I am a big fan of AARRR. But it has one major issue: it focuses on Acquisition instead of Retention. And that could destroy your mobile startup.

The App Store was very different in 2008. It was:

- young,

- had 500 apps,

- had low competition (no saturation),

- low acquisition cost channel,

- was starving for apps.

Fast forward 9 years, and today the App Store is:

-

- mature,

- has 2.5+ million apps

- incredibly high competition, not only from the sheer number of apps but from well-funded large companies (there is a reason why FB dominates the leaderboards)

In the early days of the App Store it made perfect sense to focus on Acquisition to gain traction as:

- CPI (cost per install) was ridiculously cheap,

- in certain markets, there were NO competitors at all,

- neither in the industry nor on your phone.

Today, the story is very different:

- CPI is crazy high,

- competition is all over the world,

- app giants (like Facebook, Instagram, Snapchat, Messenger, Youtube) are eating away the time spent on mobile,

- user expectations are higher than ever,

- retention rates are terrible.

Still, most companies focus on Acquisition first instead of getting the product right.

If you only focus on Acquisition as a marketer today, you are just digging a hole for your mobile startup.

Stop digging!

Acquisition vs Retention: Intro to the AARRR funnel

The AARRR funnel (aka Pirate Metrics) was created exactly 10 years ago in 2007. The model helped thousands of entrepreneurs and startups to navigate the noise in creating and growing products.

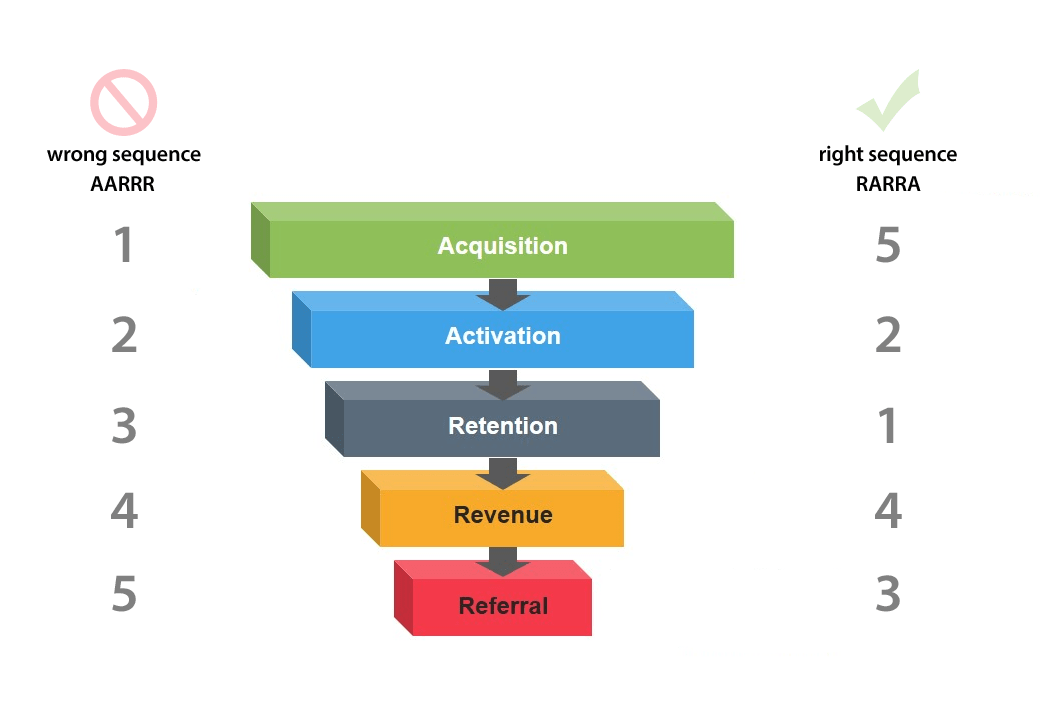

But as the AARRR model became popular over time, one key element was never emphasized: what is the right sequence to use the model?

The original AARRR funnel

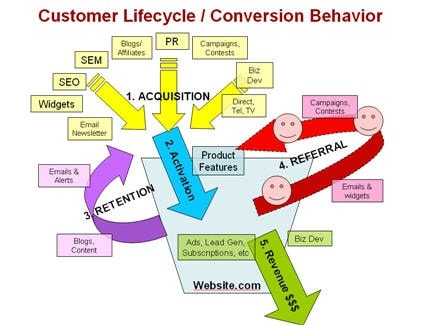

The original post Product Marketing for Pirates: AARRR! (aka Startup Metrics for Internet Marketing & Product Management) details how you can use the model. It helps you:

- develop a model of customer behavior

- and later use conversion metrics/web analytics to assist marketing & product management efforts.

The basic concept identifies 5 types of user behavior:

- A: Acquisition — where do users come from?

- A: Activation — what % have a good initial experience?

- R: Retention — what % comes back and uses the product again?

- R: Referral — do they like it enough to tell their friends?

- R: Revenue — can you monetize any of this behavior?

The advantage of this model is that it could be applied in many industries. Thus, in the last decade, a lot of startups have started to use and implement it. But one thing was never made clear to a lot of us.

The sequence of the AARRR funnel is misleading. It makes you focus on Acquisition instead of Retention. And that will destroy your startup.

I totally get it. Marketers want to market. They don’t want to work on retention UI/UX/product. They think that “UX is for UX people” and “Product is for product people.” As a marketer, their “job is to acquire users”.

While entirely understandable, the mentality of “whatever happens after the acquisition is for everyone else to figure out” is reckless and wrong.

As AARRR looks like a “linear process”, many startups focus on it exactly this way. But that’s fatal.

