Since its creation in 2014, the Mobile Growth Stack has been widely adopted by companies around the world, helping to define new opportunities for growth practitioners. In the wake of its success, the Phiture team has dedicated numerous articles, presentations and events (alongside our professional consultancy services), to promote further learning about the Stack in practice.

Fast-forward eight years, and it’s time to revisit the Mobile Growth Stack with a full reconfiguration for 2022. This article presents the latest version of the framework and explores the new updates in detail. It’s important to note however, that the Mobile Growth Stack will always remain a work in progress and as always, we welcome and appreciate feedback on how to improve it.

A brief history of the Mobile Growth Stack

The Mobile Growth Stack is a one-page ‘cheat sheet’ framework that encapsulates and organizes the key growth levers and enabling technologies that can be applied in the pursuit of growing a mobile app or game. The framework is one of many conceptual tools that can help to develop and refine a coherent and comprehensive mobile growth strategy.

The framework originally debuted back in 2014, at the App Promotion Summit in Berlin and was published in a Medium Post the same day. Due in no small part to the positive feedback and response, the Berlin-based mobile growth consultancy, Phiture, was subsequently co-founded by myself and Moritz Daan.

Over the past five years our growing team has been devoted to de-mystifying the mobile growth eco-system and empowering companies and individuals to grow their apps. Together, we have achieved this through frameworks, knowledge-sharing and hands-on consultative partnerships. We have spent an increasing amount of time helping our clients — mobile app publishers across almost every category, from startups to public companies — to understand and apply these frameworks in their businesses and to deliver measurable, sustainable, growth.

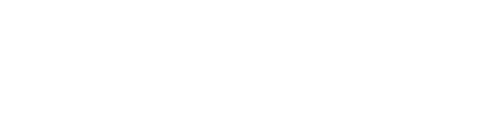

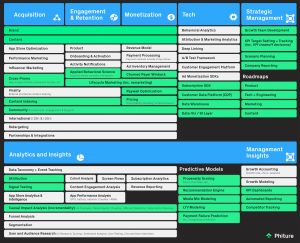

The new Mobile Growth Stack 2022

Updates to the Stack are in green

Updates to the Stack are in green

Brand and Content as multipliers across the Stack

“While notoriously tough to quantify, brand equity counts.”

Brand cuts through everything, which is why it now sits right at the top of the Stack. It can multiply impact across Acquisition, Engagement & Retention and Monetization.

Branding means more than allocating budget to some poorly-measured marketing campaigns, it’s the ongoing process of defining and expressing the core identity of a product.

Many data-driven growth marketers may regard brand marketing as old-school “Mad Men” territory. Conversely, brand marketers may fear that optimizing for performance at the expense of building ‘bigger picture’ brand value, trades long-term success for short-term metrics uplift. Both sides often have a point; publishers of successful apps find a way to leverage this tension productively to grow sustainably.

From five years of building Phiture and working with over 100 apps, we’ve observed that brands with a well-constructed, authentic and consistent brand identity, reflected coherently throughout their marketing and product experience, have higher potential for long-term growth. A strong mobile app or game brand can acquire and retain loyal users who in turn, may be more likely to recommend it to others.

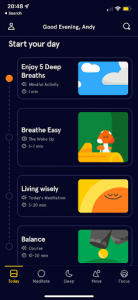

Headspace’s signature branding is consistent across the Google Play Store, Netflix and iOS.

Content is key

For some apps, content means everything. It’s not just streaming apps like Netflix, SoundCloud and Spotify that live or die on their content; lifestyle apps like Headspace, Lifesum, Asana Rebel, etc. also depend on a fresh stream of engaging content, be that new meditations, recipes or exercise plans.

Subscription apps in particular often deliver ongoing value to their users by providing users with access to a growing library of premium content. Subscriber retention therefore, often depends on producing or acquiring and surfacing fresh, relevant content to subscribers to keep them engaged long term. Outside of subscriptions, game companies also invest heavily in rolling out post-launch content and LiveOps to keep gamers coming back.

If your app is content-centric, or even contains any significant amount of content as a supporting feature, the Content cell of the Mobile Growth Stack applies. Whether user-generated or professionally produced and created in-house, content is a key asset that should be leveraged to the max. Measure engagement with specific content and with categories or genres to inform production and also to direct users to the content that the data tells you will resonate best with them.

Content drives impact across the Stack: popular content can be featured in advertising and app store screenshots to attract new users. Relevant content can be recommended to existing users and subscribers in the product UX and CRM messaging. It can and should also leverage it in your paywalls to increase conversion to subscription.

