At Phiture, we are often approached by pre-launch, or early-stage companies asking for help and consultancy about growth. We usually reply with thanks and ask them to come back when they have achieved Product/Market Fit. Our position is thus: until PMF is achieved, it’s too early to get serious about growth. This is pretty much precisely what Marc Andreessen says:

“When you are BPMF [Before Product/Market Fit], focus obsessively on getting to product/market fit. Do whatever is required to get to product/market fit. Including changing out people, rewriting your product, moving into a different market, telling customers no when you don’t want to, telling customers yes when you don’t want to, raising that fourth round of highly dilutive venture capital — whatever is required. When you get right down to it, you can ignore almost everything else. I’m not suggesting that you do ignore everything else — just that judging from what I’ve seen in successful startups, you can.” — Marc Andreessen

Getting to PMF with a mobile app is a tough proposition. Before the iPhone, distribution was actually the primary challenge: Telco’s ‘made the market’ by deciding what content they put on their portals and consumers had little real choice. With the app stores, all that changed; we now have near-total democratization of distribution, where any individual or company can publish an app and build a user base.

The app store economy bears a great many hallmarks of what economists call Perfect Competition: very low barriers to entry/exit, a large number of suppliers and buyers, highly-informed consumers, transparent pricing, etc. (NB: The app stores do differ from Perfect Competition in some key areas including the existence of transaction costs for publishers). While Perfect Competition might sound, well, Perfect, it really isn’t if you’re a seller; companies prefer to avoid marketplaces with such conditions since the extreme competition tends to make them work that much harder to attract and retain customers. Given that the app stores are pretty much the only game in town when it comes to app distribution (the occasional pre-install deal notwithstanding), validating an idea and establishing the fabled ‘Product/Market Fit’ under such conditions is especially daunting.

So what does Product/Market Fit actually mean? Can we define and measure it more specifically for mobile products? What does iterating towards PMF look like and when should a company shift the focus from PMF to growth?

Product/Market Fit for Digital Products in General

There is surprisingly little consensus on how to measure product-market-fit for SAAS and B2C products. What most agree on, at least, is that it’s non-binary i.e. that there are varying degrees of PMF on a sliding scale. It’s also worth bearing in mind that if the product, the market or the level of competition changes, PMF can reduce or increase accordingly.

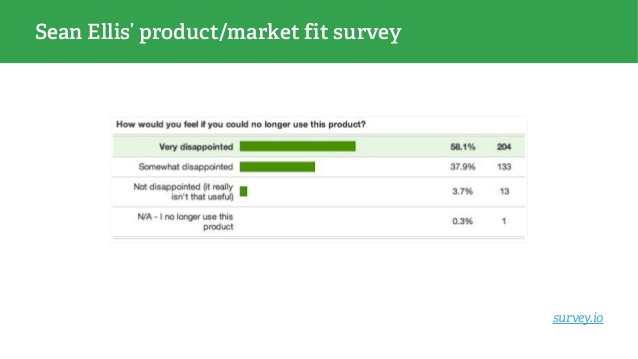

- Sean Ellis, CEO of GrowthHackers, defines PMF as where at least 40% of a product’s users, when surveyed, indicate that they would be ‘very disappointed’ if they could no longer use the product.

Sean Ellis’ famous Product/Market Fit survey question

- PMF is sometimes described in terms of potential for virality; if users ‘get’ the product (i.e. find it valuable), they become advocates for the product and ‘recruit’ new users via word-of-mouth or through invite/referral mechanisms baked into the product itself. If there are no product-based invitation methods, then Net Promoter Score is a pretty decent measure of whether users are happy enough to actively promote the product to their peers.

- A simple, but effective measure of Product/Market Fit is whether there exist users who are willing to pay for the product. If the %ge of paying users is approaching the threshold that would make scaling acquisition a sensible and sustainable endeavor, you have Product/Market Fit right there.