To get the most out of the model, you need to re-prioritize the funnel.

Instead of using it as AARRR, you should use it as RARRA.

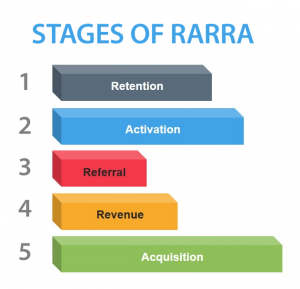

RARRA: the re-prioritized funnel

In general, RARRA is nothing more than a reordered list of AARRR for the modern, saturated, and highly competitive app store reality.

First, you need to focus on Retention, then on Activation. Then move on to Referral and Revenue. The last step should be Acquisition. The very last step. Not the first one.

Here’s a very simple graphic that highlights this shift.

Re-prioritize the AARRR funnel to RARRA

I have seen quite a few companies who have totally missed this. And in fact, I am guilty of this too. There were multiple times when I jumped on testing Acquisition channels, way before the underlying product had good enough retention or activation rates. Don’t get me wrong: it makes perfect sense to get a feeling of CPI and blended CPI values early on. I even have an example of this later on in the article.

I have seen quite a few companies who have totally missed this. And in fact, I am guilty of this too. There were multiple times when I jumped on testing Acquisition channels, way before the underlying product had good enough retention or activation rates. Don’t get me wrong: it makes perfect sense to get a feeling of CPI and blended CPI values early on. I even have an example of this later on in the article.

But putting the primary focus on Acquisition without considering what happens after is the death knell for your startup.

Why?

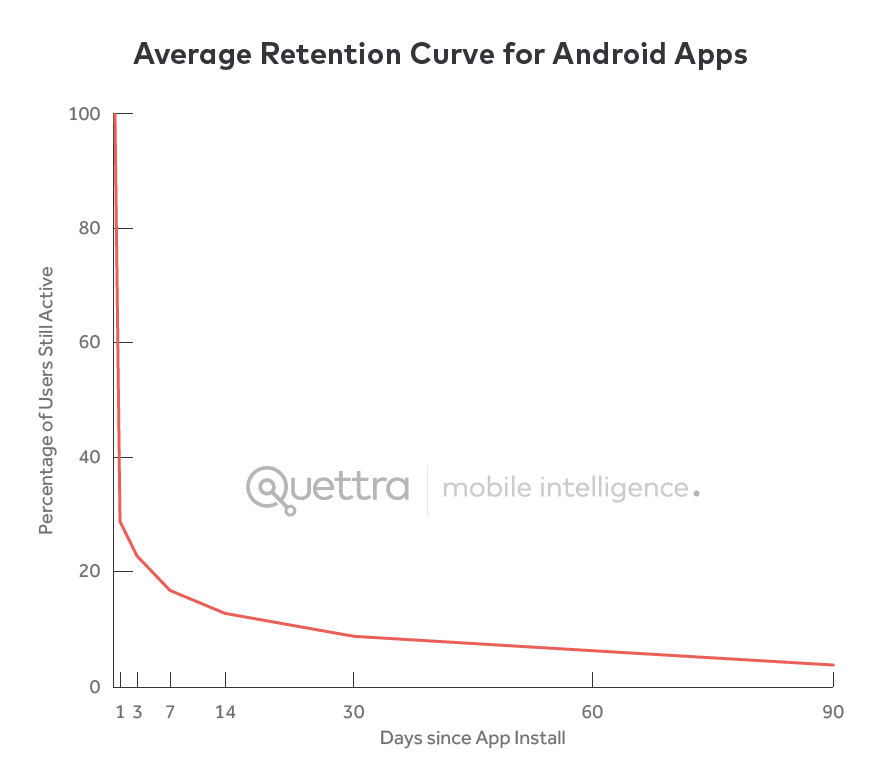

Because data and research suggest that average apps have very bad retention metrics. Losing 80% of mobile users in a few days is absolutely normal as Andrew Chen pointed out recently.

The heart of the problem

If you look at the retention curve of an average mobile app, you’ll see a huge drop in usage right after the install.

Days since App Install

Based on Quettra’s data, the average app loses 77% of its DAUs (daily active users) within the first 3 days. In 30 days, it’s 90%. After 90 days, it’s over 95%.

The retention rate after 90 days is around 5%. Crazy.

And it’s just getting harder as more apps hit the market.

Just imagine: if you acquire 100 users via paid ads, but in 3 days 77 of them will just leave. And never come back. Your CPI was 5 dollars. You just burned 77*5=385 USD. Now, acquire 1000 users. In 3 days, you will burn $3,850 USD. Do it every month for a year and acquire 12K users. You’ll have blown through $46,000 for nothing.

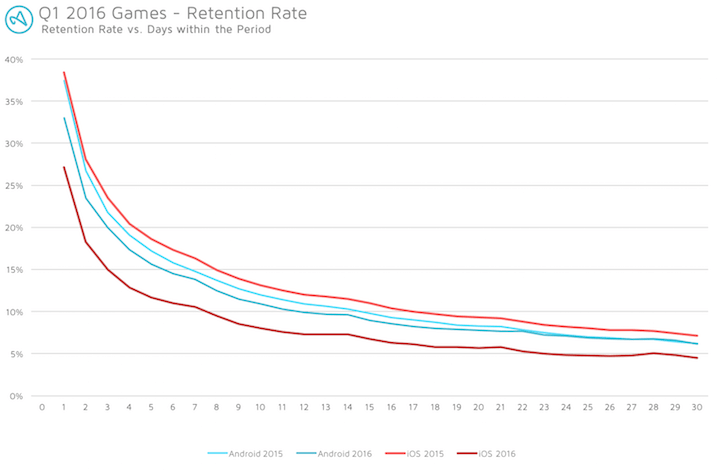

But it’s not only true for Android apps, but also to iOS apps. If we look at games on both platforms, the retention curves look identical.

source: adjust.com

It’s pretty clear:

If you don’t have retention, you have nothing.

