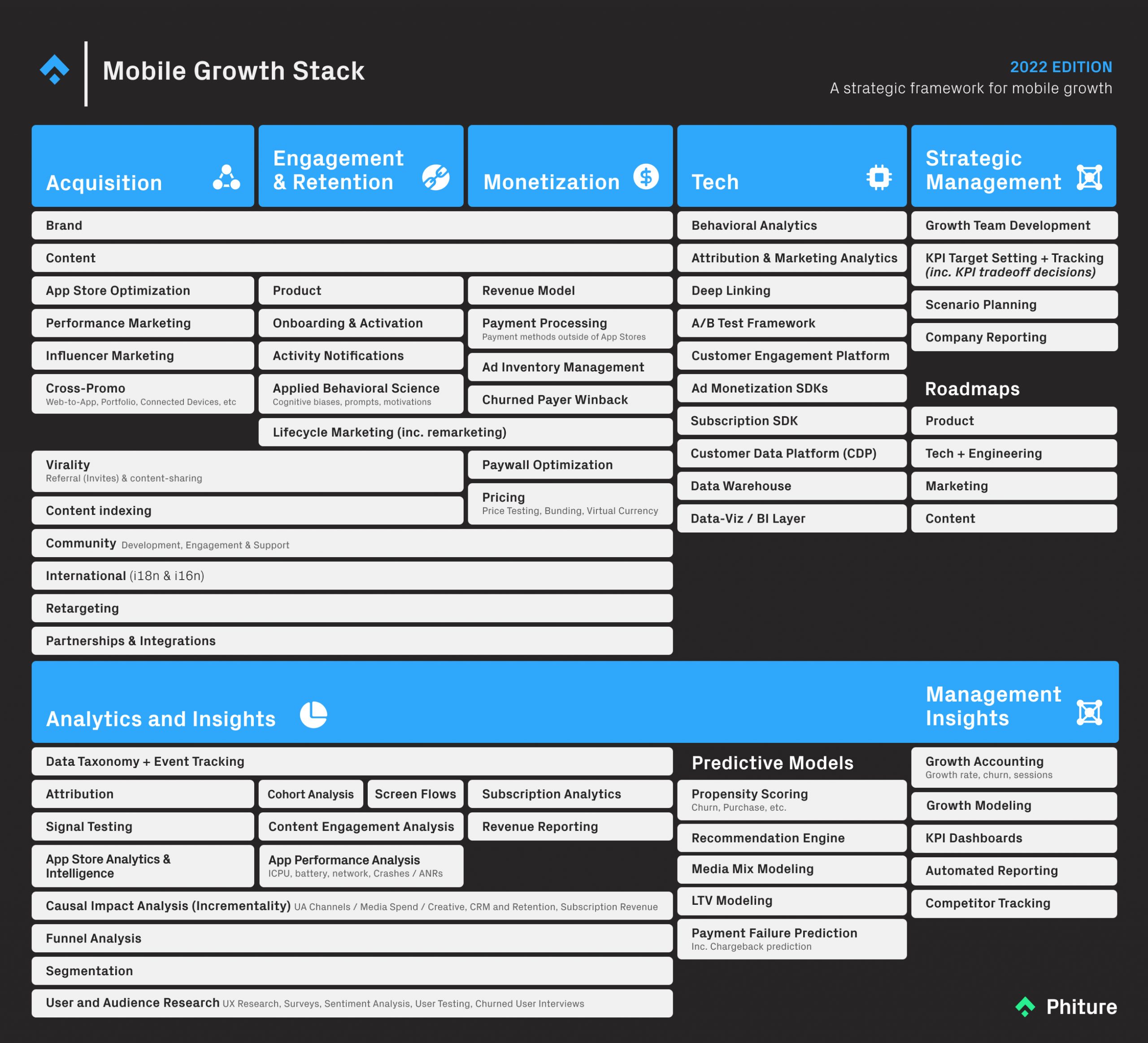

The Mobile Growth Stack is a framework that helps marketers, founders and growth practitioners develop and evolve a strategy for growing the user base of a mobile product or product portfolio. The stack can be applied at any stage during a product’s lifecycle and to many different business and financing models, although some layers and elements of the stack will be more relevant at different stages of the business.

For a detailed explanation of how to apply the growth stack to your business, check out our article on Applying the Stack, and the resources on this site, which are organized according to the elements of the stack to which they apply:

Applying The Mobile Growth Stack

The Mobile Growth Stack contains a lot of information and can be intimidating at first glance. This article explains…

medium.com

History & Evolution

The stack was first developed and published by Andy Carvell, based on a 15-year career developing and publishing mobile products and services, and particularly from the 4.5 years, he spent growing SoundCloud’s mobile user base. Andy and fellow ex-SoundCloud growth team member Moritz Daan now update the stack together, based on their combined experience working with a range of app developers and publishers worldwide as mobile growth consultants at Phiture.

You can read the original blog posts about the stack below:

2015: The Mobile Growth Stack Revised

For an in-depth guide to applying the growth stack and ‘stack thinking’ to your business, check out the accompanying article on this site, Applying the Stack.

Follow us on Twitter at @phituregrowth for updates!

How Does It Work?

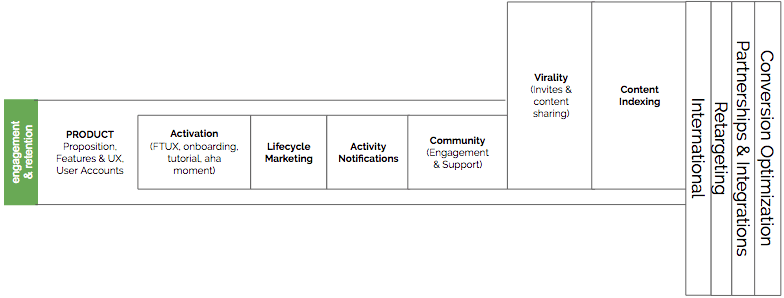

The stack has three horizontal layers, representing key performance objectives: Acquisition, Engagement/Retention, and Monetization, supported by a fourth layer: Insight & Analytics.

Companies at different stages of product maturity will likely prioritize different layers in order to reach their short-to-medium term business goals, but a successful strategy will need to generate impact in all three core layers at some point and will be highly unlikely to achieve this without investment in Analytics & Insight.

Each element (i.e. each individual cell) in the stack represents an activity that could or could not form part of the mobile growth strategy. Not all elements will be equally applicable to a specific app, category/vertical, or finite set of company skills & resources. A smart growth strategy does not attempt to cover every element of the stack, but selects an appropriate mix of activities that plays to core strengths, provides the best opportunity for near-term growth gains, and invests in developing additional capabilities and channels for the next — hopefully bigger — phase of growth.

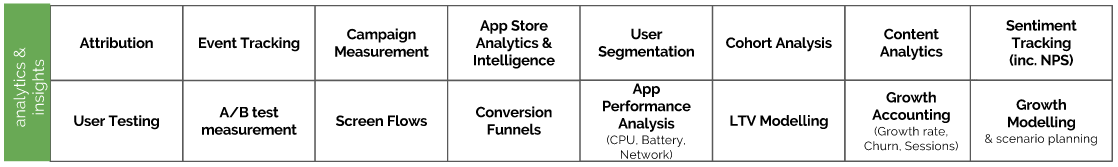

Insight & Analytics

The Insight & Analytics layer is the most comprehensive in the stack, underlying the importance of quantitative and qualitative data, metrics, modeling and reporting play in guiding growth activities, measuring impact and identifying opportunities. Many tools and services exist to aid specific data collection or processing activities in this layer, though it’s possible with enough investment to craft custom solutions or quick hacks or database queries to gain short-term insight.

Attribution

Attribution of mobile app installs to specific marketing campaigns, content shares on social networks, invites or other acquisition sources involves different tracking technology to the web world. Browser cookies can be used on mobile/responsive web sites, but for native apps, users are tracked using device-specific IDs such as IDFA or Android ID, or via imperfect fingerprinting technology that combines a number of data inputs to match a user (or, more correctly, a device) to a click an install. Attribution becomes even more challenging when accounting for multiple touch-points and cross-platform traffic (e.g. desktop web to mobile device install).

Deeplinks

Native mobile apps are evolving; no longer are they launched solely from the phone home screen, but are increasingly launched from deeplinks that take users directly to specific content within the app (assuming they have it installed). Many mobile apps implement deeplink schemas that provide additional entry points into the app. Deeplinks can be included in push notifications, emails, messages, other apps, links from websites and pretty much anywhere else that a regular web URL could be launched. Not only that, content within the app can be indexed by Google and surfaced in search results (app indexing is also supported for iOS 9 and above when Universal Links are enabled). Deep links are also used in retargeting campaigns, where existing (but possibly lapsed) users are served advertisements in other apps aimed at re-engaging them and bringing them back into a specific part in your app.