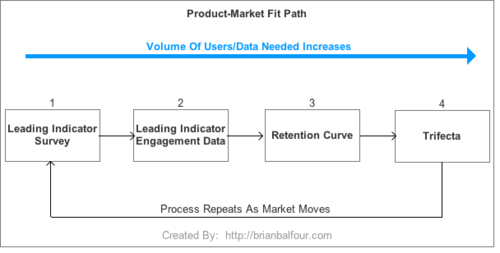

While all of the above provide some proxy for measuring Product/Market Fit, Brian Balfour provides a more comprehensive set of tests to validate the level of PMF. In his essay on Product/Market Fit, Balfour makes the case for a ‘Trifecta’:

- Strong leading indicators from a qualitative survey (using an approach like the ones above)

- Strong leading engagement indicators (meaningful engagement with the product, as evidenced by a high volume of core events)

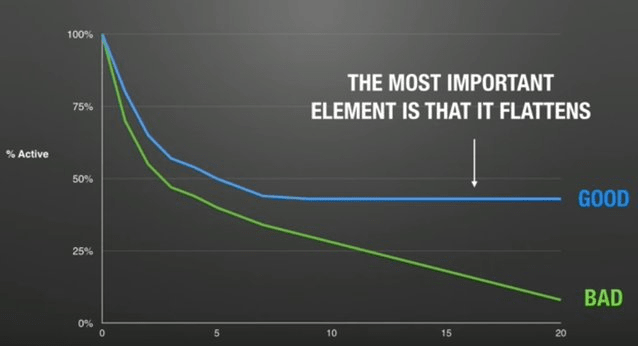

- A retention curve that flattens out:

Source: Brian Balfour’s presentation at WMD 2015 — video

Apart from being a more rigorous definition, this approach also accounts for the lack of data that might exist in early stages, particularly for B2B products, where there may only be a trickle of early users/customers: each measure is increasingly data-driven relative to the last.

Balfour’s view of Product/Market Fit, which also encapsulates the concept of PMF as an ongoing process, is described neatly in the diagram below (source):

It’s worth noting that all of the above methods for discerning Product/Market Fit do not discriminate between SAAS and B2C companies.

Andrew Chen makes some astute observations about PMF for B2C products. In this article, Chen makes a strong case for focusing first on the Market (a view echoed by Andreessen) sets out a practical test for establishing pre-existing demand by analyzing the volume of searches pertaining to a solution that the product aims to provide. Finally, Chen suggests frequent user testing and competitor benchmarking to evaluate how well the product is satisfying consumer requirements for such a solution.

Product/Market Fit for Mobile Apps

So, is it possible to build on the work of Ellis, Chen, Balfour, et al. in a way that provides a useful perspective of Product/Market Fit specifically for mobile apps? Here are my thoughts:

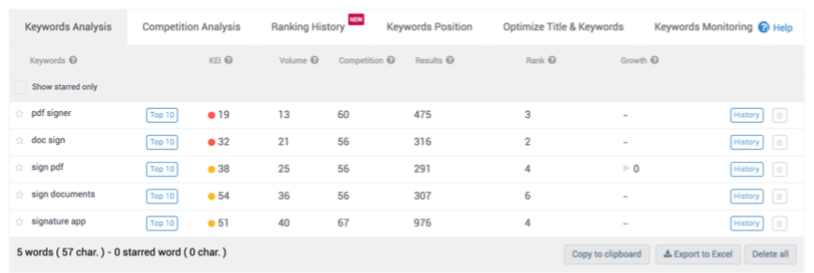

Consult app store keyword search volume data to determine market viability

Applying Andrew Chen’s approach to market evaluation for mobile products would involve estimating app store search volumes for keywords relating to your product. While there is no Keyword Planner tool for the app stores, both Apple and Google provide data on relative search term popularity/volume. Tools such as AppTweak and MobileAction provide additional insight into keyword search volume across both Google Play and the Apple App Store.

Search Volume data from AppTweak

If search volumes for terms relating to your particular product are comparatively low, perhaps a mobile app isn’t the right vehicle for the product. Or perhaps the product and marketing efforts can be pivoted relatively easily to capture a larger, related market by solving a similar need?