But if you have retention for a segment of your users, you can work backward and fix everything else later on.

If a mobile startup invests time and effort in growing, before they have good retention; they are just renting expensive users.

Without ROI, you’re setting money on fire. That’s why it is crucial to focus on retention first and then move on to activation. And save acquisition for a later stage. Instead of AARRR, you need to focus on RARRA.

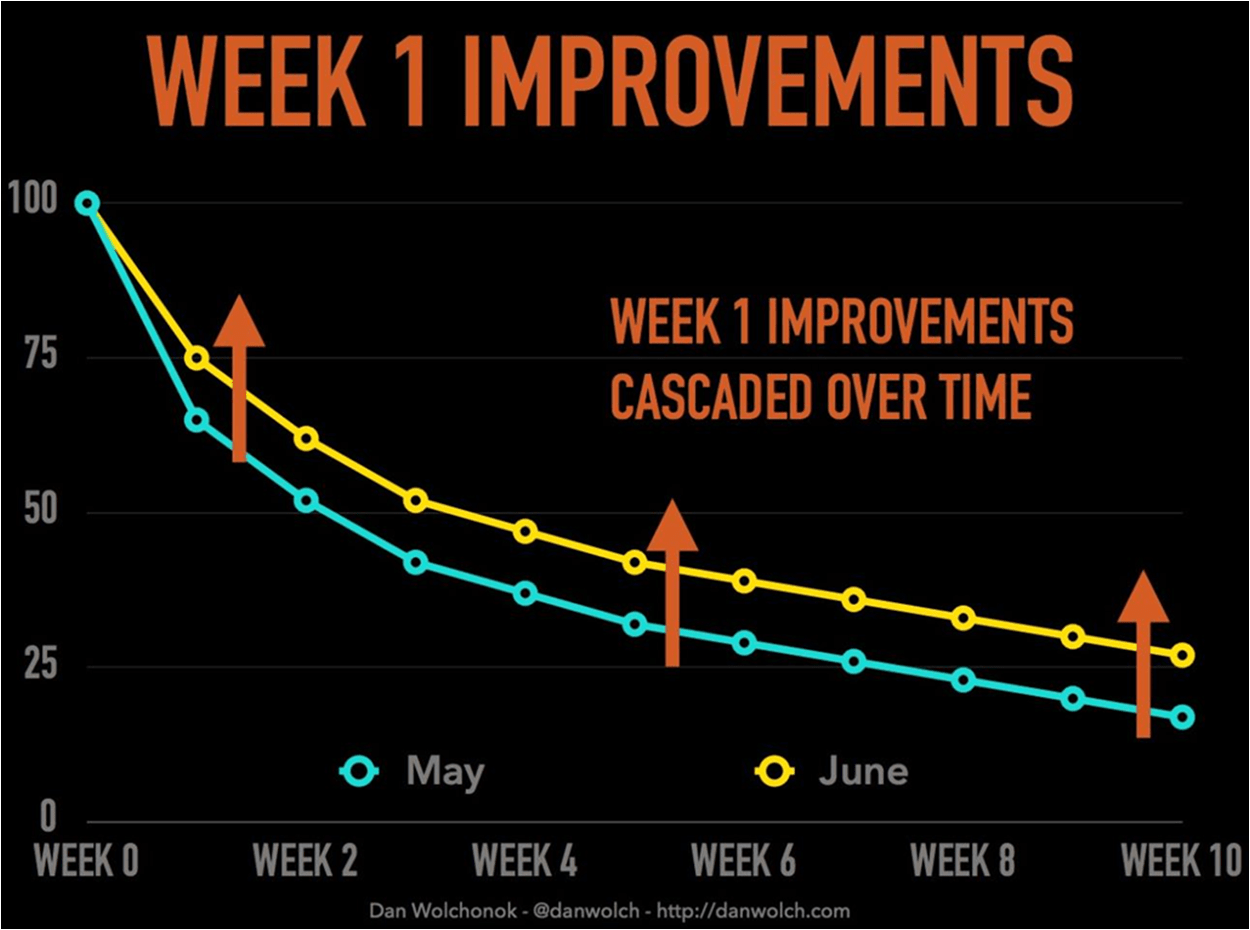

Here’s the good news: even small improvement inactivation can have big results in retention, mostly because these activation improvements cascade over time. This is a great way to bend and push the retention curve up. Sounds simple in theory, but harder to do it in action. So how should we move forward if AARRR fails to help us?

If you want to read more on the topic, you should check out Thomas Petit’s “Mobile Growth #RARRA” presentation. Also, if you are serious about mobile growth, you should follow Thomas on Twitter.

AARRR is a great model, don’t get me wrong. It just doesn’t emphasize enough the focus points. RARRA is a much better approach here. It’s better because it navigates you towards what is important.

You don’t want just downloads. You want users who keep coming back. Retention is a good proxy metric for your product’s success.

That’s why I love RARRA. It focuses on the core thing: retention.

Easier said than done. I know.

That’s why we have to take a step even further and put RARRA on steroids.