If your app supports deep-linked content, it’s important to gather information on how these links are performing. Understanding which deeplink URIs are being opened and, ideally, where the user came from (e.g. browser link, push notification, retargeting campaign, etc.) will provide valuable insight into which content is most popular and deeper understanding of how various channels and campaigns perform for re-engaging existing users. Such data can inform the editorial policy for new content and aid optimization of comms activities.

Event Tracking

Measuring user engagement at a granular level is a critical pre-requisite to making data-driven optimizations and to evaluate adoption and performance of features.

Any action the user takes within an app (app opens, account registration, navigation between screens, button presses, content shares, purchases, etc.), as well as things that happen within the app programmatically (e.g. an enemy spaceship is destroyed, level is complete, account successfully created, etc.) is a candidate for tracking as an ‘Event’ as part of the analytics implementation. The analytics SDK will typically transmit these events along with any additional metadata relating to this occurrence of the event (typically referred to as ‘Event Properties’) to a server when network conditions allow.

Aggregating and storing event data sever-side for analysis in a web-based dashboard is by now common practice and many analytics tools exist to simplify this task. Such quantitative event data shows how users are interacting with the app/game, which features are most/least used, can help identify bugs (e.g. if event counts suddenly nosedive, the feature associated with the event may be broken) and allow the visualization of engagement funnels for key user paths. Additionally, sever-generated marketing campaigns or activity notifications can be triggered by events and possibly personalized with event property data.

Campaign Measurement

Marketing campaigns, whether they are for user acquisition, engagement/retention or monetization, require proper measurement in order for impact/ROI to be measured. Without a quantitative understanding of campaign and creative/copy performance, advertising budgets cannot be properly allocated or scaled and campaigns cannot be optimized.

In the case of user acquisition (UA) or retargeting campaigns, this topic is closely linked to install/deeplink attribution and event tracking; marketers need visibility of how many installs each network and campaign variant delivers, how much they are spending to acquire these new users, and the ‘quality’ of these users (typically measured in terms of engagement/retention or monetization events that are generated by cohorts of users attributed to the campaign) in order to optimize ad spend for performance.

Lifecycle marketing such as email, push and in-app campaigns also require detailed measurement in order to run experiments to improve open & click rates and downstream performance goals such as increasing in-app-purchases, driving more key actions within the app, improvements in retention, etc.

App Store Analytics & Intelligence

Any app publisher will be distributing their app through at least one (and likely several) app stores; aside from iTunes App Store and Google Play, many other distribution channels exist including Windows Store, Amazon App Store, Samsung Apps, Myapp (Tencent), etc.

Basic App Store Analytics provides measurement and reporting of app installs and in-app purchases by country, device, OS version, etc. as well as those of your competitors if using a services that make these data available.

With thousands of new apps and games submitted to the app stores every single day, staying visible in the stores is a constant battle for app publishers. Observing and reacting to competitive trends, keyword search volumes and other market intelligence can give publishers an edge over the competition. Reviewing predicted download data for top apps in a category can inform strategic planning and provide an indication of how many daily downloads a publisher needs to achieve in order to reach a specific ranking in the store (though the common download estimates — generated using predictive methods — should be treated with caution, since accuracy varies considerably between categories and analytics tools). Nevertheless, analysis of app store data, with a view to deriving actionable insight, can be helpful at all stages of the product lifecycle.

App Store searches also form an important part of app discovery and careful identification and testing of keywords can lead to increased organic downloads from the store. Many ASO tools exist that estimate keyword search volume and estimate the difficulty of ranking highly in search for specific keywords.

User Segmentation

Not all users are created equal; some groups of individuals will be more engaged, more likely to spend money within the app, or otherwise display some common trait(s) that enable them to be grouped together into meaningful segments for the purposes of analysis, marketing, dynamic pricing and so-forth. Most analytics tools allow creation and tracking of dynamically-updated user segments based on user metadata (a.k.a attributes) or behavior within the app. By tailoring in-app and external messaging campaigns to specific user segments, marketers can increase relevancy and impact of their campaigns and drive more impact.

Cohort Analysis

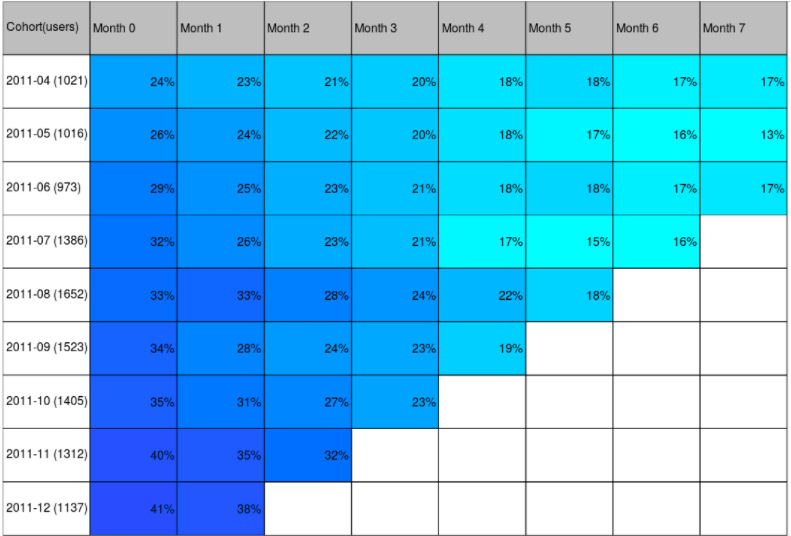

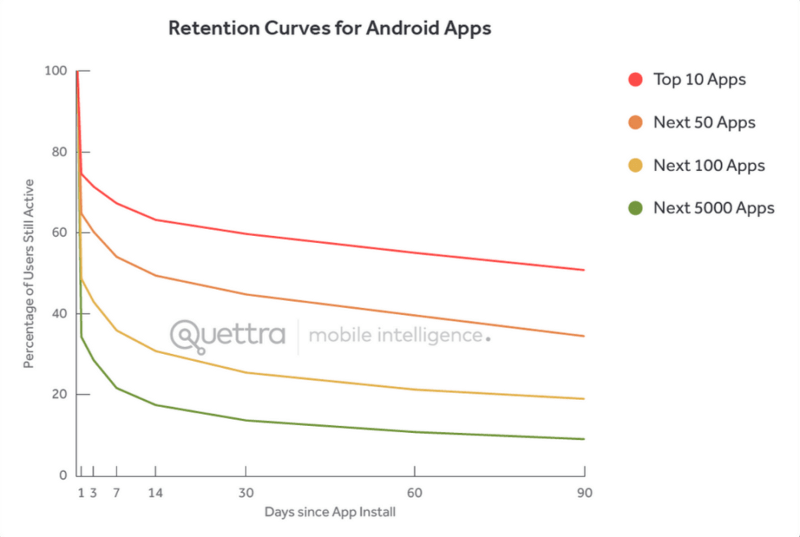

In order to understand how user growth and retention is evolving over time, it’s important to examine users in cohorts (groups of users with some common trait, typically install/sign-up date) rather than relying on top-line metrics such as total registered users, monthly active users (MAU), and daily active users (DAU), which tend to mask underlying retention problems.

A typical cohort retention table divides users into cohorts from the period (typically day/week/month) that they were first seen in the app and shows how many users (or what percentage of the cohort) returned to the app in the following periods.

An example cohort table (also known as a Cohort Triangle)

Content Analytics

If an app or game contains dynamic content e.g. news articles, recipes, photos, music tracks, etc. then tracking engagement (views, likes, bookmarking, purchases, etc.) on and sharing of content provides insight into which content and categories deliver the best ROI. In addition to tracking content engagement, it’s also desirable to measure how many referred users a specific item of content generates as a result of being shared and which channels deliver the best virality.

Sentiment Tracking

Customer satisfaction is important; unhappy or disgruntled users are at high risk of churn and may also voice negative feedback on app stores or online forums, deterring potential users. Conversely, happy or delighted users can be powerful advocates for a mobile product and should be identified as such in user segmentation.

There are many ways to measure customer satisfaction; online, in-app or email surveys can be used to gather detailed feedback, but more commonly users are simply asked via a pop-up to give the app a rating from 0 to 5 stars, or else to provide their Net Promoter Score (NPS) rating with the simple, standardized question “How likely would you be to recommend [product] to a friend of colleague?” (with a rating 0–10 possible).

Users who give the app a high rating can be confidently targeted with requests to rate the app in the store, invite friends, share content or tweet about the app. Users with negative sentiment can be identified and — hopefully — placated by customer service efforts and encouraged to provide feedback directly to the publisher rather than in a public.

Sentiment tracking techniques can be used to quantitatively gauge user reaction to new features or content, possibly before rolling out to 100% of the user base.

