Editor’s note: This is a guest post from Saket Toshniwal. Saket leads the team for CRM, Growth, and Product Marketing at LOVOO. LOVOO is a social entertainment app with 120+ million users. Saket builds strategies across all stages of our user journey, upscaling the interaction with customers, and building a robust CRM ecosystem. Saket is also a thought leader, speaker and consults companies to grow product monetization smartly. Saket has worked on 100+ experiments on subscription monetization and pricing tests.

It’s safe to say that people are willing to spend their money on (and in) mobile apps of all kinds, and app makers are doing their best to show-off features and optimize conversion funnels. Yet I often find that companies miss the boat when it comes to product monetization. For instance, one of the best ways to get immediate monetization results is the subscription model. Even though a lot of companies use this model, many managers still don’t get the best out of their product monetization, and instead, rely on guesswork that doesn’t deliver results.

Radically improving the odds that your product monetization will succeed is just a matter of removing the guesswork. That happens when you put customer demand and willingness to pay in the driver seat—when you design the product around clear product-pricing and monetization tactics.

In this article, I’ll be sharing a few techniques that have helped companies I worked with to increase their subscription revenue for product monetization, and show you a few tips and tricks that even the experts don’t know. These subscription monetization tactics have proven to work. I’ll be covering everything from an initial reduced price subscription to smart pricing tests.

1. Initial Reduced Price Subscription

For both Android and iOS, introductory pricing is incredibly revenue-effective. Yet very few apps use it. I think it’s an absolutely amazing pricing technique to increase revenue from subscribers who love your product, or find value in your product. Even so, the concept itself might be a little less known to regular users, as a sale on the whole subscription time is more common. With that in mind, I highly suggest using it for all your subscription packages, especially for three-month, six-month, and one-year subscriptions.

If your users can buy your subscription online, offering an introductory price is an excellent technique because you’ll get higher net revenue across the board.

A few risks and pitfalls to keep in mind, though:

- Don’t show the introductory offer to new users until they have seen the regular point of sale at least two times and still didn’t purchase. This is particularly important from the CRM growth perspective, as you can then reach out at particular points in the cycle.

- Don’t have $10, $20 or $40 as an introductory price. Have $9.99, $19.99, or $39.99, and renewals at one-and-a-half to two times that amount. At Lovoo, we tried multiple approaches. We started with identifying big payer churn: when a user starts paying less, we opted for a churn off reduction. We then identified big payers and normal payers. One thing we learned was to expect renewal rates to drop because price-sensitive users will cancel more. The good news is that renewal-revenue should increase even if renewal rates fall.

Take a look at this example. Assume, for a second, that the regular price of your subscription is $24.99. Your period 1 renewal rate is 70% of users, while your period 2 and period 3 renewal rates are 50% and 33%, respectively. The total revenue of this subscriber would be $63.22. ( 24.99*1 + 24.99 * 0.7 + 24.99 * 0.5 + 24.99* 0.33).

Now, let’s change it. Let’s use our lowered introductory price of subscription at $19.99. The renewal price of your subscription is $39.99, while your period 1 renewal rate is 60%, period 2 renewal rate is 40%, and period 3 renewal rate is 25%. The total revenue by this subscriber would be $69.98. ( 19.99*1 + 39.99 *0.6 + 39.99*0.4 + 39.99*0.25).

The final incremental revenue you’ll be looking at is 10.7% per subscriber.

2. Churn Prediction and Prevention Modeling Revenue Growth

Churn prediction and prevention are also important tactics to keep your product monetized. You can build several segments to prevent churn of revenue. I would recommend starting with identifying several different types of users/churn models that help understand how to prevent churn overall. I always look at the following two:

- New payer churn. New payer churn refers to a user who has had a lapse of 14 days (gaming and single purchase), not subscription. Subscription is also relevant, but only after they churn after the first month of renewal. To win them back, you need more than a discount: users who churn don’t really know all the features, premiums, or benefits they can derive out of the product. This is part of the first time payer lifecycle: a user sees a price on the product but needs discounts and a bargain to buy it. A small purchase can do wonders. Giving them a share of the wallet and upgrading them to higher tiers are also worth considering here.