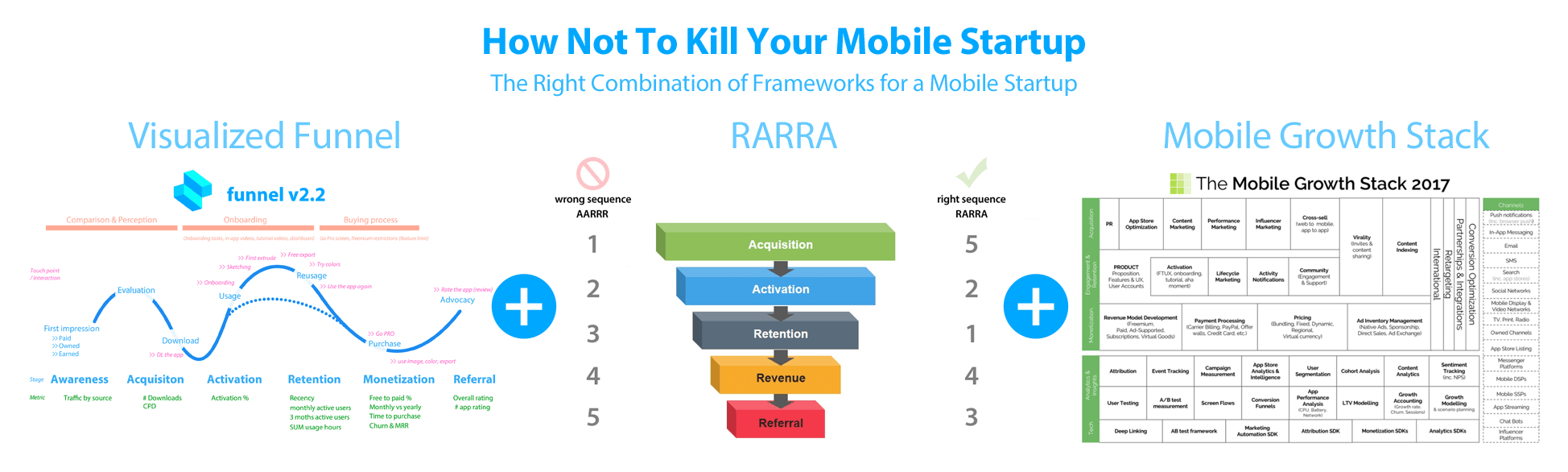

RARRA meets Funnel Visualization

If you combine the funnel doc with RARRA than it also enables better focus for the growth team. You always know which stage you are working on and how that fits into the entire user flow.

It can help you:

- sell your marketing vision to the board and get more budget from the CEO,

- the CEO can always be in the loop and feel where things are heading,

- identify key areas where you need to hire (or fire from),

- build trust between marketing and other departments

- communicate better internally and externally.

When I joined Shapr3D as an early team member in 2016, I spent my first weeks on understanding the user funnel. It took me a while to get a clear picture of how users interact with the product, where they come from, what drives app downloads, and so on.