User Testing

Nothing brings a product team a reality-check faster than inviting real people to try out a new product / feature. Whilst the feedback from user testing sessions is qualitative in nature, it can be incredibly revealing and often just a few user tests are required to identify common themes and usability issues within the product, which can inform product optimizations, design and even complete product pivots.

In an early-stage startup, frequent user testing is especially valuable; bringing in real people to interact with prototypes and early product versions challenges assumptions about product-market fit and wrenches teams out of the myopia and groupthink that can manifest itself in enthusiastic founding teams.

A/B Testing Measurement

Multivariate testing is an essential weapon in the growth marketer’s arsenal. Planning, executing and interpreting the results of A/B tests, tied to hypotheses that refine a bigger-picture understanding of the product’s qualitative growth model is the bread-and-butter of growth.

In order to A/B test new product features, UX tweaks, marketing campaigns and user communications, tools or frameworks must be in place to assign users to statistically significant test and control groups, measure the impact on the relevant metrics and conversion goals, and report results.

Screen Flows

Similar to event tracking, screen flow tracking provides insight into how users navigate through the app, which screens they land on and the paths that they take to get there. Analysis of screen flows can identify under-utilized screens or features that might benefit from more prominence in the UI (or cutting out completely), or show that users are spending a lot of time in unexpected parts of the app.

Conversion Funnels

Tracking and visualization of each event in key engagement flows such as account creation, purchases, searching, etc. helps identify under-performing flows and guide optimization efforts by showing the drop-off in users as they move through each stage.

New funnels can be created on an ad-hoc basis in most analytics suites, so new funnels can easily be created to monitor performance of new features or purchase options. Detailed event tracking is a pre-requisite for funnel visualization.

Billing And Revenue Reporting

Some mobile apps or platforms operate marketplaces where suppliers and consumers can trade virtual or real-world goods or services. In other cases, content within the app may be licensed on a pay-per-play or pay-per-view basis from a supplier.

If any of the above apply, accurate (and ideally automated) logging and reporting of payouts, license fees, royalties, or revenue garnered from advertising, in-app purchases or subscriptions is a required component of the product’s analytics and reporting framework.

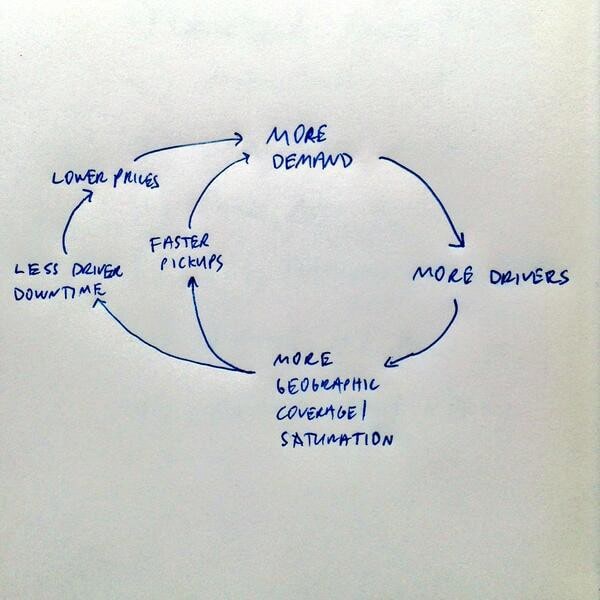

Growth Modelling

Growth is a a system, with numerous inputs and feedback loops. Developing a shared understanding — leading to an abstract model — within the organization galvanizes growth efforts, informing the hypothesis generation and ideation process. The growth model will likely be refined over time, as this shared understanding develops through experimental learning and deeper understanding of user behavior, market dynamics and operational data.

In addition to developing a high-level qualitative model such as the one above, a spreadsheet or similar quantitative model that connects acquisition (broken down by the various acquisition channels and viral loops) and retention/churn will prove highly valuable, both for understanding the present and creating projections for different scenarios. With such a model, scenario planning becomes possible and the team can adjust their mix of acquisition and retention efforts according to what will deliver the most impact on active user growth.

LTV Modeling

Understanding the lifetime value (LTV) of users is incredibly important once the app is monetizing. LTV is a Present Value calculation of the future expected revenue generated by a user over their lifetime. Since this is a forward-facing projection, LTV modelling is not an exact science; actual revenue generated by users may exceed or underperform the LTV calculation and as such it pays to be conservative when using LTV for advertising-buying decisions. LTV can be influenced by many factors including acquisition source, user demographics, range of monetization possibilities within the product, etc. If user retention (lifetime) can be increased, it follows that LTV will be higher too.

Growth Accounting

While a quantitative growth model is used to generate forward-looking projections, the process of Growth Accounting involves keeping track of current and historical user growth. Active user growth can be considered a simple function:

Active Users = New Users + Retained Users — Churned Users (for a given period e.g. last 30 days)

(Note: ‘lapsed’ users is perhaps more correct, since they may not have fully churned in the sense that they will never return, but simply that they were not active in the period).

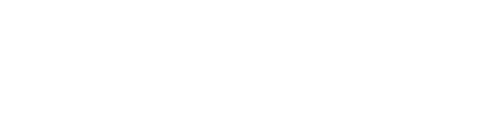

Another way to think about it, is that growth comes from three separate ‘buckets’ of users: new users, repeat users and returning users. Repeat users are those who were active in the previous period and were seen again this period. Returning users were re-activated after lapsing in the previous period. Tracking active users in these three buckets provides deeper understanding the active user number and what is driving the growth (or lack of it) in a given period.

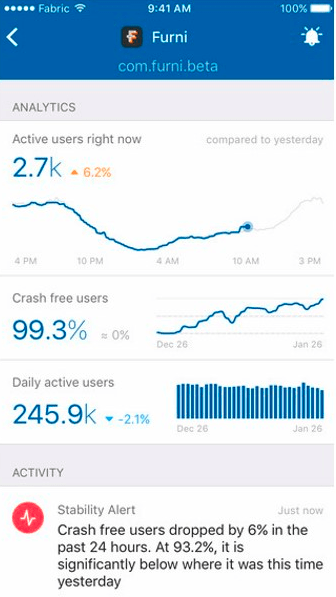

App Performance Analysis (CPU, Battery, Network, Crashes Etc)

One important way that mobile products differ from desktop apps and websites is the range of circumstances in which they may be accessed. In a desktop environment, web apps can safely assume an unmetered internet connection (likely with decent bandwidth and latency) is available at all times. Good mobile products are designed to work in situations where bandwidth is limited, latency is high, or where there is no network connection available. Mobile devices run on batteries and users are increasingly savvy to the point where battery hogging apps may be deleted for this reason. Similarly, many users do not have unlimited data plans and expect apps and mobile sites to be data-conscious. Finally, apps that crash are swiftly uninstalled, often with a poor review left in the app store.

Whilst performance analysis is likely to be considered primarily by the engineering team, it’s worth keeping in mind that a product that performs poorly in any of the above scenarios is likely to suffer from high churn and/or reduced engagement. Paying attention to performance metrics will alert the team to any potential inhibitors to growth.

Above: the Fabric monitor app, which incorporates crash reporting.

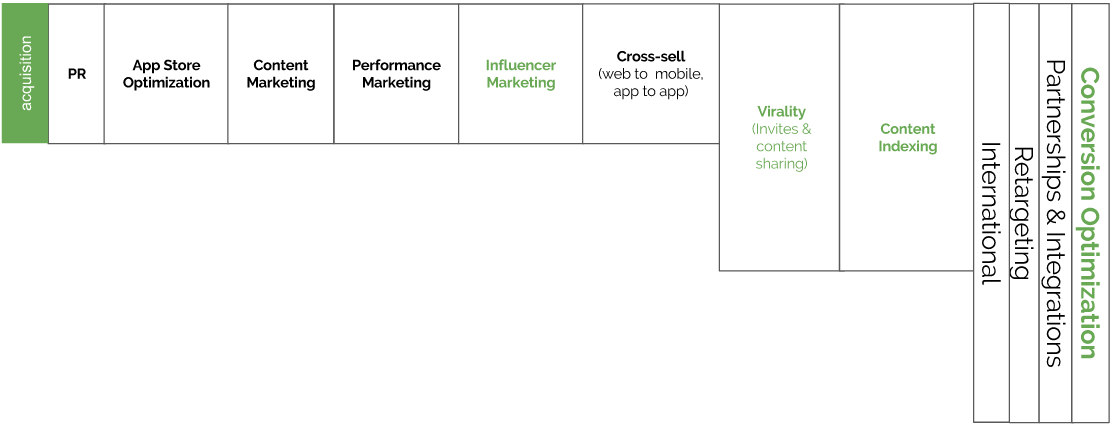

Activities In The Acquisition Layer

The Acquisition layer of the stack encompasses the activities that could be undertaken to acquire new users for a mobile app, whether through paid, earned or owned channels.

