What happened?

A landmark U.S. court ruling has changed how iOS apps can handle payments, but only for apps listed on the U.S. App Store.

This update stems from the long-running Epic Games v. Apple antitrust case. In April 2025, a U.S. federal judge ruled that Apple must fully comply with a 2021 injunction, formally allowing developers to guide users to external payment options and preventing Apple from collecting commissions on those external transactions.

The ruling also limits Apple’s ability to restrict messaging or the placement of outbound payment links. (Reuters, Engadget, Wikipedia)

Key changes are:

These rulings only apply to iOS apps published on the US storefront.

- External payments are now allowed: Apps can direct users to a checkout flow outside the App Store.

- No Apple commission on external payments: The usual 15-30% fee no longer applies to purchases made outside the app.

- No design restrictions: Apple can’t control the design, placement, or content of external payment links or buttons.

- Limited interference from Apple: A neutral notice is allowed before users leave the app, but nothing more. Furthermore, you can now communicate freely with your users about external payments and link to them directly in your messaging (including push notifications, in-app messages, and all other channels).

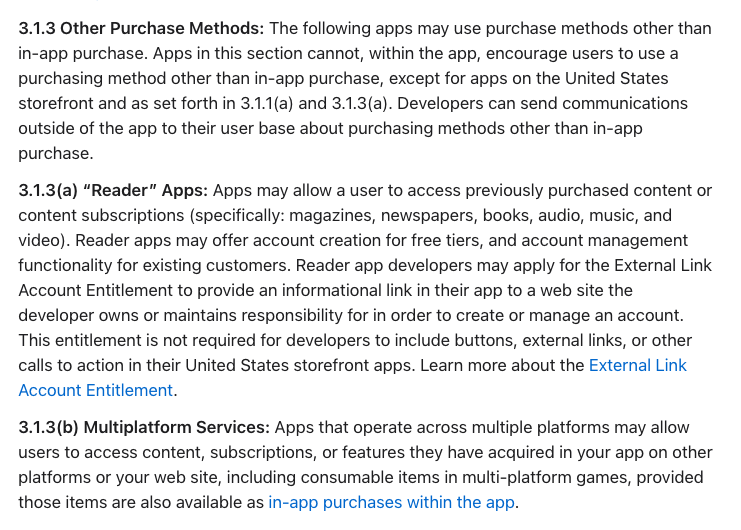

Apple has updated its App Review Guidelines to comply with the ruling:

Phiture’s take

This ruling could mark a significant shift in how app monetization is handled on iOS. If your app has a significant user base in the U.S., it presents an opportunity to increase your margins and gain more control over your monetization flow. But there are important trade-offs to weigh.

If you’re interested in exploring 3rd party payments, we recommend taking an experimental approach. Use tools like RevenueCat or Superwall to A/B test external payment flows for a subset of your U.S. users. Measure conversion and retention rates and proceeds closely to evaluate viability and profitability.

If you already use providers like Stripe or Paddle, integrating external flows will be smoother. If not, be aware of the additional work this change might bring, including managing taxes, refunds, and chargebacks yourself.

Potential benefits of using external payment flows

External payments can reshape your revenue strategy, but only if implemented with care. However, these benefits come with both technical and behavioral risks that need to be understood before rolling out at scale.

Potential benefits:

- Higher margins: Skip the 15-30% Apple fee entirely.

- Faster payouts: Unlike Apple, some providers offer payouts within days or even instantly, which is useful for reinvesting into your marketing motions.

- Greater flexibility: Update pricing tiers, introduce bundle offers, localized pricing, or discounts instantly without waiting for app review.

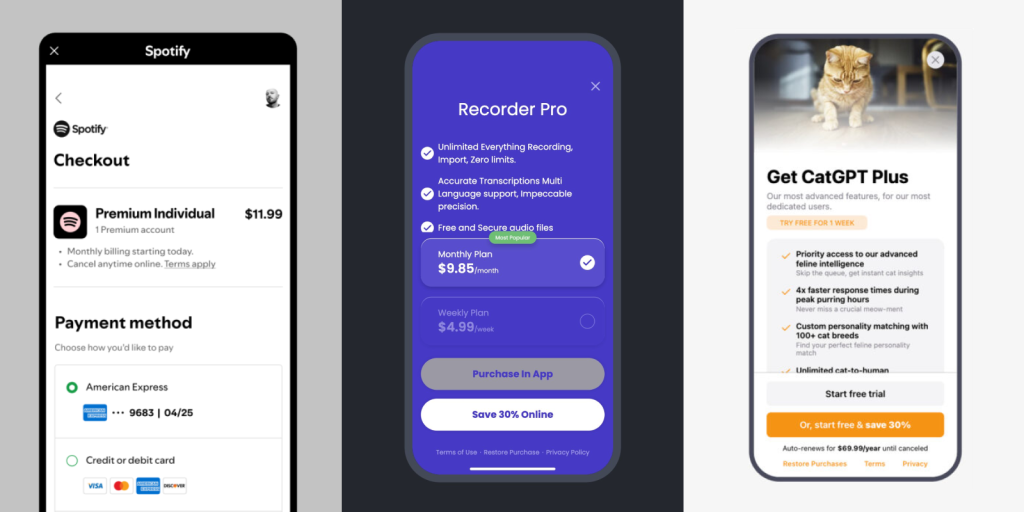

- Custom UX: Fully control your checkout design and flow to optimize conversion.