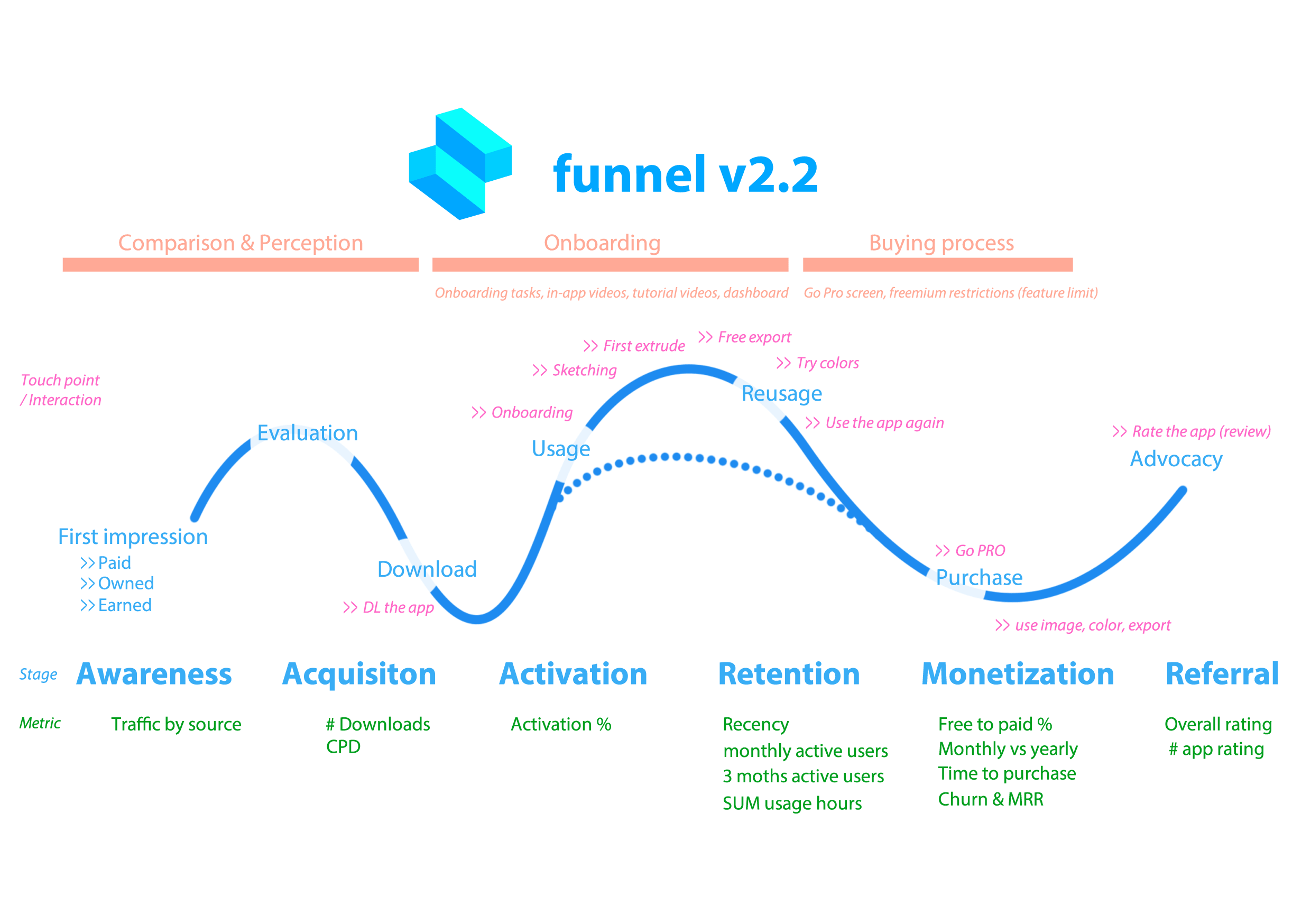

Did a few surveys and user research and tried to map the funnel. For this, I used the AARRR model. I like to slap Awareness on top of the AARRR framework, so it becomes a 6 element model:

- Awareness, Acquisition, Activation, Retention, Revenue, Referral

Though the model seems easy, it can get complex when you want to attach metrics, key actions and interactions to it. So it makes sense to visualize it. This is an early version of my funnel.

Shapr3D’s funnel

It covers the main stages in blue (from Awareness to Referral), the metrics that are tracked at every stage (green), the processes on top (orange), and the key actions in the middle. The blue line is not linear on purpose. It’s just a visual aid for me to know that there’s a flow of users and not everything happens easily after each other (ups and downs).

As a first step, this really helps layout all the areas that you’d want to work on as a full-funnel marketer or as a team.

Having a good funnel overview of your product is extremely important:

- it helps you understand the product much better,

- makes stages and definitions clear for every team member,

- brings the entire team on the same page.

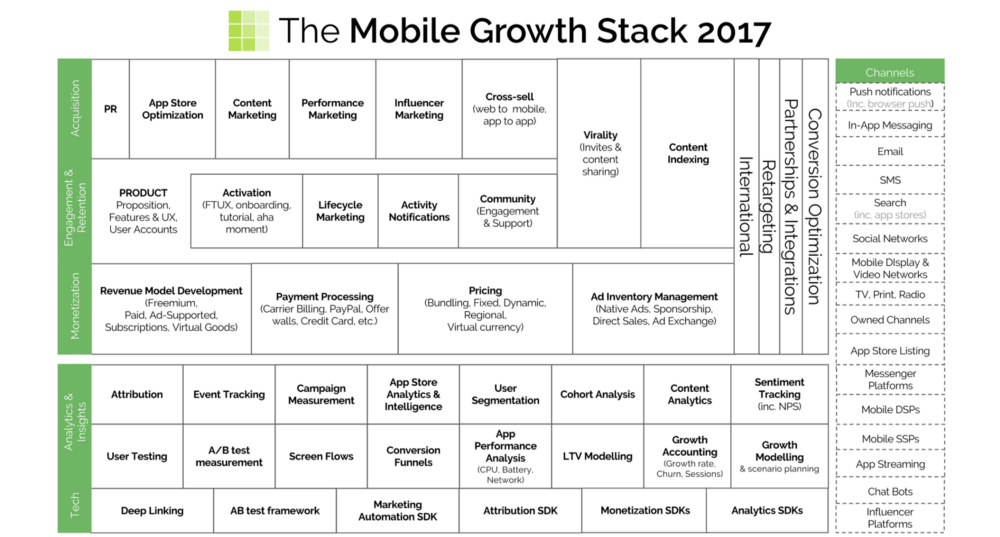

A few weeks ago I wrote an extensive post on how you can combine and implement Andy Carvell’s Mobile Growth Stack and the Visualized Funnel at a tech startup based on my experience at Shapr3D. If you haven’t read it, you should definitely check it out.

How to implement the Mobile Growth Stack at a tech startup? — Shapr3D case study

Learn how you can use the Mobile Growth Stack to drive app installs, and grow your retained & monetized userbase.