PR

PR activity involves generation and pitching of press-worthy stories with the hope of enticing journalists to cover them instead of the glut of competing stories on any given day. Ultimately, well-executed content marketing is likely to deliver more dependable returns over time, but creative PR can provide a significant — if linear and tough to attribute — boost to organic growth. Since PR is usually not a core competency for startup founders and data-driven growth marketers, PR agencies who know the local/industry media landscape are often engaged, sometimes on a performance basis (e.g. paid per press mention).

App Store Optimization (ASO)

ASO consists of three core activities:

App Store Conversion Rate Optimization:

Since the app stores are the distribution gateways for almost every consumer mobile app, systematic testing of the assets (screenshots, title, keywords, description, app icon) used to promote the app or game in the app store to optimize the conversion rate from ‘store page visit’ to ‘app install’ is an activity that magnifies the impact of all other acquisition activities. Performance marketing spend will stretch further if app store page conversion is increased; the cost-per-install (CPI) will fall, since more users who click on ads will end up installing the app.

App Store Search Optimization:

Optimizing for the best-performing keywords that will attract high search volume and convert well with the app’s target audience is a process of refinement and experimentation, which requires periodic review in order to stay ahead of competitors. For some apps, app store search represents a large proportion (up to 80%) of the organic traffic to their app store listing, whereas in other cases, search plays a smaller role in app discovery. In any case, user acquisition can be increased by at least some degree by ranking highly in search results for relevant keywords.

App Store Featuring:

All of the major app stores have some concept of featuring, whereby editorial teams give prominent temporary placement of banner-style advertising for selected apps, based on various editorial criteria. Getting featured by Apple, Google, Amazon and other platform owners can deliver a significant (and free) boost to user acquisition over the period of featuring. Publishers of apps that are featured typically invest time cultivating direct contacts with the relevant app store managers and provide them regular and timely information regarding upcoming significant app releases, though this is not always the case.

There are numerous things that can increase the chances of an app being featured: ensuring the app UI exemplifies the platform design guidelines, supporting newly-released platform features or hardware, creating custom content for special calendar events that can be tied to app store promotions and ensuring the app is free from bugs and crashes are some of these. Ultimately, editorial teams want to surface the best quality apps in their stores and rarely — if ever — provide guarantees of featuring.

Content Marketing

Content marketing requires a significant investment of time and resources before it is likely to pay off, but a strong content marketing program can provide a significant, sustainable and growing (albeit linearly) source of new users.

Content marketing can take many forms, but involves generation of blog posts, news, infographics, artwork, tips & tricks, top-10 lists and other kinds of online content that appeals to the target audience for the core mobile product (the app, game or constellation of apps that is being promoted) and should include prominent links to the app stores where the app can be downloaded.

Example: If the product in question is a budgeting app, creative and engaging content would be generated for people wanting to save money or manage their finances: this could include tips & tricks for saving money, an infographic about the budgeting process and so-forth.

Content marketing posts are typically published on owned media such as the company blog, but can also be shared over social channels, email, etc. to amplify reach. Over time, with regular content published, the posts should climb the rankings for web searches relating to the topic and drive more organic search traffic to the posts and subsequently to the app. Content marketing builds brand awareness and can measurably increase acquisition, but can take several months to start delivering users.

Performance Marketing

Performance marketing via mobile display/video advertising networks, paid search ads, app install ads on Facebook, Instagram, Twitter, and other channels provides an opportunity to scale user acquisition far more aggressively than most other channels, albeit for a price.

Typically, performance marketing becomes a viable strategy for products that monetize at least some portion of their userbase -though in-app advertising, in-app purchases, subscriptions, or some combination — and when the customer acquisition cost (CAC) of new users from a given marketing campaign yields a positive return on investment (ROI), calculated by predicting the Lifetime Value (LTV) of a user within a certain confidence interval.

Performance marketing campaigns usually involve bidding against other advertisers for ad placements on a CPM (cost per thousand impressions), CPC (cost per click), CPI (cost per install) or CPA (cost per action: e.g. a purchase of an item or subscription) basis.

Read more about setting up a scalable paid user acquisition channel here.

Influencer Marketing

The term ‘influencer marketing’, in its broadest sense, covers a broad range of activities that involve working with influential individuals or groups to obtain brand or product advocacy or endorsement from them. This concept is far from new: tobacco companies have been influencing us via movie stars for generations, commercial sponsorship of sporting personalities is taken for granted, and so on.

Working with influencers has traditionally been hard to measure, time-consuming and potentially expensive, but often nonetheless effective. The emergence of performance-centric influencer platforms, connecting advertisers with a new generation of independent influencers — including bloggers, YouTube stars, Instagrammers and Snapchatters — has democratized a space once dominated by big brands and celebrity agents. It’s now possible to scale influencer marketing to groups of influencers that individually have a smaller reach — albeit among loyal audiences interested in potentially niche topics — than the superstars with tens of millions of followers. Embeddable tracking links and real-time reporting of impressions and clicks have, at the same time, enabled marketers to be more data-driven with their influencer marketing spend; they can calculate conversion rates, cost-per-install (CPI) and other performance metrics.

Increasingly, influencer marketing is becoming a performance marketing activity that augments or replaces traditional mobile app install campaigns, evaluated against Facebook and DSPs on the same terms. In many cases, these developments have shifted influencer marketing from being a brand marketing activity to a measurable growth tactic.

Distribution Deals

Distribution partnerships that provide access to a large audience / user base of a strong network or brand can boost reach substantially overnight. Typically they are harder to achieve as a small company that’s just starting out, since there has to be some kind of value exchange taking place and the more attractive collaborations for growth tend to be with larger companies with millions of users.

Just a few examples of distribution deals include partnerships with mobile telecommunications carriers (the telco promotes your app to their subscribers in exchange for a cut of the profits, or perhaps a flat fee), traffic exchange between websites, pre-installation of (possibly customized) versions of an app by manufacturers of smartphones, smart TVs or other connected devices.

Viral Loops

The illusive concept of ‘virality’ is hard to generate artificially; ultimately, sustained viral growth is likely to be rooted in a strong product or engaging content. However, paying careful attention to content sharing, item gifting, or invitation flows, cultivates the right conditions for virality to occur.

Each channel (e.g. email, mobile messaging networks, social networks such as Facebook, Twitter, etc.) will display different dynamics in terms of the number of users reached (e.g. one-to-one vs one-to-many, ease and likelihood of being re-posted within the network by receivers, etc.), the conversion rate of these shares and the average time it takes to close the loop and acquire a new user through this channel. The two key variables that govern the performance of a viral loop are K-factor (avg. number of users each invite/share reaches x Conversion Rate) and Cycle Time (avg. time taken to close the loop). Of the two, shortening the Cycle Time yields a more dramatic increase on growth trajectory, since virality compounds over time.

Cross-Sell

When an existing userbase exists on another owned product or platform (e.g. desktop web app, mobile web app, another app or game in the company portfolio, etc.), opportunities exist to cross-promote between these properties to funnel users towards a newly-launched app, or to migrate desktop/mobile web users to native mobile, where there are additional ways to engage, retain and monetize them.

Driving traffic from one owned property to another is a great source of ‘free’ users who already have familiarity with the product/brand and hence are likely to be easier to retain than totally new users coming fresh to the app. Cross-sell is particularly useful for products with short life-spans where users may become bored of the experience after some time; game publishers employ cross-sell tactics extensively in order to deliver users to newly-released games in their portfolio before the older games reach the end of their shelf life.

Content Indexing

Content Indexing of deep-linked atomic content, principally via Google App Indexing and the improved Apple Search that rolled out with iOS 9 provides new opportunities to drive app discovery as well as referrals of existing users directly back into the app.

Ensuring web and mobile web content is also properly indexed and is mapped to the same content inside the app is important when implementing a coherent and optimized Search Optimization strategy, since Google currently still requires matching web content in order to index content within apps (though this will likely change in the future, as the relevance of web declines further).

Conversion-optimized responsive landing pages and Facebook pages should also not be overlooked as additional channels for driving app downloads and should also be optimized for search, although likely a full Content Marketing program will yield stronger results (but also require more creativity and effort) than pure advertisement landing pages.

Engagement & Retention

Product at the core of the Engagement & Retention Layer

Growth as a discipline sits at the intersection of product (including design), marketing and data science. Earlier versions of the Mobile Growth Stack may have given the impression that engagement and retention are primarily functions of growth marketing; this is manifestly not the case.

Retention stems from an engaging product experience and no amount of activity notifications, lifecycle marketing or community engagement initiatives will keep users using a badly-designed product that they do not find engaging. Product is now explicitly placed at the core of the engagement & retention layer to reflect this.