- Reduced churn and higher LTV (potentially): Subscriptions managed outside Apple are less visible to users and may be harder to cancel.

Potential caveats to keep in mind

Of course, the trade-off is complexity. Moving payments outside of the iOS ecosystem may deter some users, introduce new compliance responsibilities, and reduce transparency around cancellations and refunds. These changes must be managed carefully, especially during A/B testing and early experimentation.

While attractive on the surface, external payment systems introduce complexity and conversion risk:

- Impact on conversion: Redirect warnings and the unfamiliar flow might deter users. Some users prefer the security of Apple’s native system and central subscription management. As well as increased friction, the extra unfamiliar step may deter impulse purchases, particularly among first-time users.

- Operational overhead: Managing your payment system means handling taxes, fraud, and support. You can use payment service providers to outsource this.

- Provider fees: Stripe, Paddle, and others also charge fees, albeit much less than Apple.

- Support implications: Users who encounter billing issues will reach out to your team, not Apple. Make sure support workflows are prepared.

What about the EU?

The U.S. court ruling does not apply to apps listed on the EU App Store. However, the Digital Markets Act (DMA) already compels Apple to allow external payment options in the EU. That said, Apple is taking a different approach in this market:

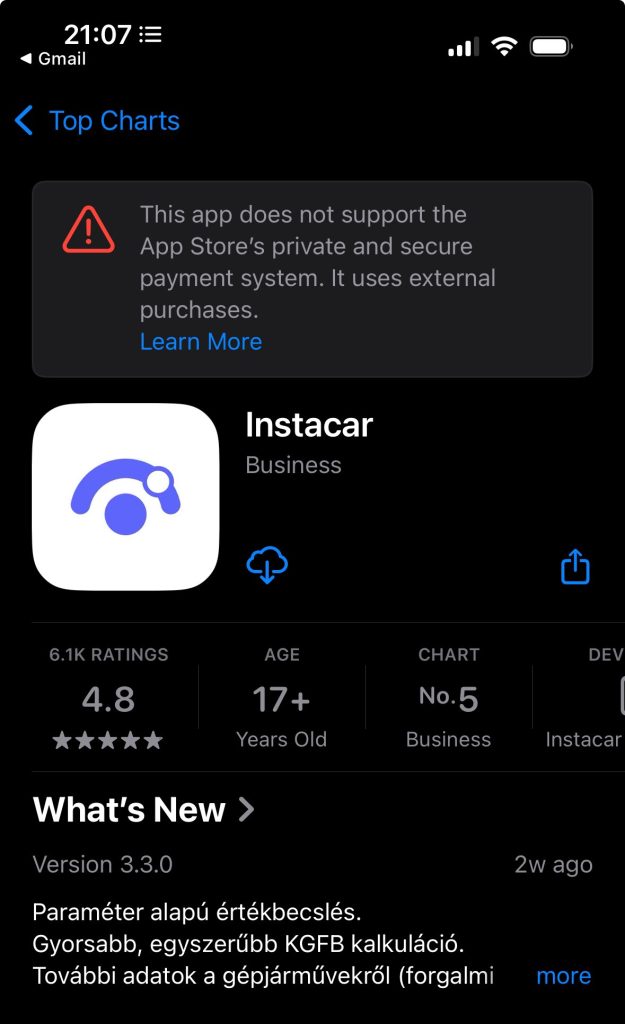

- Apple shows a warning label on App Store listings of apps that implement external payment links.

- This warning is shown before the user even downloads the app, potentially deterring them from proceeding.

- Phiture expects this messaging to have a significant negative impact on conversion rates, especially for subscription-based or premium apps.

- Fees like Apple’s Core Technology Fee (CTF) or App Store commissions might still apply.

While external payments may still offer margin benefits in the EU, these warnings will likely offset those gains by hurting user acquisition. As in the U.S., we recommend testing carefully and monitoring conversion closely before rolling out changes at scale.

Getting started

If you’re using RevenueCat or Superwall, both have published updates to support external links within paywalls. Start with an experimental approach:

- Test with a limited U.S. segment.

- Compare conversion vs. Apple IAP.

- Monitor net revenue, churn, and support tickets.

If you don’t use any of these, but want to get started, here is what you can do:

- Review technical documentation from your billing provider.

- Build an A/B test framework using RevenueCat, Superwall, or internal tooling.

- Launch a U.S.-only pilot.

- Analyze behavioral, revenue, and support data.

Additional Reading

RevenueCat: What Epic vs. Apple’s ruling means for developers, PMs, and marketers

RevenueCat: The pros, cons, and “gotchas” of the new US ruling on external iOS payments

Paddle: The Apple vs. Epic ruling: A new era of app monetization

Vivek Ginotra’s take on LinkedIn

Table of Contents