mobilegrowthstack.com

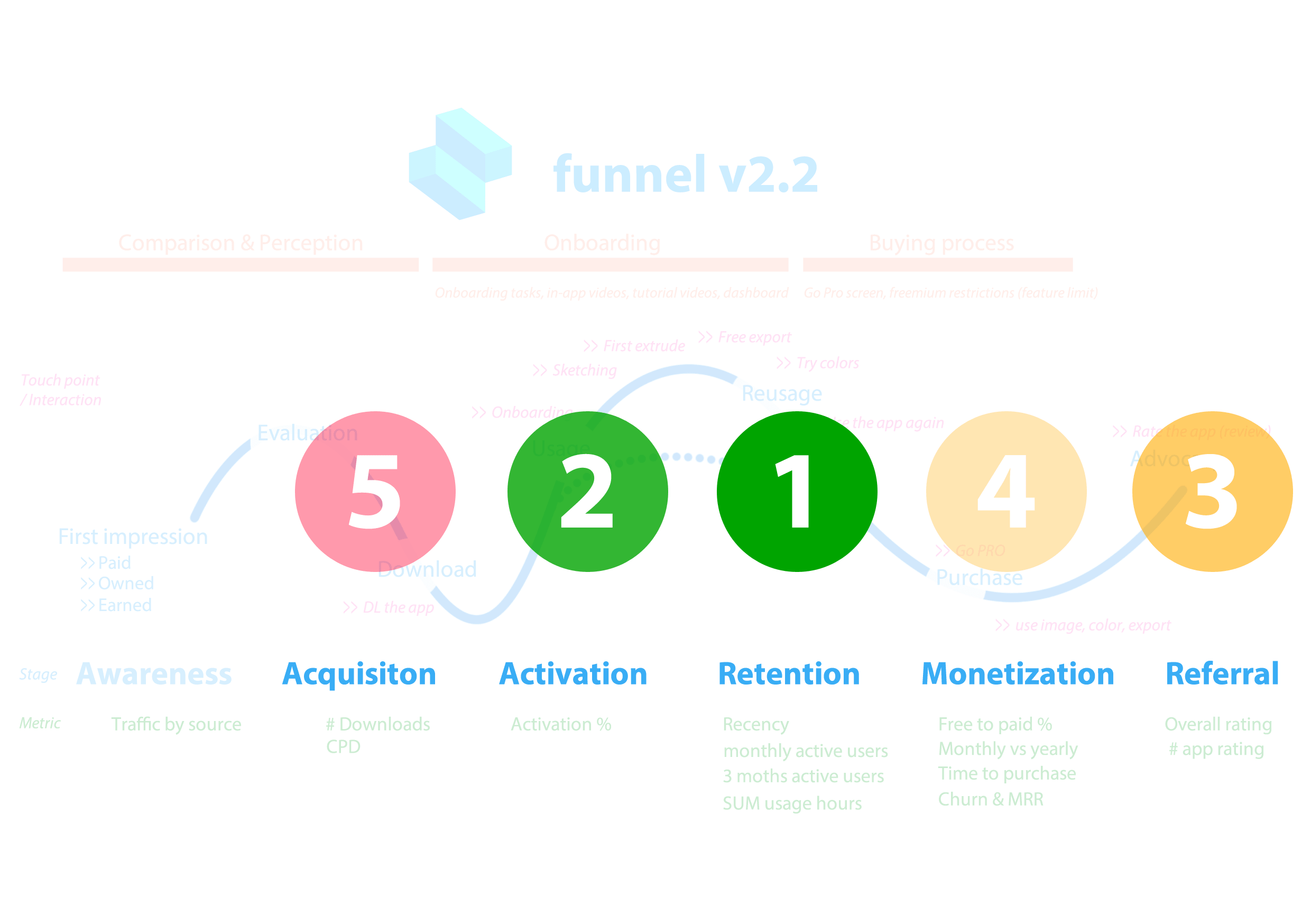

When RARRA meets the funnel

Highlight focus areas in the AARRR funnel with the help of RARRA.

You’ve already taken a giant step forward in NOT KILLING your mobile app in the first place.

But you shouldn’t stop here. Now you have the overview and know where to focus, it’s time to get into execution mode. That’s where the Mobile Growth Stack comes into place.

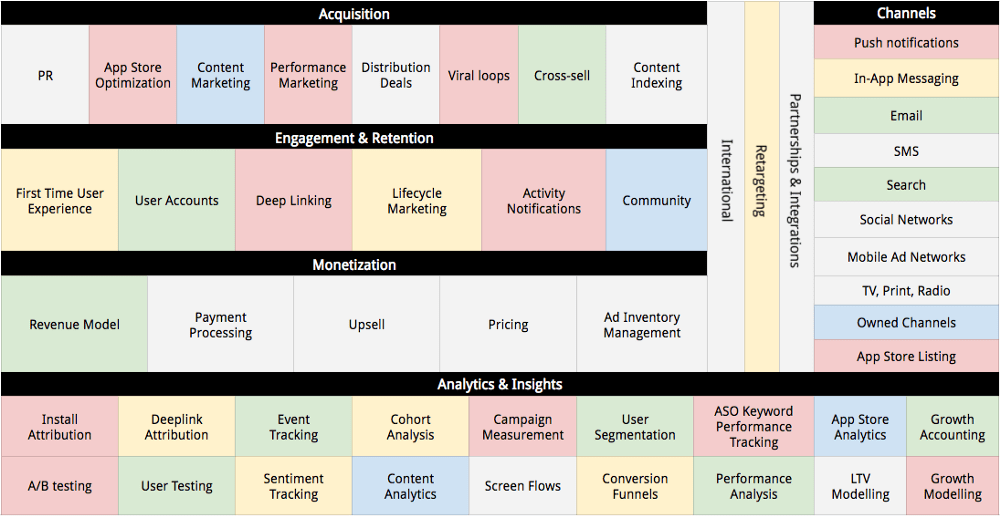

The stack is a light-weight framework for strategic mobile growth. It’s a powerful tool to guide any growth team.

If your company is before launch, you should use the framework as a reference for focus and product development. You can even use color codes to highlight important areas and elements that don’t yet apply to you.

It’s also useful to re-visit the audit / color-coding exercise over time, to see if it makes sense to adjust focus areas. Because hopefully, the experiments will have improved the performance of some activities.

If you are after the launch, you can use it for multiple reasons:

- use it as an audit tool for your mobile startup

- use the stack as a framework for growth.

As a framework for growth, you can either apply the stack to:

- construct your own experiments or

- replicate somebody else’s ideas.

In both cases, the framework serves as a guidance and reference point. You just need to pick boxes from the framework and match them with tools and processes.

Here are some ideas you might do for better retention and activation:

- create an onboarding tutorial for users

- send in-app messages and push notification to users

- send re-engagement emails

- create a webinar that explains how to use the product

- share case studies on how others have successfully used the product

- create dedicated landing pages and websites for specific product use cases

You can create your own list of ideas, save them in a backlog, and test them. Focus on Retention and Activation first. Not on Acquisition.

Of course, I know that you need volume to have meaningful test results, so it makes sense to run initial acquisition campaigns, but you have to be SMART about these.

You need to have a full-funnel overview in mind when you run an install campaign. This is where we combine the funnel with RARRA and the growth stack.