Activation

The specific definition of activation is product-specific, and may evolve over time as a deeper understanding of user behavior is gathered and the drivers of longer-term engagement are established more definitively through hypothesis testing. However activation is defined in a specific product, it’s a key growth objective to activate users swiftly in order that they experience the core product value quickly and begin their path to higher and prolonged engagement. This is all a fancy way of saying that users need to find the product engaging early on in order to keep using it. Whilst this, too, is ultimately a function of core product, activation rates will typically benefit from focused effort from both product and marketing sides to assist users on their journey towards their ‘aha moment’.

First Time User Experience (aka New User Experience / NUX) is inordinately critical in the lifetime of a user; if a user doesn’t ‘get’ the proposition and reach a moment of delight — or at least appreciation — during their first few minutes using a freshly-installed mobile app, the session will probably be their last.

The majority of user churn occurs in the first few days. Cohort decay graphs all take fundamentally the same shape, regardless of the app. New user onboarding efforts should aim to flatten out the curve at a higher retention rate (see example below). If this can be achieved, compound growth gains follow.

User Accounts

Persisting user data by providing mechanisms for account registration and sign-in assist usability and can increase retention. US prepaid smartphone users upgrade every 7–8 months(post-paid a more moderate 18–20 months) and break them far more often than that. Thus, the challenge for retention is not just to increase session frequency, but also to incentivize users to re-install the app onto new devices, or to initiate sessions on borrowed or desktop computers (assuming a web experience exists) when their main device is not available.

Creating an account arguably increases the user’s investment in a product or platform. User accounts provide a way to collect more information about users such as email addresses, phone numbers, or other user attributes that can be used for lifecycle marketing purposes. They also give users a place to call home and a sense of identity within the product: offering personalization options (e.g. customizable avatar/username/profile picture, themes, etc.) further increases the user’s emotional investment and reduces their likelihood to churn, at least when properly integrated into the overall experience. Finally, the account registration process can be designed to provide opportunities for users to invite colleagues or friends (e.g. via contact list import) or connect with other users on the platform, increasing network effects.

Account creation should be as frictionless as possible. Facebook, Twitter, Google, LinkedIn, among others, offer simple account creation and sign-in without requiring users to create new passwords, which increases the chances that users will complete the process.

User Accounts: Pros And Cons For Mobile Growth

Deep Linking

(see also: Deeplink Attribution, Content Indexing)

The term Deeplink refers to a URI (Uniform Resource Handler) that a smartphone OS handles by opening a specific native mobile app at a specific piece of content, a screen/feature in the app, or in some cases some specific executable code. Implementations differ between mobile platforms, but in all cases, it’s possible to map web URLs to content within the mobile app.

Deeplinks are a valuable way to drive re-engagement of existing users; by clicking on a deeplink, the user is returned back into the native app and is not required to navigate through other screens or menus in order to engage with the content or feature that was linked, much in the same way that desktop web users can be linked directly to any content within a domain rather than just the homepage.

Various solutions exist to solve the problem of not knowing whether someone clicking on a deep-link has the corresponding mobile app installed. Android apps register an intent to handle regular web URIs from a specific domain: if the app is installed, it will intercept relevant web links and map them to in-app content. iOS Universal Links (supported by iOS 9 onwards) deliver similar functionality, though earlier iOS versions do not support such mapping, necessitating a messier solution, or the use of deep-linking features from their attribution partner, or dedicated third party deep-linking services to handle deep-links more elegantly, as well as provide additional functionality such as redirecting users without the app installed to the appropriate app store to download it (thus driving acquisition and retention with one ‘smart’ link).

Lifecycle Marketing

Lifecycle marketing involves communications through relevant channels such as email, push, in-app, etc. to optimize the flow of users through the lifecycle towards loyalty, high engagement, and monetization.

A traditional customer lifecycle looks something like this:

Source: E-Metrics Business Metrics For The New Economy by Jim Sterne and Matt Cutler

The growth marketer needs to invest time in mapping out and defining the key engagement milestones in the user lifecycle according to the specific nuances of their target audience and their current understanding of their qualitative growth model (with the expectation that this understanding — and hence the model — will evolve over time as lessons are learned and hypotheses are tested).

A cohesive, considered and continuously-refined lifecycle marketing program facilitates and enhances the user journey (typically starting with strong onboarding and activation) and reduces user abandonment, attrition and churn through timely, targeted interactions. Lifecycle campaigns typically aim to inform, educate, inspire or motivate users towards higher levels of engagement, re-activate inactive users before they churn completely, or encourage loyal users to spend more, invite friends, or complete other valuable actions.

Lifecycle campaigns are targeted at segments of users at a similar stage in the lifecycle or who have some common attributes. They are often triggered on some user behavior (e.g. a welcome email once the user creates an account, or a re-activation push notification when the user has been inactive for a period of time), or sent out on a scheduled basis (e.g. weekly digest or newsletter).

There is a high risk of annoying users with communications that are considered spammy or unnecessary, so a smart lifecycle program is adaptive to user preferences and response (open rates, clicks and subsequent in-app engagement).

Lifecycle Marketing 101

Activity Notifications

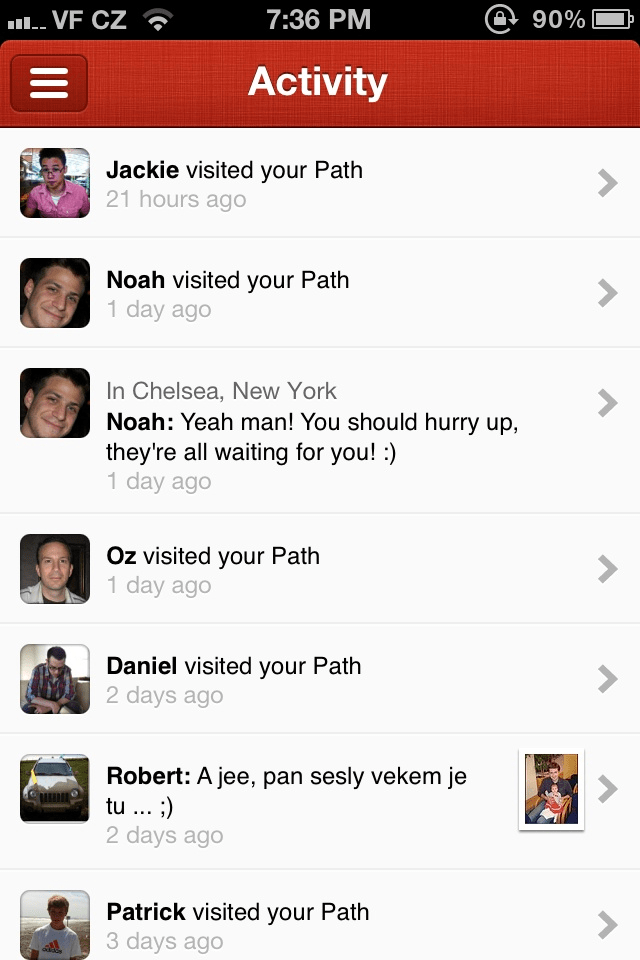

Activity notifications differ from lifecycle campaigns in that they are usually driven by events that occur outside of the user’s personal experience with the app: either things happening in the real world, or in the broader network that the app connects with. Generated programmatically, usually in real-time and often personalized specifically for each user, activity notifications should inform users of things that are relevant and interesting to the user, based on preferences they have expressed, either implicitly through their past behavior or explicitly by opting to be notified about certain events, content or topics.

Good candidates for activity notifications include:

- Social signals such as friends joining or things friends/contacts are doing on the platform

- e.g. “John just posted a new photo”, “Alice achieved a new high score of 505433”

- Social Interactions with the user or their content

- e.g. “John commented on your post”, “Alice’s army just attacked your village!”

- Things that happen in the real world of relevance to the user:

- e.g. “Leave now to arrive at Town Hall for your 5pm appointment”, “Heavy traffic on the M69 motorway”

- Content relevant to the user’s tastes or preferences:

- e.g. “New track uploaded to the ‘techno’ group”

- Time-delayed events:

- e.g. “The video you uploaded has been approved and is ready to view”

Note that notifications are not just push notifications; while push is a great channel for delivering real-time notifications to users when they are not in the app, they are not the only effective channel and it’s also not possible to reach all users since many users do not enable push notifications. Other channels suitable for delivering real-time activity notifications include email, SMS, desktop browser notifications and in-app pop-ups. The effectiveness of notifications to drive subsequent engagement and retention can be amplified by implementing a bespoke in-app notifications feed or inbox features within the app itself, which stores all notifications in a more permanent form for later browsing and does not rely on the OS notifications tray, in which an app’s notifications compete with those of other apps installed on the device.