Even if the app is not content-centric, gains can still be made by producing and surfacing content that is relevant to the target audience. This can be achieved through email marketing and possibly within the app in a feed, even if such content is not the core value that the app provides.

An example of OnX Hunt delivering relevant content to users through email

Subscription-centric changes to the Monetization layer

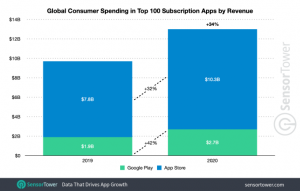

Perhaps the biggest shift in the mobile growth landscape is that subscription is now undeniably the dominant business model for mobile apps in almost every category outside of games.

Subscription continues to grow as the dominant revenue model for apps: Source

For B2C mobile apps, this is largely due to both Apple and Google building robust subscription features in their respective app eco-systems that enable publishers to make subscription products available to consumers. Despite this industry-wide shift to consumer subscriptions, there is little indication that users are willing to spend more on mobile apps than when they bought apps or IAPs on an individual basis. In other words, mobile apps are still competing for roughly the same ‘share of wallet’.

The winners in the app subscription game are those who are able to retain subscribers for months or years, therefore increasing ARPU versus an atomic, IAP-centric model. However, the requirement to compete with an ever-growing number of mobile subscription apps — including media mammoths such as Spotify and Netflix — means that every subscription app needs to fight hard to acquire and retain paying subscribers, thus providing a new set of challenges for growth practitioners. It is for this reason that Paywall Optimization and Churned Payer Winback make a debut in the Monetization layer, while LTV Modeling and Subscription SDK appear in the Analytics & Insights and Tech layers respectively.

While a successful subscription growth strategy will incorporate many other elements of the Stack, growth practitioners may wish to consider implementing initiatives that leverage one or more of these new elements. Considering subscription optimization holistically, one might apply a model such as this:

Phiture’s approach to Subscription Optimization

Paywall Optimization

Paywalls are now a key feature of many apps. They often mark the boundary between what is available for free, versus content or functionality that the user must pay to access.

Gone are the days when a paywall was built once by the product team as a single user story and then left untouched for months or years while the team focused on new feature development. Paywall optimization is increasingly — and correctly — regarded as an ongoing activity that requires robust measurement and iteration to squeeze out better margins in an increasingly competitive subscription environment.

Paywalls are often and should be shown at multiple points in the user journey. They are also increasingly optimized as part of growth work, with different variants A/B tested to see which messages and graphical presentations resonate better with users and drive more conversions to higher-value subscription packages.

Churned Payer Winback

Juicing conversion rates on the paywall is definitely an important piece of subscription revenue optimization, but winning apps will also pay close attention to the lifetime value of their subscribers. They will need to work tirelessly to reduce subscriber churn by keeping users engaged in the long term (particularly if they happen to be paying subscribers).

While engagement tactics for both free and paid users are covered in the Engagement & Retention layer of the Stack (since these activities often can be applied to both segments), the 2022 update adds Churned Payer Winback explicitly to the Monetization layer. This is a distinct activity that encompasses a potentially wide array of approaches, including provision of discounts, changes to the product flow to recognize and interact with churned users, CRM and more.

Defining Applied Behavioral Science

Many readers may be familiar with ‘gamification’: the application of gaming mechanics to develop or refine UX patterns and flows within products that are likely to be more fun and compelling, or habit-forming. Applied Behavioral Science is a more comprehensive term to capture the set of principles, theory and approaches that growth professionals are leveraging in order to increase engagement and usage frequency.

For those wanting to get a decent grounding in the topic and how these principles can be applied to digital products, we recommend checking out Nir Eyal’s Hooked. Another, older book that explores relevant concepts (such as scarcity, social proof and authority, to name a few), is Robert B Cialdini’s Influence: The Psychology of Persuasion.

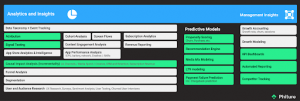

Analytics & Insights restructured and augmented

The landscape of mobile app analytics and insights is evolving rapidly, with new third-party APIs and in-house systems being developed to help growth practitioners employ statistical methods and Machine Learning models. Their lakes of data are fed by these developments to drive (and measure) incremental improvements across varied growth surfaces.

“The stakes are getting higher.”

The winning apps will be the ones that are able to adapt to new market dynamics and employ new methods and technologies to squeeze more measurable impact from their initiatives.

In the 2022 Stack update, the Analytics & Insights layer has been re-worked substantially. Firstly, the relevant elements have been organized under the columns of the Stack they usually impact (i.e. Attribution is under the Acquisition layer). Secondly, we’ve created two new sub-sections: Predictive Models and Management Insights.