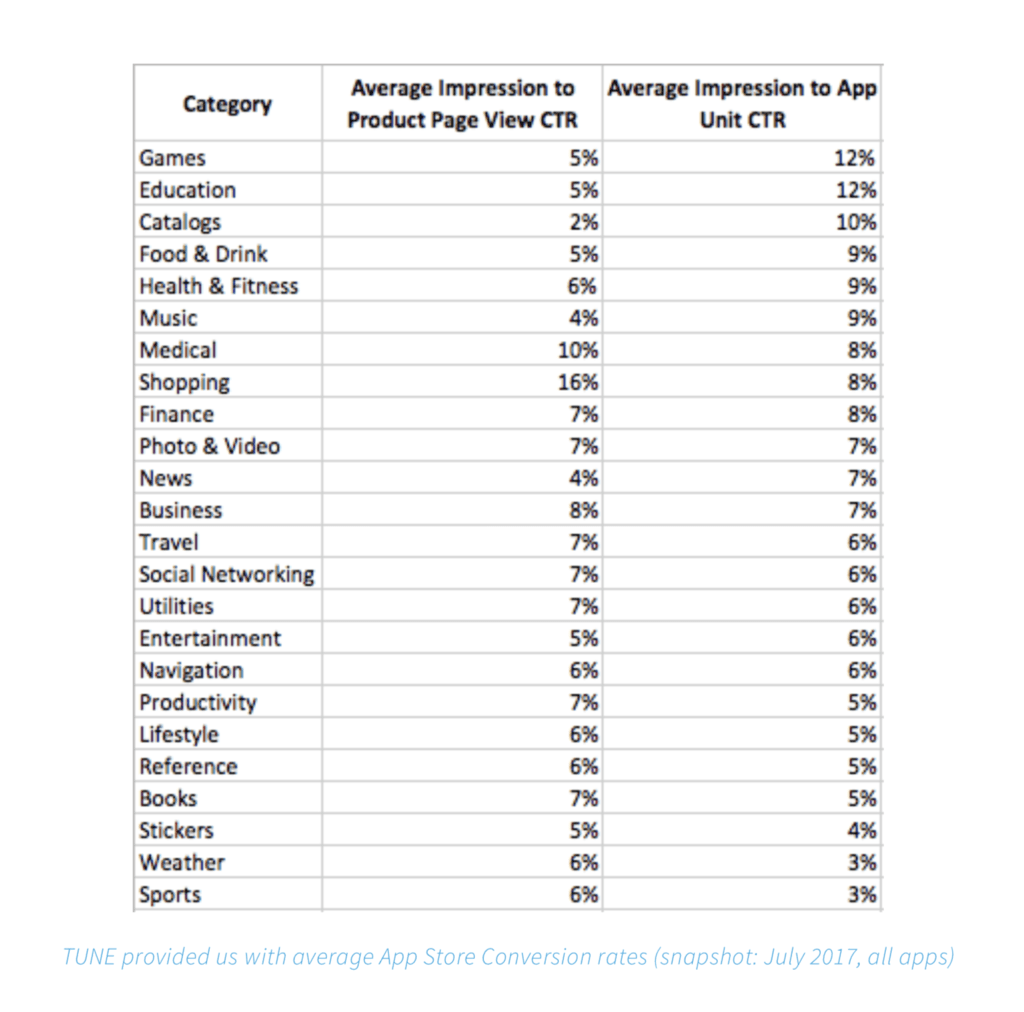

App Store conversion metrics as leading indicators for Mobile Product/Market Fit

The App Store and Google Play store make available data that can serve as leading indicators: specifically, conversion rates from the app store listing show whether the product proposition is resonating with the target market. These data are even more valuable when taken in the context of category averages:

Source: Advanced App Store Optimization ebook

Conversion on the app stores can be improved within certain limits through iterative App Store Optimization of assets such as title, description, icon, etc. In addition, CVR will vary depending on where the traffic is coming from. For these reasons, it’s not advisable to use the app store CVR as the only indicator of PMF. However, when used in conjunction with deeper funnel metrics (see next section), they provide a useful signal.