Above: Path‘s in-app activity feed

RRF: a framework for building impactful notifications

Community (Engagement & Support)

Developing and nurturing a community of power-users of the product generates a sense among even casual users of being part of something bigger, whether or not they are active participants in the community.

Building social features within the product or an online forum where enthusiastic users can meet, discuss the product, report problems, generate new product ideas, etc. requires significant sustained investment, but is not the only way to support and engage with users; often self-organized communities spring up quite organically around apps and games without any input or control from the publisher. Such users often voluntarily act as unpaid ambassadors and promoters both offline and online in other networks and forums. Engaging with these users wherever they are, making them feel appreciated and valued is likely to accelerate and magnify the community effect.

Supporting users who have problems or encounter bugs can turn a disgruntled user into a loyal one, reducing their likelihood of churn and potentially turning them into a promoter (this is verifiable through sentiment tracking before and after community support interactions). Support also requires investment, although generation of self-serve resources such as FAQs, chat-bots and how-to guides can reduce the resources required in answering emails, phone calls or online inquiries.

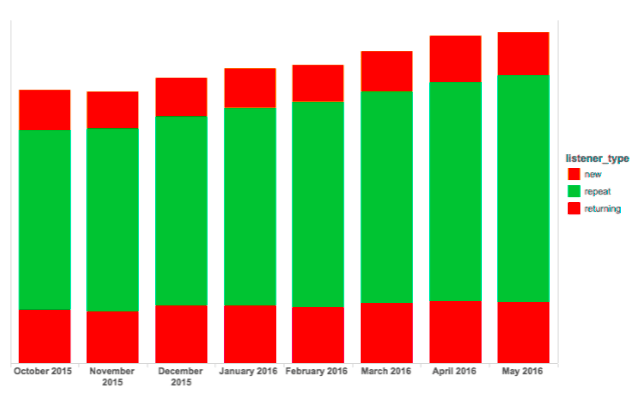

Monetization

Revenue Model Development

Due to the all-time-low barrier to developing and publishing a native mobile app, it’s perfectly possible to build a mobile app and achieve impressive user growth without ever trying to generate revenue from it. However, for all but the most simple standalone apps, a publisher will face escalating costs in the form of engineering, maintenance, support, servers, 3rd party tools licensing, etc. as app usage increases. VC funded startups often focus on growing active users and engagement before attempting to monetize and often have a significant runway to nail the product-market fit, but at some point, the product must demonstrate tangible value if the investment is to be recouped. Bootstrapped startups or lone developers do not have the luxury of months or even years and typically monetize their apps and games from launch day.

Typical monetization strategies include:

- Paid apps (user pays upfront to download in the app store, or a one-off fee to create an account on the service)

- Freemium with in-app purchase (basic product is available and usable for free, but upgrades or special items can be purchased as in-app purchases, sometimes intermediated with virtual currency)

- Subscription apps (typically monthly or yearly fee for access to some or all of the features)

- Often used in conjunction with the Freemium model, but possibly require a subscription from the outset.

- Ad-Funded (the app serves adverts, usually in the form of banners, full-screen interstitials or videos, which generate revenue from click-throughs to advertiser sites)

- Affiliate (the app features products or services from 3rd party vendors and takes a cut from purchases, which may happen within the app or via the vendor website/app)

- Offer Walls (often used in conjunction with other payment methods in freemium apps and games: the user completes ‘offers’ from brands or advertisers and is rewarded within the host app, usually with virtual goods/currency or other in-app/in-game upgrades)

A publisher may experiment with different revenue models over time, combine multiple models (e.g. ad-funded free tier, premium tier as pay-as-you-go with in-app purchases or subscribe to get full unlimited access), or use different models for different platforms.

Payment Processing

If the app offers subscriptions, in-app purchases (virtual goods/services, content or in-app functionality/upgrades) or facilitates any kind of e-commerce transaction, there must be a way to accept payment from users. IAP is by far the simplest option since payments are handled by Apple, Google, Microsoft, etc. as part of their app store ecosystems, taking a 30% cut in the process (20% for Windows Phone).

For e-commerce apps selling real-world goods or services (anything outside of the app itself), the onus is on the publisher to process user payments from credit/debit cards, PayPal, bitcoin, Boleto or whatever payment methods are most popular with their users. Payment processing is a complex business, but many 3rd party services exist that can be integrated to facilitate payment processing, billing, etc.

Upsell

Upsell describes the activity of driving more upgrades, subscriptions or purchases (and hence not applicable for all revenue models). In a nutshell, efforts should be made to convert freemium users from free-tier to subscription or purchase and to increase the average revenue per paying user (ARPPU) by driving additional ongoing purchases, ideally with increasing frequency, value or ideally both.

Upsell activities are closely tied to pricing, since users may be more inclined to purchase at specific price points, at specific points in their user journey, specific times of the day / week / year and so on.

Specific Upselling tactics include:

- Special offers & discounts

- Bundles

- Limited-Edition items

- Calendar or event-based merchandizing (prominent display or announcements themed around gifting days, real-world events, etc.)

- Loyalty points (earn discounts or rewards through frequent purchases)

- Promoting goods & services to existing/new users through in-app and external channels

- Reminders when subscriptions are close to expiration date

- Abandoned-cart campaigns over owned or paid channels to re-market specific items to users who were close to purchase but did not complete the transaction (possibly incentivized with a discount).

Pricing

When selling in-app purchases (IAPs) or in-app subscriptions, it’s important to understand the policies of the store. Apple uses Price Tiers, which to some extent normalize prices across currencies but require careful consideration to optimize profits across regions. Google Play implements price tiers for paid apps, but permits granular control of IAP prices in each currency.

Virtual Currency, Dynamic Pricing & Micro-Transactions

Employing a virtual currency brings both complexity and fine control over the app economy and may make dynamic pricing or price experimentation easier to achieve. Whilst virtual currency is usually considered the preserve of games, there are other notable examples, including Skype Credits which are sold in bundles to provide talk-time to landline and mobile telephones.

Apps and games usually sell virtual currency bundles as in-app purchases, and/or give them away to incentivize high-value actions such as account creation, viewing adverts, etc. or simply launching the app on consecutive days. Use of virtual currency or other virtual rewards to incentivize engagement in non-game applications is an example of Gamification.

Bundling

Whilst currency is usually sold in bundles (e.g. boxes of gems in Clash of Clans), virtual goods, content and functionality within the app may be retailed for amounts far less than the smallest bundle size in so-called micro-transactions. Microtransactions and virtual currency bundling not only enable fine-grained control over pricing and more control over in-game item inventory but also make it harder for users to calculate how much they are spending in real money, which can distort their estimation of value within the virtual economy.

Bundling is also a classic retail strategy for goods sold for real currency: McDonalds ‘menu’ deals combine burgers, fries and a soft drink at a cheaper price-point than buying them separately, although research suggests that consumers (at least in some industries / product categories) value the option to buy bundled items separately when evaluating buying options. Bundling is supported for regular IAPs, so a virtual currency is not a pre-requisite for testing such pricing tactics.

Discount Coupons & Sales

Much like bundling, other traditional retail tactics work just as well in the app economy. Offering discounts through virtual ‘coupons’ or appstore-issued promo codes (limited to 100 per app version on iOS, but unlimited in Google Play) can be helpful in promoting increasing demand for items, to reward loyal users, or to incentivize purchase completion in abandoned cart scenarios.

Since IAP prices can be adjusted at any time, it’s possible to put items on sale for a limited time and promote them using regular in-app and external channels, or by highlighting them in the UI.

Ad Inventory Management

With products that serve adverts, whether display (banners/interstitials), audio, video, or some other format, consideration should be given to the placement, type and number of advertisements that will be shown, as well as how these adverts will be delivered.

User experience, and hence user behavior, may be altered by the decisions made regarding advertisement:

- Serving too many adverts or interrupting the user experience with intrusive ad formats such as videos (even if skippable) may reduce user engagement and retention with the core product and cause negative user sentiment (though may also generate more advertising revenue).

- In some cases, users may be less inclined to make purchases if they encounter adverts before becoming a paying customer. Conversely, some products offer an ‘ad free’ experience to users who upgrade to a premium subscription or pay a one-off fee via IAP.

- ‘Click-outs’ (clicking on advert and being redirected to a website / app) halt the user’s current session in the product; in the worst case, they may never return.

- Loading times for advertisements that are not pre-cached natively could cause performance issues and consume mobile data. If partnering with an ad exchange, it may be hard for the publisher to directly control these factors since ads may be downloaded from the exchange via a black-box SDK with little configurability.

- Advertisements from unscrupulous (or downright fraudulent) advertisers may be served in the product, which could result in irate users and increased churn. Ad quality is hard to police, since adverts are often served programmatically via bidding platforms, making checking every advert impossible. The only way to be 100% sure that all adverts will be suitable is to directly sell advertising units in the product to brands, which is unfeasible for most publishers. Working with trusted networks can help, although many networks trade traffic and ad inventory between themselves, which increases the chances of a weak link that lets in poor quality adverts.