- Churned big payers. This refers to big payers that have stopped contributing to your overall revenue, and who contribute $3,000 or more a month. First off, start with the obvious question: why are they churning? Try to understand the absence of action based on activity and retention metrics, as well as key events. The subscription-cancellation generally happens on a U-curve: they cancel in the first or last seven days.

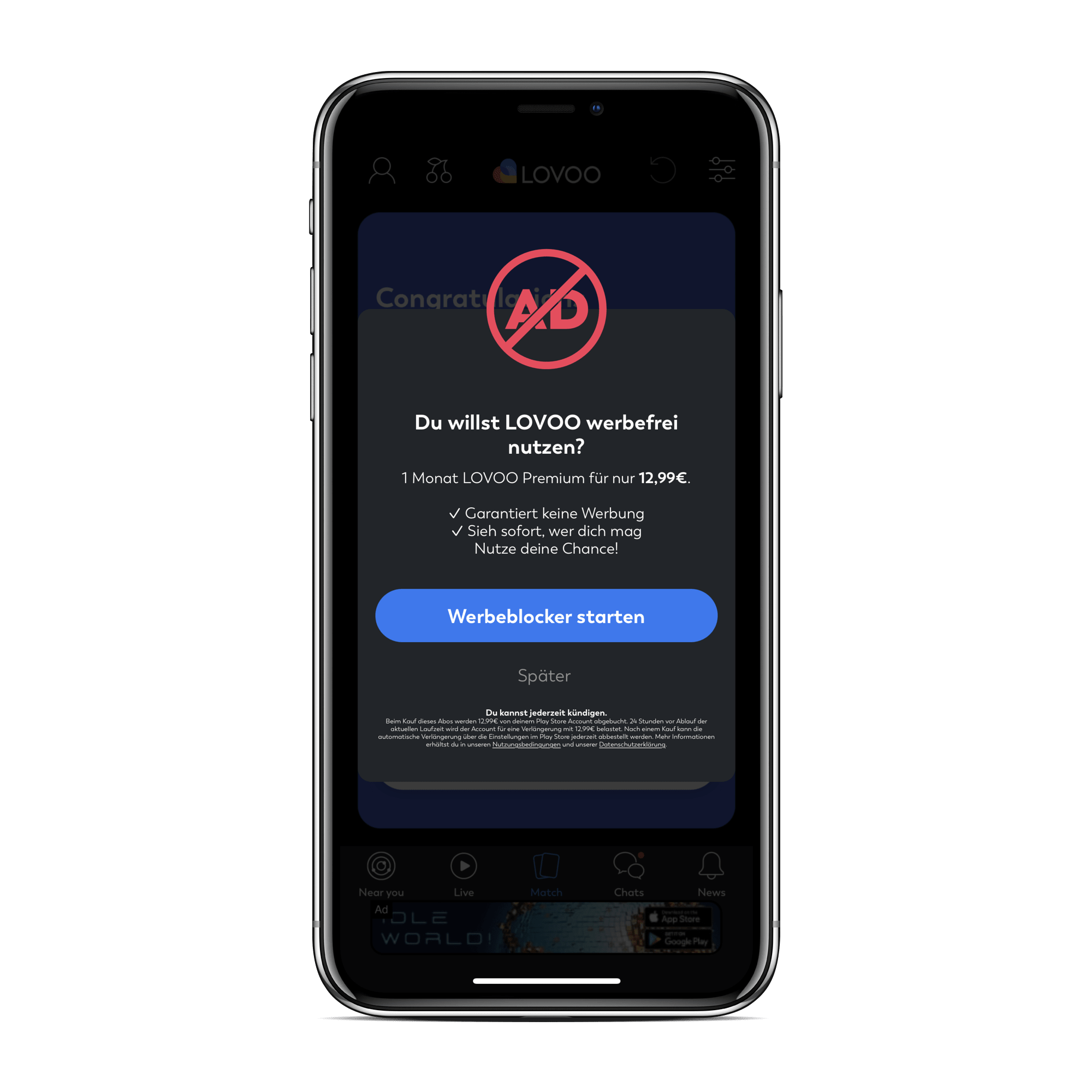

This segment of users is essential to win back. At this point, it’s important for your CRM teams to launch several re-engagement campaigns through push notifications, email, in-app messages, and more. It’s important to keep telling your users the value of your product at the beginning of the cycle so they don’t churn. In the last four to seven days of their subscription, your communication should be different: you’re motivating them to come back. Creating FOMO—conveying the idea that “your benefits will be lost”—is also a good technique at this point in the cycle.

Whenever there is a specific pause (3 months, or 6 months, let’s say), another great option is to give your users a pause subscription instead of an outright cancellation.

3. Sleeper Subscribers

These are paying subscribers who have been inactive for at least 30 days, and have not canceled their subscription. Here, users either forget to cancel the subscription, or have bought a long-subscription and found your subscription less valuable at a given period. You will find that you have lots of sleeping subscribers who are paying for your membership and not using your product.

You have to tactically communicate with your sleeping-subscribers. The Amazon example below is a great way to do that. Notice how the CTA directs you immediately to the Prime Music app. It’s a perfect example of communicating the right engagement without reminding the user that they haven’t been using the app.

4. Combine Subscription and Single Purchases

The best way to increase your monetization is to combine subscriptions and single purchases. Here are a few reasons why:

- People who have bought subscriptions are more vested in your product. You can give more value to them via single purchases and ask to purchase more.

- People who are hesitant to purchase subscriptions and often happy to try the offering through a single purchase.

- It’s easier to monetize users who are already paying and happy with your product. Some ideas to upsell with single purchases are icebreakers, gems, badges, levels, etc.

Several companies I worked with doubled their revenue by combining subscriptions and single purchases. When users buy subscriptions, they are more vested in your product. Then, more hooked users continue to buy single purchases, which range from credits, level up, gems, unlocks, badges, virtual gifts, tips, and more depending on the type of app you have.

5. Smart Pricing Tests

Smart pricing tests for subscriptions are among my favorite tools, and have been successful in increasing subscription monetization. Here are a few recommendations that have worked wonders for me.

-

- Increase membership runtime from one-three-six months to three-six-twelve months instead.