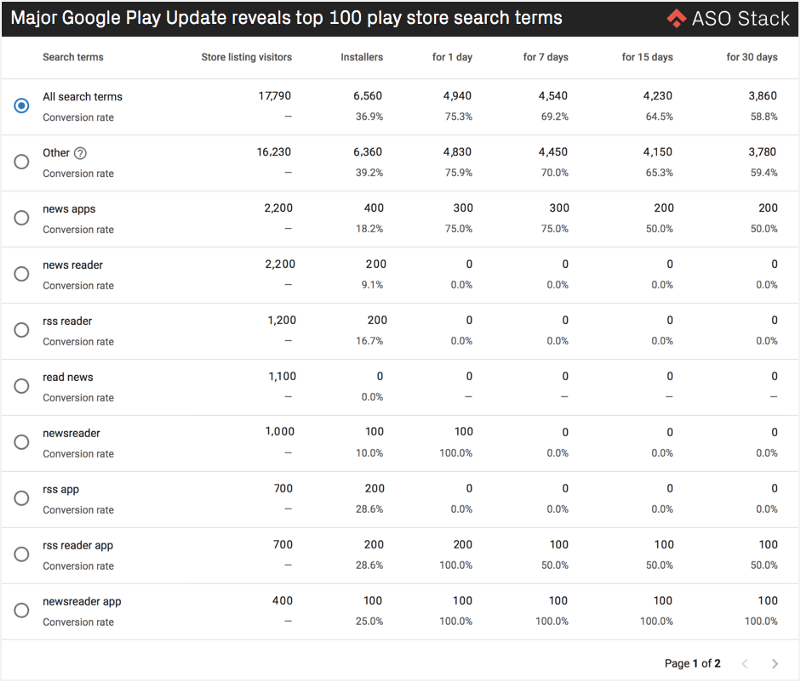

Even better than considering the blended (i.e. all traffic sources) app store page conversion rate, look at the conversion rate coming from specific search terms. Understanding, at this granularity, which search terms are bringing users that go on to download the app, provides a goldmine of actionable insight when iterating towards higher Product/Market Fit. In the early days, such data will help to qualify assumptions about how effectively the current product proposition addresses user intent.

Beta functionality in the Google Play console, showing conversion rates by search terms. (Source)

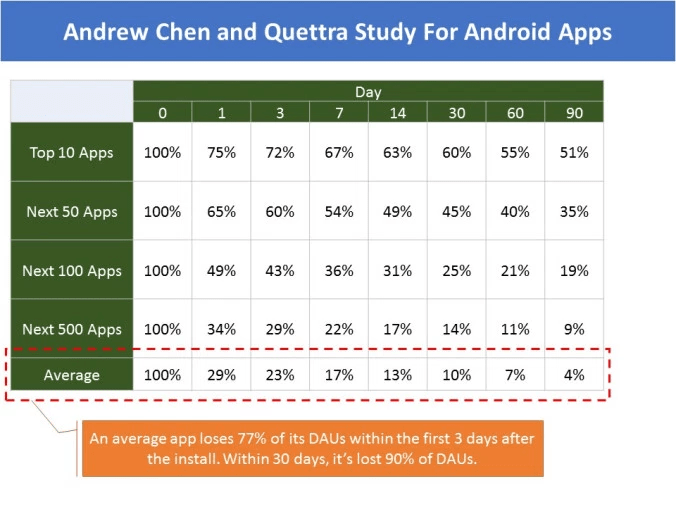

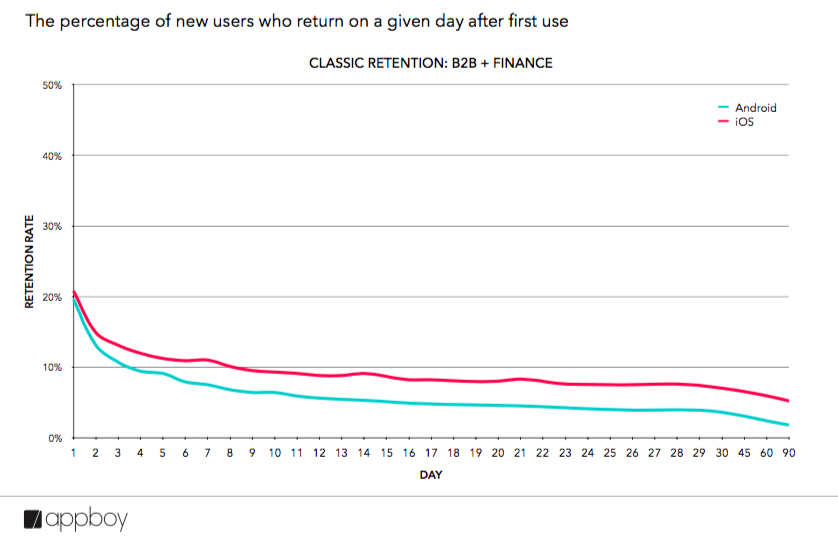

Use mobile app retention benchmarks to guide product iteration

Balfour’s acid-test of the retention curve leveling out (for at least some sizeable segment(s) in the overall cohort) is still the gold standard for evaluating Product/Market Fit from the product side. It can take a while to establish this, however, since cohorts need to age for 90 days or longer to see if and when the retention curve levels out. Also, there’s a question of where the curve levels out; there’s a big difference in growth potential if it levels off at 50% vs 10%.