When considering these factors, trade-offs will be made between short-term ad revenue and longer term retention, engagement.

Activities That Cut Across The Stack

Internationalization

‘International’ growth is a broad topic that transcends any particular layer in the framework. Growth tactics in international markets are likely to be quite specific to your product/service and the competitive landscape in which it operates. However, done right — which likely will mean more than simply translating the product and localizing the app store listing, though this would be a good place to start — internationalization will act as a catalyst for your acquisition, engagement and monetization efforts and hence complement activities across the stack.

A strong international strategy will likely take into consideration supporting locally-relevant payment methods, integration with the most popular social networks in target regions, country-level or regional partnerships and so on, and hence works in combination with many of the individual cells in the stack.

Retargeting

Effective re-targeting of users or potential users with targeted messaging can be used to drive acquisition (by re-targeting visitors to a web app or landing pages with adverts for the mobile product), increase engagement, or to boost monetization; it cuts across all three layers. Ideally, a growth marketer would be able to pinpoint users who had dropped out of — or got stuck in — any stage of the user lifecycle and deliver a message that will hopefully nudge them towards a goal.

Partnerships & Integrations

Business development, technical integrations and partnership activities can drive impact for acquisition, engagement & retention, or monetization, depending on the nature of the deal.

Partnerships can take many forms and are limited only by the creativity, persuasiveness and perceived value by the parties involved. Some common types of partnerships that could be employed to drive growth include:

Traffic exchange between websites or native apps

Pre-installation of mobile apps by device manufacturers or mobile carriers

Co-marketing activities

Sponsorship of events, individuals, or organizations

Licensing of intellectual property e.g. a movie, book, song or image rights

Affiliate deals

Loyalty schemes

In many cases, such partnerships will include a commercial component such a revenue share, licensing fee, guaranteed minimums, etc. though the specifics are very much subject to negotiation and will depend largely on leverage.

Conversion Optimization

Conversion (Rate) Optimization (aka CRO) is an activity that forms the basis of the majority of data-driven growth efforts. In the stack, the term ‘conversion optimization’ is used broadly to refer to efforts to increase rates of conversion between one state to another, as opposed to specifically referring to purchase or subscription events.

In the acquisition layer, conversion optimization forms an important part of App Store Optimization (optimizing conversion from app store listing impression to install), Performance Marketing (ad impression to click or click to install), and Cross-Selling efforts between products and platforms.

In engagement & retention, conversion optimization efforts center on moving people between non-engaged or low-engaged to higher states of engagement via numerous means. Conversion optimization is a core activity in lifecycle marketing, where email, push and in-app campaigns are relentlessly optimized for higher open and click rates, as well as improvements in downstream engagement metrics. Product and marketing efforts around activation often aim to convert users from having not performed an activity in the app (e.g. used a feature) to having done so (or done so more often than before), often within a specific conversion measurement window such as the first few days of their lifetime.

In the Monetization layer, optimizing for conversion to a purchase, subscription, incentivized video view, or ad-unit click, are key to increasing profitability and CRO is hence at the core of monetization initiatives.

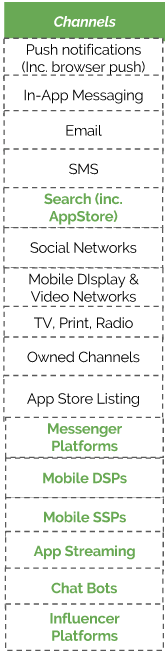

Channels

Although certainly not exhaustive, the above list includes the channels that the majority of growth practitioners are using today. As with all elements of the stack, some channels will prove more or less effective in reaching a particular target audience for a particular business.

It’s often worth experimenting with the channel mix itself; a reactivation campaign might yield poor results when delivered over email, yet drive high impact when the message is refactored for push, or vice-versa. More likely still, greater impact could be gained when lapsed users are reached via a multi-channel campaign, possibly even including re-targeting users in other apps.

Channels and tools are secondary to the core activity; they can — and often should — be swapped out or augmented over time.

Push

Native push notifications and browser notifications provide a way to reach the user when they are not using the product and hence are highly effective channels — when used wisely — for re-engagement of existing users. Push is an opt-in channel, so not all users can be reached, but the impact on the opted-in is often worth it. In order to increase the reach of push as a channel over time, many growth marketers invest significant effort in experiments designed to increase push opt-in rates.

In-App Messaging

In-App messages appear within the main product user experience and can be delivered either on web or native mobile. Any in-app dialog, pop-up, or information screen can be considered an in-app message, though in recent years Mobile Marketing Automation (MMA) frameworks have abstracted this technology from the main app to allow marketers to design, test and measure targeted campaigns without requiring engineering resources or new native app builds to be submitted.

In-app is a very powerful channel, since they grab the user’s attention during their regular app or game usage and click-rates of 20–50% are not uncommon. However, due to the intrusive nature of such campaigns, they should be used carefully and sparingly to avoid ruining the core experience and increasing user churn.

While arguably not as effective as it once was, email remains a valuable channel for marketers across both web and mobile. Mobile users can be reached with emails in real-time and often receive push notifications from their mail app when new messages arrive. When considering email as a channel for activity notifications or lifecycle campaigns targeting mobile users, extra attention needs to be required to how the email will display on small-screen devices and how any links are implemented (best practice dictates that users should be directed to a website if the native app is not installed and deep-linked into the app if it is).

To use email as a channel, its a pre-requisite to request the user’s email address and many countries also have strict laws governing opt-in, permissions and what constitutes lawful email communication.

SMS

Every mobile device, including non-smart feature phones, supports SMS. As such, SMS as a channel has a huge potential reach. As well as being used as a channel for notifications, SMS can be used to drive acquisition by sending a link to a mobile website or app store page to users who provide their phone number (usually on a product’s landing page). This method is particularly useful for less smartphone-literate users who are unaccustomed to finding apps in the app store, but know their phone number, and for effectively acquiring users from desktop to mobile.

As with email, SMS is quite highly regulated in many countries and requires the collection of user phone numbers.

Search

Search as a channel covers organic and promoted app discovery via search engines and app store searches. This could be via targeting specific keywords, or through indexing in-app content that appears in search results. The channel description in the stack has been updated to reflect paid search opportunities on both Android and iOS platforms and in particular Apple’s Search Ads, which began rollout in 2016.

Search engine marketing is a powerful user acquisition channel for browser-based users on both web and mobile, with Google AdWords dominating the market. Advertisers bid on keywords or phrases in order to rank highly in the results and drive traffic to their app or site.

Apple recently announced that it will be launching paid search in the App Store, which will further increase the relevancy of search as an acquisition strategy.

In addition to paid search, SEO (and by association Content Marketing), ASO keyword optimization and Mobile Content Indexing can be significant sources of ‘free’ traffic to the app stores, or — in the case of Content Indexing — deep-link referrals back into the app for existing users.

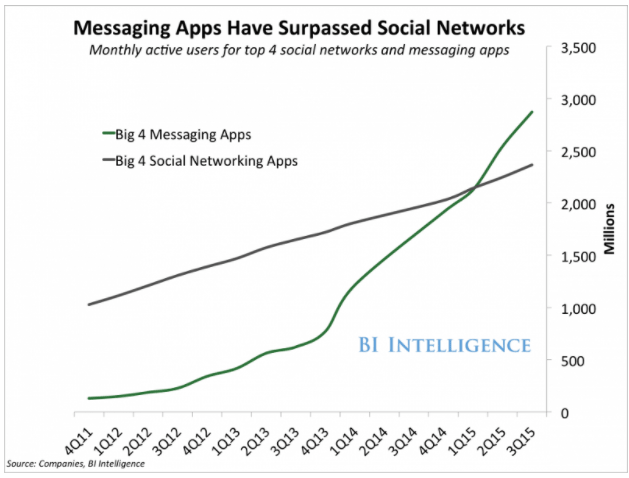

Social

Social networks — including messenger apps — provide access to potentially huge numbers of potential users.

Social media marketing can be a great way to connect with potential and existing users, drive acquisition, deeper engagement, or develop communities.

Referring to all ‘social’ as one channel is a major simplification; each social network has different characteristics in terms of the potential for connecting to or building audiences, methods of communication that are possible, support for paid or promoted posts and myriad other factors. Social is actually a huge topic, which will be explored in detail in multiple articles in the sub-section, over time.