Putting it all together: RARRA + Visual Funnel + Growth Stack

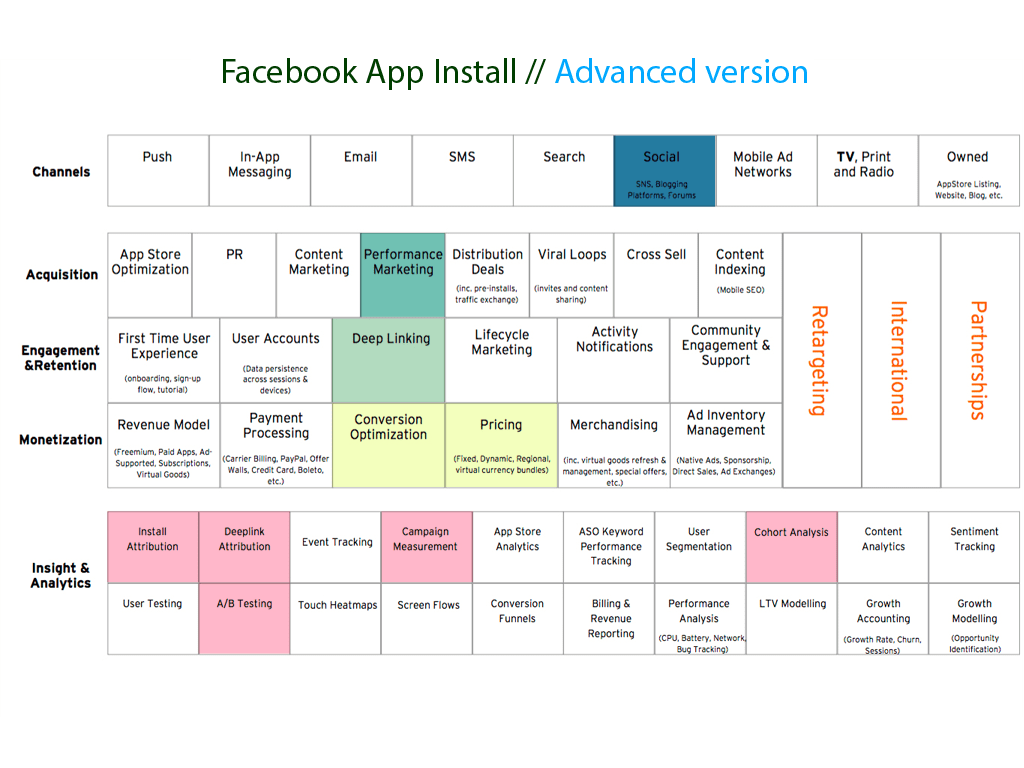

If you want to run a Facebook App Install campaign to test initial CPI and retention for users coming from paid ads, you want to use:

- Social as a channel

- Performance marketing as an acquisition type

- CRO and install attribution as a monetization & analytics layer

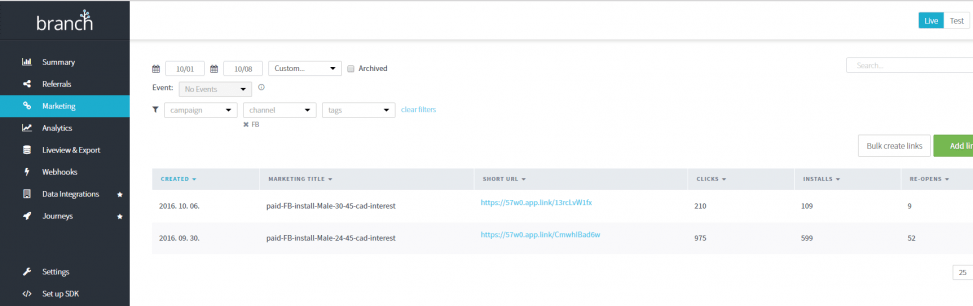

To run this you can use Facebook’s Power Editor as the ad platform, Branch.io for attribution and track results using these two tools plus iTunes Connect. If you have some sort of mobile analytics implemented like Mixpanel / Flurry, you can get even more info and run cohort analysis as well. If you have all these in place, that’s where the magic happens. 🙂

There’s more on this process in my previous post where I outlined how you can implement this stack in your mobile startup.

To give a very specific example, here’s my setup for this exact test campaign:

- Created Facebook ads to drive successful app installs

- Checked CPI

- Checked retention

- Checked ROI for the campaign

Notice how I not just run an simple Acquisition campaign but already have a full-funnel mindset in place? Great!

I wanted to be able to track users from the very beginning, all the way to the end (do they retain? do they pay? do they refer others?). In order to do this, I followed their journey:

- Users click on the targeted Facebook Ad.

- Lands on the Apple App Store

- Downloads the app

- Starts using it (activates)

- Comes back (retains)

- Pays for the app (monetized)

- Leaves a review, rates the app (advocates)

