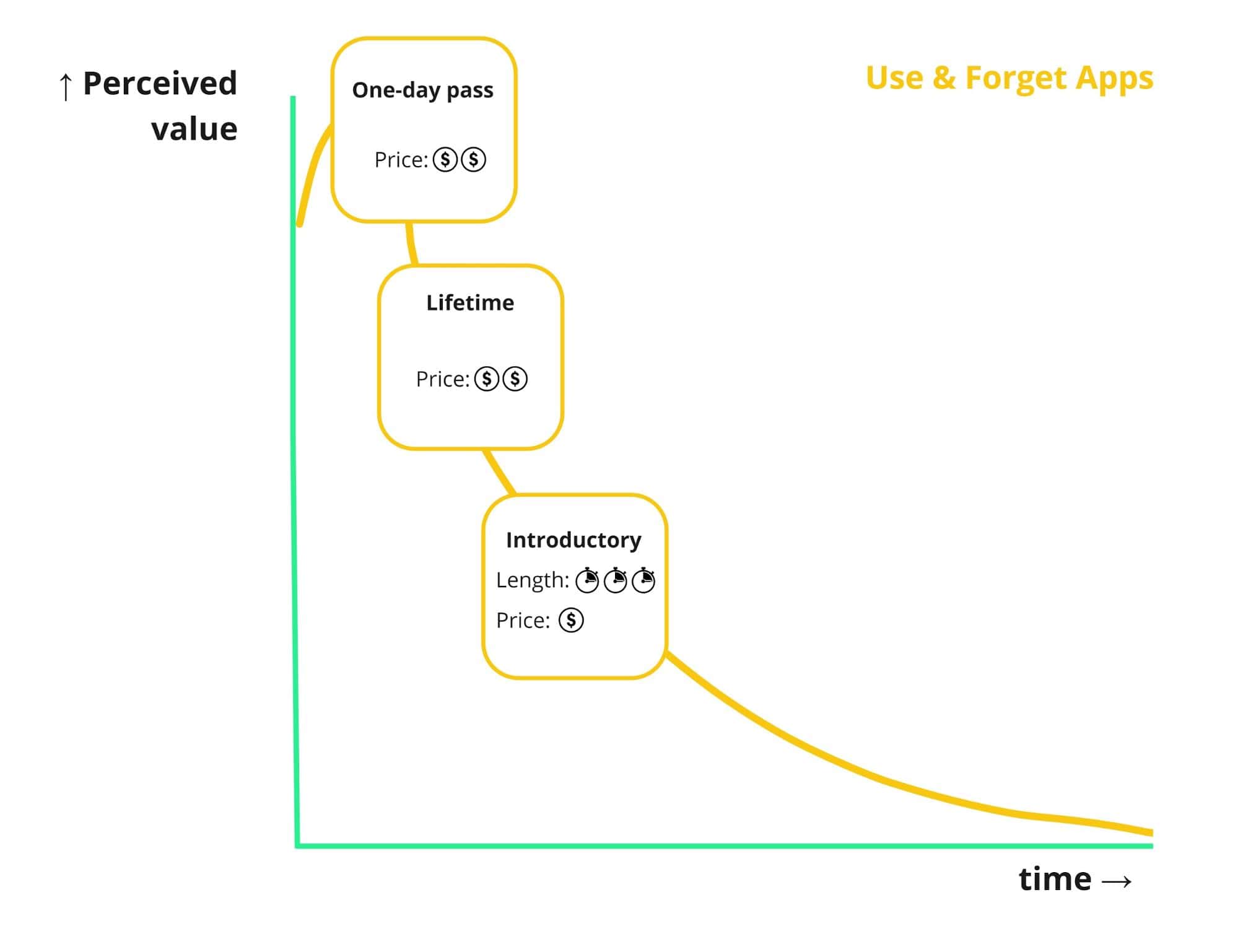

Use and Forget Apps

This kind of app serves mainly for one purpose: to scratch an immediate itch. That includes activities such as cleaning photos to get more space, expensing a business trip, measuring something, or getting rid of possible security threats. The distinction from the other categories is that the provided value is high but limited by short-term or one-time use.

As we have seen with the Boost cleaner app example, it might make more sense to focus on immediate financial exchange for value rather than pushing users into trials or subscriptions in general. Think one-day passes, lifetime purchases, or—if you really want to push users into a subscription—do introductory pricing instead of a trial as this will at least give you some revenue.

This type of app also tends to have extremely low retention. You might want to try a lot of first session offers as second sessions might not be available.

As you can see from this graph, offers follow quickly. In this category, I wouldn’t object to even doing even two offers during one (first) session.