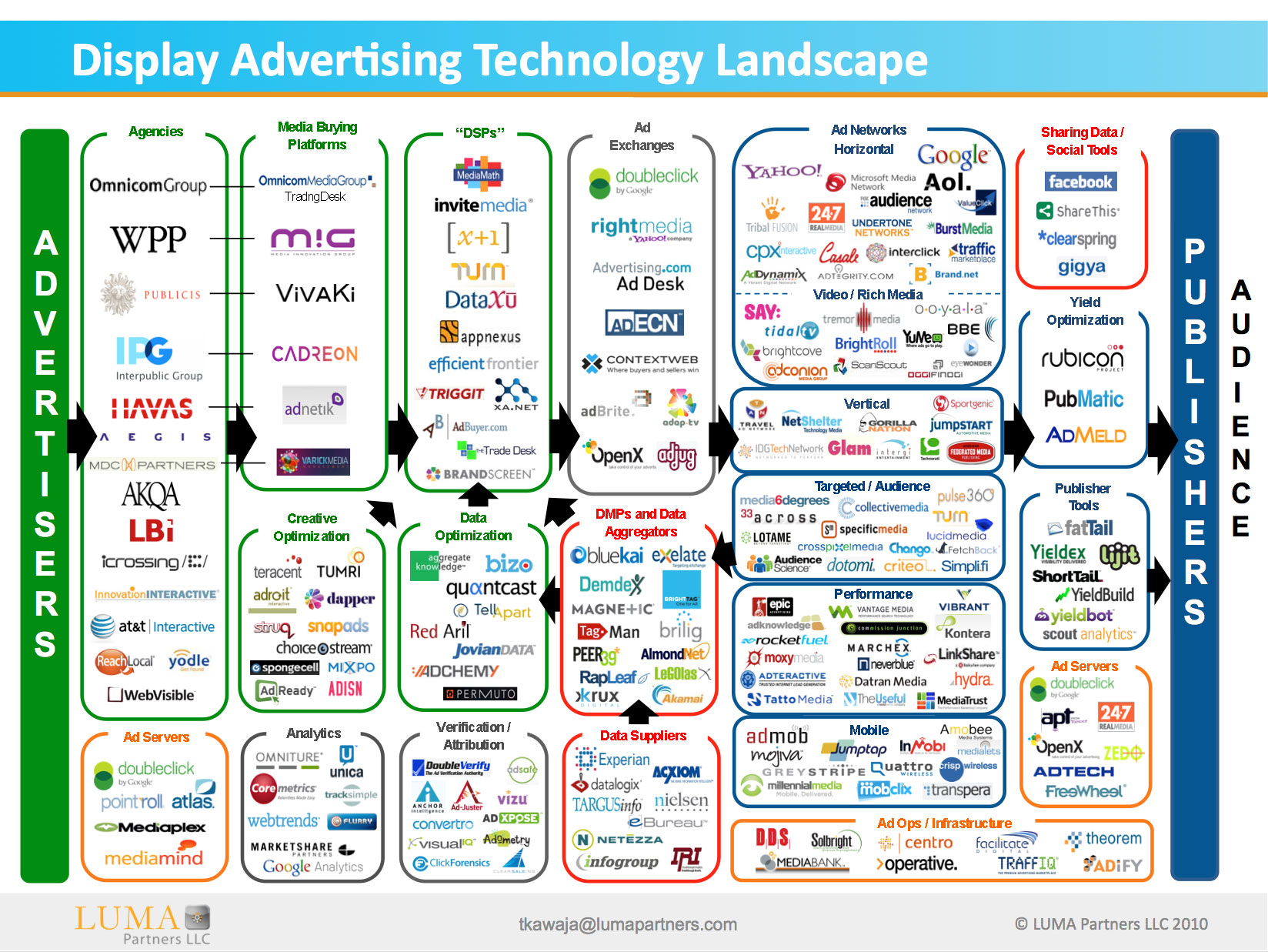

Mobile Ad Networks

(Image credit: LUMA Partners LLC Source)

Mobile advertising networks provide opportunities to advertise your product or service in other mobile apps and websites. There exists a multitude of companies in the ‘Ad-Tech’ ecosystem and many options for advertisers seeking to acquire or re-engage users. Targeting options, traffic volume, regional/national traffic availability and pricing options (CPM, CPI, CPC, etc.) vary greatly between players in the ad-tech space.

When buying users for your mobile app from paid channels, the goal is to find the right mix of providers that deliver the volume and quality of users (usually defined by their propensity to monetize or at least engage with the app) at a customer acquisition cost (CAC) that is sustainable for the business: this requires heavy investment in analytics, CRO on campaign creatives and attentive budget & campaign management.

TV, Print, And Radio

Television advertising has seen a remarkable resurgence over the past year, as CPIs from popular channels such as Facebook have risen sharply due to saturation and marketers hunt for more economical acquisition sources. New TV attribution partners have sprung up to help mobile advertisers match app installs with TV campaigns and — despite the inherently noisy data — many marketers are reporting strong results and favorable CPIs (i.e. actual performance, rather than a brand boost) from this traditional media channel.

Other traditional media such as print and radio may also prove to be valuable in connecting with the target audience, though most growth marketers eschew these old-school techniques due to the difficulty in measuring the effects.

Billboard display advertising and even hand-distributing flyers can be a great way to saturate the consciousness of a city and are relatively cheap compared to high-priced online and mobile advertisements. For this reason, such old-school marketing channels are often used when launching hyper-local, mass-market services such as food delivery, laundry and taxi-hailing apps, albeit always in combination with digital campaigns.

Owned

Owned channels may include a company website (inc. mobile web), company blog, landing pages and other apps from the same publisher. These channels provide a great opportunity to cross-sell and drive traffic between owned properties, acquire new users through organic search engine traffic, and inform existing users about new products, features, services or marketing offers. Messenger Platforms

Messenger Platforms

The meteoric rise in messenger platforms such as Facebook Messenger, WhatsApp, Snapchat, Line, WeChat, etc. has led many to speculate that messaging is the new platform, relegating all other networks and apps to also-rans in the race for smartphone users’ attention.

Despite the competitive threat posed by messaging apps themselves to all other apps, they also provide opportunities for apps to reach new and existing users through content sharing, direct messaging (if they provide an API that allows apps to do this) and invites/referrals. Each network is different, with some permitting external links, chatbots and API integrations and others not. In addition to product-level integrations, some platforms (e.g. Snapchat) lend themselves to more traditional marketing activities where awareness and acquisition can be achieved by building an audience through content and/or performance marketing.

Each platform is different; some messaging platforms lean toward group messaging and one-to-many broadcasts while others are predominantly used for person-to-person interactions. Consideration of the dynamics of the chat platform — as well as the messaging habits of the target audience — will help the savvy growth practitioner to prioritize and tailor efforts toward the networks and integrations or marketing efforts most likely to reach and resonate with their ideal users.

Chatbots

Closely related to the topic of messaging platforms is that of chatbots. Chatbots, AI, NLP, digital assistants and conversational interfaces are increasing in prominence and — despite the immaturity of many current experiences — will play an increasingly disruptive role in the way users interact with many platforms and products in many categories.

Chatbots are included in the 2017 Mobile Growth Stack as a channel, although developments over the coming year may modify or clarify this somewhat clumsy classification. The fact is that nobody knows exactly what the future of ‘chatbots’ (itself a vague definition) will bring, or how exactly bots will merge with the current distribution and value chain for mobile products. It’s not too much of a stretch, however, to suggest that chatbots currently present opportunities for integration with — and promotion of — mobile products, as well as presenting another potential touch-point with existing users.

Mobile DSPs And SSPs

The 2017 edition of the stack added mobile Demand Side Platforms (DSPs) and Supply Side Platforms (SSPs) as additional channels to recognize the rise in programmatic advertising. DSPs allow advertisers to buy ad impressions across a range of 3rd party apps or sites, often providing access to multiple ad exchanges, often providing sophisticated targeting criteria and a broad range of options for ad placement. As such, DSPs are an increasingly important part of the performance marketing mix for some companies.

Supply Side Platforms (SSPs) are the publisher-side equivalent: facilitating finer control of monetization via ad inventory inside the product by allowing programmatic buying of ad placement within the app.

App Streaming

Streaming apps and games offer users the chance to experience some or all of the product without ever downloading it as a classic native app from the store. Typically facilitated via HTML5 and with the potential to be distributed over some messaging platforms, app streaming can present a real alternative to traditional distribution and hence is an interesting emergent channel. It remains to be seen to what extent streaming apps will replace traditional app store distribution versus augmenting it, growing overall reach and becoming another touchpoint (like HTML5 web apps) with the user along their journey towards native app adoption.

Summary & Applying the stack

The stack is still a work-in-progress; we welcome feedback, suggestions, and stories/examples from anyone working on growth and marketing for mobile.

The latest iteration of the stack, along with a growing number of articles on all of the topics it covers, can always be found on this site, which we hope will be a valuable resource for mobile growth professionals around the world.

Table of Contents