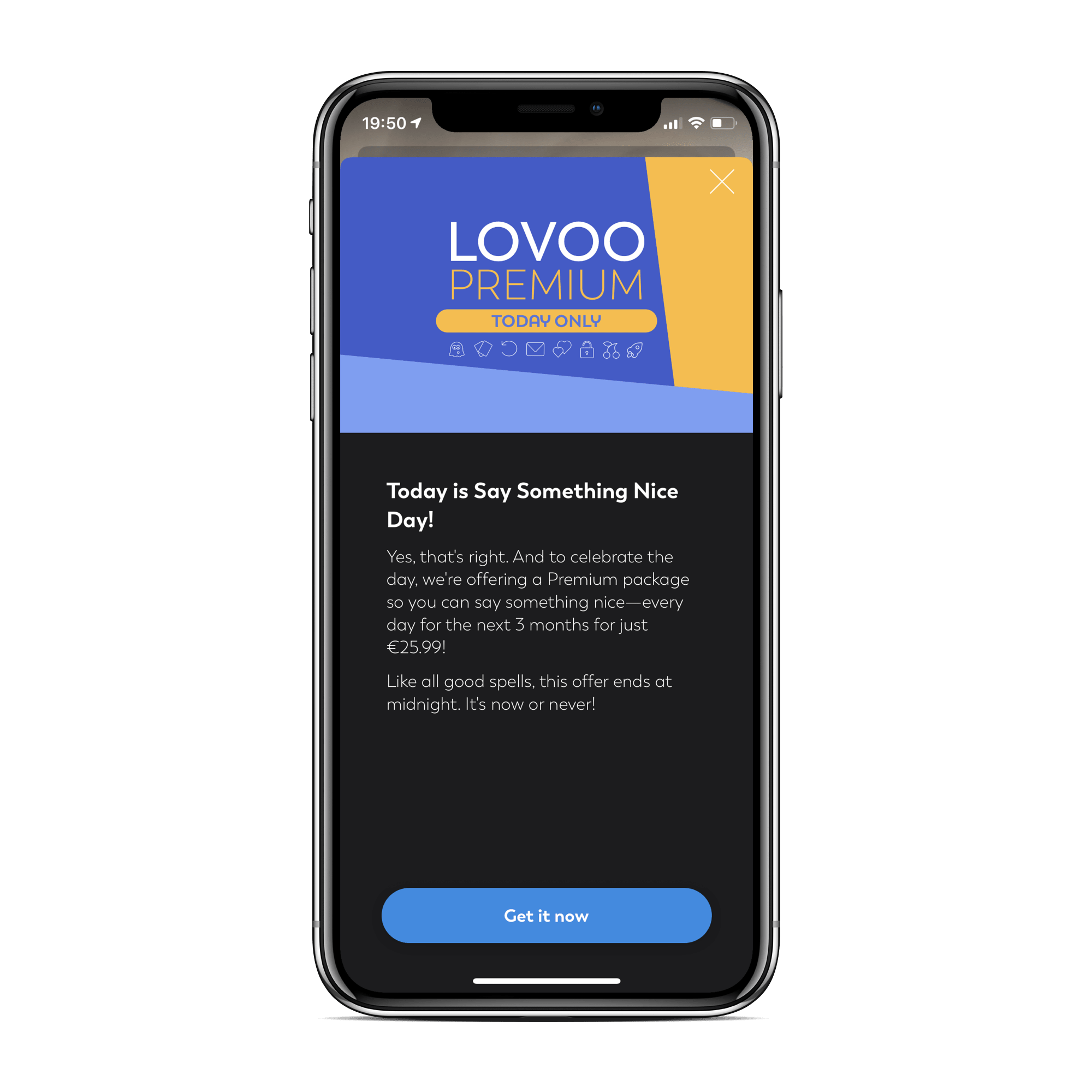

- Kick-off your initial discount with a count-down timer. It’s a great way to put good pressure on your users without overbearing them.

- Extend price segmentation. You can do this by analyzing your current main KPIs and moving them slightly. It also involves understanding that pricing is different in different countries as per capita income is obviously different.

- Use limited discount special offers. These can be seasonal, or as part of a campaign.

- Introduce an offer chain and increase the base price with discounts at the same time.

- Offer Installments in subscriptions for long subscription run-time. Installments add more revenue because they’re not free.

- Add a cancelation survey at the time of cancelation and email verification at the time of cancelation.

6. Subscription Metrics and Dimensions

Lastly—and this goes without saying—looking at your metrics is crucial in order to understand your product monetization. I recommend looking at the following:

- Sold units

- Gross/total/net revenue

- Paying users, payer share (over DAU, MAU)

- ARPU (over DAU, MAU), ARPPU

- Conversion rate, CLV (D1, D7, …)

- Active subscriptions

- Runtime revenue

- Renewal rate,

- Churn rate

- Subscription unit

- Revenue growth

Key dimension metrics to look at are the following:

- Gender

- Age group

- Platform

- Acquisition channel

- Purchase

- Package

- Reduced offer

- Payment provider

- Payment error – grace period

- Account hold for active subscriber

- Activity informing and recommendations to upgrade

If you keep track of these metrics, you’ll be on your way to having the right kind of monetization for your app.

In conclusion, testing and measuring the above six tactics can really help you in the short, mid, and long run. Subscription monetization is really the best way to increase growth in your company’s revenue after the product has achieved product-market fit.

Table of Contents