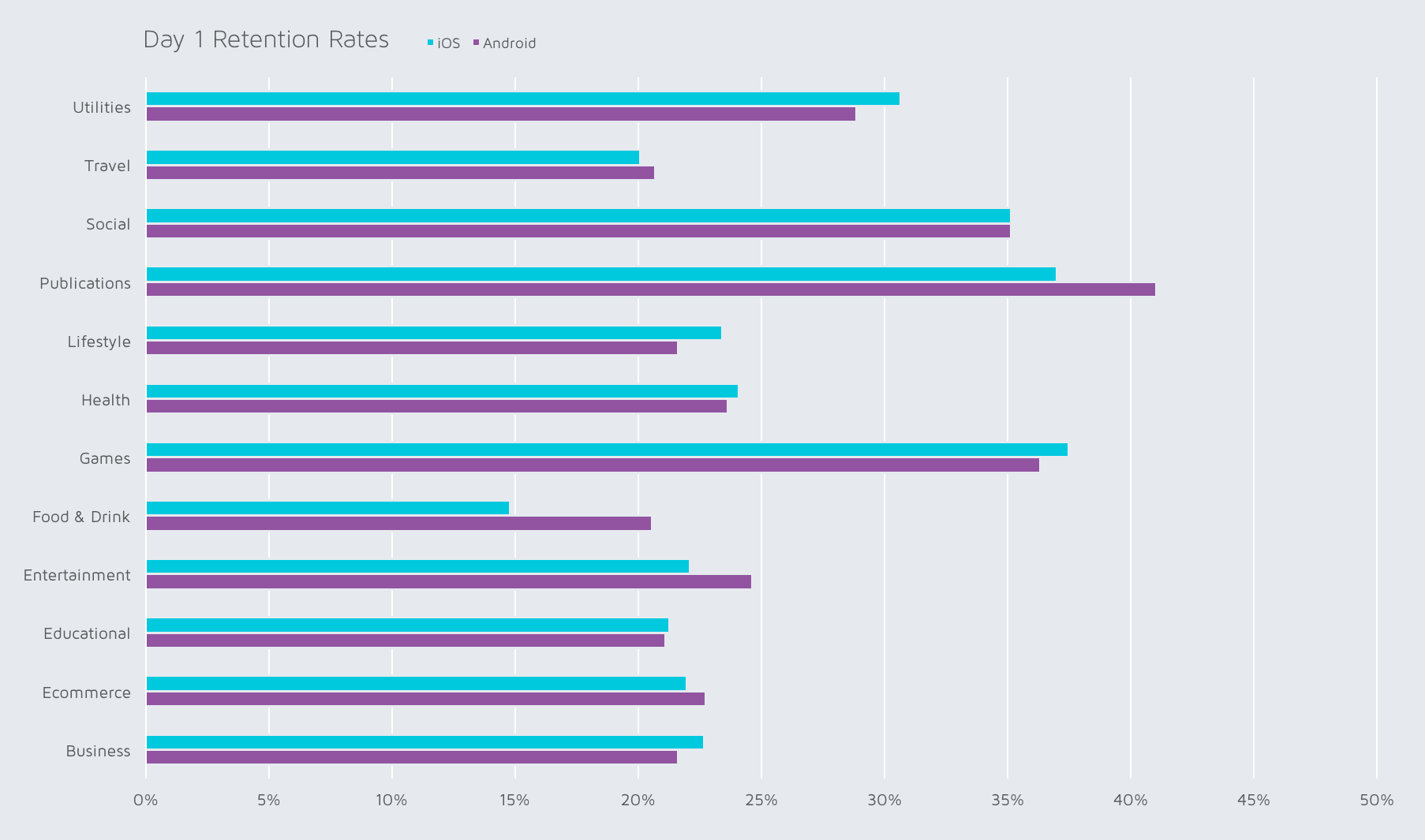

Mobile app retention benchmarks can be helpful to get an early feel for how the product is performing. Since the onboarding/activation phase in the first few days of usage is disproportionally important in defining where on the graph the retention curve will level off, it makes sense to focus on metrics such as D1, D7 or Week-0 (first week) retention when benchmarking. This also promotes faster iteration cycles, since fresh results become available relatively quickly after a product change is made, compared with optimizing for D30, D60 or beyond. (NB: this is not to say that later-stage retention isn’t important for establishing true Product/Market Fit; it’s just not the ideal place to start with optimization).