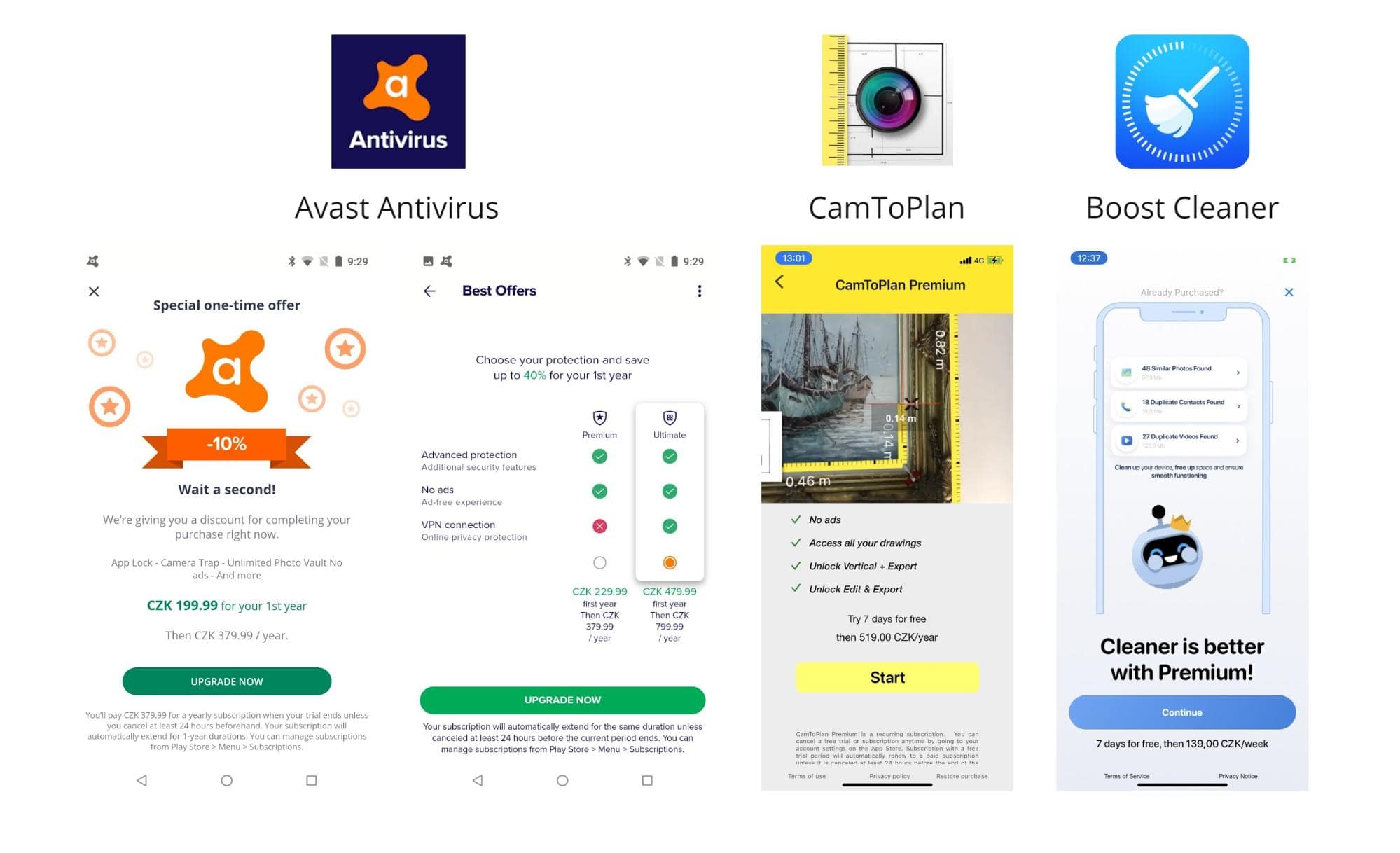

The current solution of the subscription screens from selected apps. We can debate if Avast Antivirus belongs to the fold, as it offers long-term protection and also the VPN as an upgrade. I think it really depends on the user’s trigger for downloading.

Summary and Recommendations

As you can see, based on the value users see in the app, there are actually quite a few approaches to pricing. Each app should optimize on different types of subscriptions with different lengths. You can see from the screenshots that even very popular apps may have room for improvement here. Of course, it’s possible that they already know which strategy works best for them, but my experience in this department tells me that they haven’t tested many routes much.

You might also argue that you can fit some apps into multiple categories. Push on monetization early and also sell later. Or that some apps might have different values than I have previously outlined. That certainly may be the case—I don’t claim that my perspective explains everything.

But if you want to work on your subscription revenues in 2021, I recommend testing different subscription types and lengths based on user-perceived value as you see fit. If you have this checked on your to-do list, you might try introducing more tiers or try to optimize your offers more dynamically. Let’s save that for the next time.