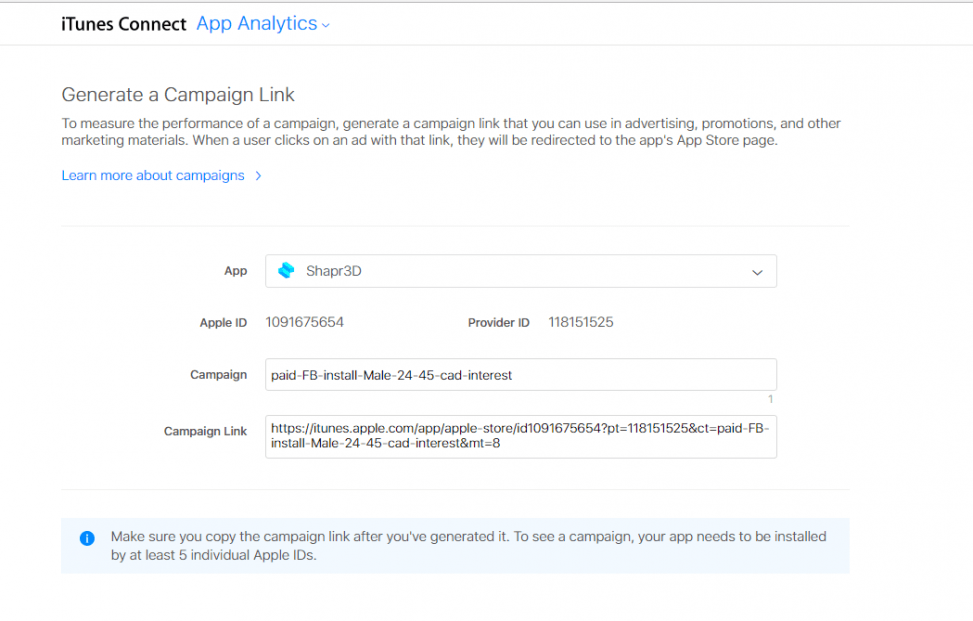

In order to track everything, I had to set up tracking in reverse order.

- Had in-app analytics already setup (Mixpanel) + FB + iTunes Connect Analytics

- Used iTunes Connect Campaign Generator to create an attributed link for the ad

https://analytics.itunes.apple.com/#/campaigngenerator

It’s the same as a UTM tagging tool for Google Analytics.

- Created more links and segments to test

To test many variables at scale, created a tagging template for parameters like age, gender, source, type and interest. It works the same as the iTunes Connect generator, but I can tag links at scale here.

- Set up attribution for these links

I signed up for Branch and used these tagged links to create attributed deeplinks.

5. Used these attributed links accordingly in the Facebook ads and tracked how they performed in terms of CTR and CPI.

![]()

- Later used the Branch + iTunes Connect + Mixpanel data to understand activation, retention, and monetization metrics.

That’s where things got really interesting.

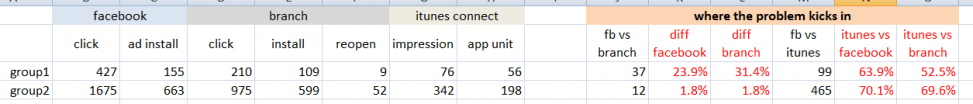

- I had a lot of data I could look at and measure the test results.

- There was one odd thing I have discovered. The data in iTunes Connect, Facebook, and Branch were way off.

Read the full story on “Why Data Literacy Matters” on the Data36 data blog here.

Took some time to figure it out, but it turns out Facebook overreports app downloads, while iTunes Connect underreports them as it only has info on users who have enabled opt-in data.

Wait, wut?

Heard it right. According to iTunes Connect, Apple only shows data from users who have agreed to share their diagnostics and usage information with app developers.

In the last 30 days, it was only 34% of all users who installed Shapr3D.

So there’s no reliable info on the other 2/3 of your users. Nice…

This opt-in data shouldn’t affect app unit data, but for me tagged campaigns never returned “the values I expected” so I am skeptical there. But many usage data options are opt-in only, so measuring retention for campaigns is almost impossible because of this.

That’s why it’s a smart decision to rely on a mobile attribution partner as well (like Tune, Adjust, Kochava, or Appsflyer), not just on the analytics system given by Apple.

The Mobile Growth Stack helped me to put this together and saved me when the numbers came in way off. Without the stack, it would have been a nightmare to figure out how elements were connected and where things went wrong.

Running tests and experiments like this one is important, but you should only do these acquisition tests if you:

- can measure what happens later down the funnel or

- you’re REALLY sure the numbers add up and it’s a numbers game of CPI vs LTV.

Premature scaling and acquisition can really hurt your mobile startup. In fact, it can literally kill it.

So instead of jumping right into the acquisition/execution model, I would suggest to do the following:

Figure out retention first. Then Activation. And save Acquisition for later.

To help you better navigate this space, you should follow these steps:

To build a good mobile marketing process

- Map out the funnel of your users

- Use RARRA to find focus areas/stages

- Do an audit using the Mobile Growth Stack

- Collect experiment ideas in a backlog

- Use the Mobile Growth Stack to construct experiments

- Carry out the experiments

- Test & Measure

If you focus on these steps, you are more likely to succeed. If more app developers have followed these steps, we would have fewer mobile startups fail.

The AARRR funnel is a good concept, but it doesn’t help you to focus on the things that really matter.

Use RARRA instead. Focus on retention. And save acquisition for later.

These three simple rules might just save your mobile app.

If you combine the Visualized Funnel with RARRA and the Mobile Growth Stack, you have something very few mobile startup companies have:

- you know the user flow and main areas (Funnel)

- know what to work/focus on (RARRA)

- how to execute it (Stack)

- + a chance to survive 🙂

How Not To Kill Your Mobile Startup: Funnel meets RARRA meets Mobile Growth Stack

Want to make sure your mobile startup fails? Focus on Acquisition!

Want to maximize your chance of winning? Focus on Retention!

These frameworks can help you win.

Want to read more like this?

There are very good resources on the topic. If you are serious about mobile marketing (analytics, ASO, UA and more) you should check out:

- The Mobile Growth Stack blog by Phiture

- Join the ASO Slack group

- Follow the Growth Stack Twitter account

Worth the read?

If you liked the article, share the love ❤ so it can reach more people.

This article was written by Gabor Papp, Patrick Vlaskovits, and Casey Armstrong.

Table of Contents