There is, sadly, no definitive up-to-date source for app retention benchmarks, but there are periodically some useful stats published by Adjust, Braze and other vendors:

Q3 2016 D1 retention benchmarks by app category from Adjust (source)

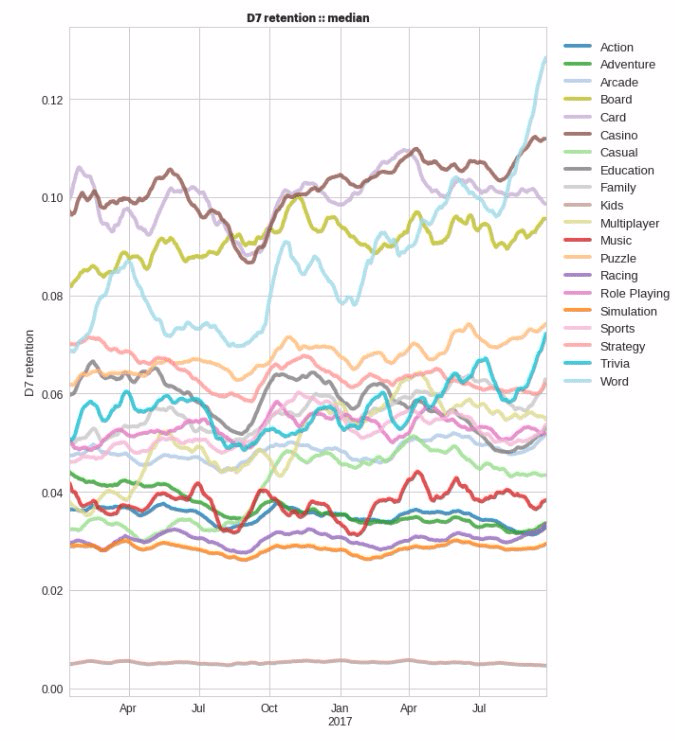

Given the large number of low-quality apps in the store, it would be advisable to aim to significantly outperform the mean retention rate for the category before concluding that PMF is strong. Where possible, use the Median as a guideline:

2016-2017 D7 benchmarks for games from GameAnalytics — helpfully, using Median values rather than mean

A couple of things to watch out for:

- Retention is a somewhat complex metric: the specific method for calculating retention varies throughout the industry, so be sure to understand precisely how the benchmark data was calculated to avoid comparing apples to oranges. One of the best explanations I’ve found of the various different approaches to calculating retention can be found on the Amplitude Blog.

- Be sure to benchmark against apps in the same category as your product, but also bear in mind that, even within a category, apps may have different ‘retention profiles’ that cause users to use them more or less frequently. If there are competitor apps with a set of very similar product features, these are the best ones to benchmark against, since usage patterns can be expected to be similar, all other things being equal. Companies like SimilarWeb purport to offer competitor engagement benchmarks, albeit extrapolated from sample panel data.

Source: Appboy Fall 2016 Digits Report

Product/Market Fit is Never Done

Product/Market Fit is tricky to define, even though it’s absolutely critical to long-term business success. Iterating towards ever-higher Product/Market Fit requires adjustment of both Product and Marketing approaches. Such iterations involve positioning the product more effectively towards the target market, or possibly targeting bigger or more lucrative markets with the same or slightly-modified product offerings. They also involve improving the core product to improve key metrics (above all: retention).

The existing definitions of Product/Market Fit are largely product and platform-agnostic. While these are great indicators, creators of mobile products can use data sources such as app store search data and app retention benchmarks to gauge their current level of Product/Market Fit with a mobile lens.

Some additional sources I used when researching — these are some great articles and links on the topic of Product/Market Fit:

12 Things about Product-Market Fit

When has a consumer startup hit product/market fit?

Why You Should Find Product-Market Fit Before Sniffing Around For Venture Money

Product/Market Fit: What it really means, How to Measure it, and Where to find it

Do You have Product Market Fit? It’s All About Retention

How to Find Product Market Fit – CS183F

Title Image credit: ‘Puzzle Pieces’ by flickr.com user: lizadaly — headline and graphic added by mobilegrowthstack.com