The theme of advanced applied data science runs through many of the updates in the 2022 Stack. This notes the evolution and broadening application of data science expertise; models and tools within digital product companies can empower the creation and growth of great mobile apps, games and platforms.

Predictive Modeling

This new addition to the Stack covers various methods for app publishers to leverage data and create predictions about future behavior for both new and existing users.

The new applied Predictive Modeling tactics:

- Propensity Scoring: Identifying users who are more likely to demonstrate a certain behavior, such as those with a higher propensity to purchase, churn, or make a specific action of interest. Such indicators (if reliable) can be used to inform interventions, such as CRM campaigns, pre-emptive discounts or perks, etc.

- Recommendation Engine: Generating recommendations of relevant content or products through better categorization of the content or product set. Relevant inference about user preferences for these categories is based on their past consumption behavior.

- Media Mix Modeling (a term often used interchangeably with Marketing Mix Modeling or MMM): A relatively mature set of statistical approaches aiming to predict the impact of future marketing efforts based on the analysis of historical data.

- LTV Modeling: Understanding and estimating the lifetime value of users. LTV prediction, like MMM, is another well-researched marketing science topic that has seen renewed interest and application in the world of digital products and mobile apps.

- Payment Failure Prediction: Identifying users likely to fail to make a subscription renewal payment (a subscription-specific and increasingly critical application of propensity scoring).

Predictive analytics initiatives increasingly apply Machine Learning (ML) — often leveraging open-source ML engines or proprietary third-party APIs — to build adaptive models that hold the promise of improving over time based on an ever-increasing number of data points.

While a well-developed and trained ML model can deliver incredible results, often even hard-coded, rule-based heuristics will deliver significant uplift over one-size-fits-all approaches to predicting user behavior in a variety of situations. When applied correctly, this can enhance the experience for the user, exposing them to more relevant, inspirational content. A good example of this is the track and playlist recommendations on platforms like SoundCloud and Spotify: based on the user’s music selection, ML can identify trends and provide suggestions for similar tracks.

It’s also worth noting that some ML models can fail to adapt to highly seasonal situations or other disruptive events (including global pandemics) that weren’t present in the training dataset. Machine Learning is not a panacea (in growth, there are no silver bullets) but it’s great to incorporate it into your growth armory.

Signal Testing

An acquisition-centric application of applied predictive modeling, which is important enough to break out separately, is Signal Testing. This term describes the activity of quantitative evaluation of various early signals that could be predictors of user value through a mix of analysis of user behavioral and revenue data. This adjustment of user acquisition targeting can optimize ad spend towards potential signal events.

Nascent platforms such as worthy.ai bring a significant level of automation, Machine Learning and predictive analytics to bear on the challenge of identifying signals that can be used to guide the (increasingly opaque) algorithms of ad networks towards users who deliver a higher ROI.

Causal Impact Analysis (aka Incrementality Analysis)

While Predictive Modeling initiatives aim to pre-empt future behavior, Causal Impact Analysis looks backward to understand the incremental contribution of specific activities, such as UA spend, App Store Optimization, CRM campaigns, new feature releases, pricing and paywall changes, to name a few.

Understanding incrementality of initiatives should be critical to any data-driven growth practitioner and hence, this activity is an element that cuts through the main layers of the Stack. Where it’s possible and practical to create control groups within your data set and run A/B tests, measuring incrementality is relatively straightforward. In many real-world scenarios however, it may not be possible or practicable to carve out clean control groups. In such cases, statistical methods can be applied to estimate incrementality. This post from Kan Nishida on the Exploratory blog does a pretty good job of breaking it down in simple terms.

Such analysis will become more prevalent as platforms like Apple and Google increase privacy controls and deterministic user-level attribution makes way for fuzzier, aggregated datasets. Mobile-specific platforms like INCRMNTL that take a lot of the leg-work out of conducting robust incrementality analysis are likely to benefit from this shift, as marketers seek more clarity on how UA campaigns are really performing and to inform, invest or divest decisions for media spend.

Strategic Management: A whole new layer

After five years of consulting mobile app publishers across many categories, it’s clear that many companies at all stages of maturity struggle to integrate their mobile growth initiatives and insights with broader strategic planning activities.

While the Mobile Growth Stack framework has helped teams to develop and apply more coherent approaches to growing apps, historically it has overlooked the activities and initiatives that bridge the mobile growth function and broader leadership of the business. In an effort to correct this, the new Strategic Management layer along with associated Management Insights, have been added to the 2022 version of the framework.

Many companies don’t have a growth model that enables them to answer questions like: “is it better on a one-year time horizon to increase retention by 5% or acquisition by 20%?”. This makes Scenario Planning difficult, if not impossible.

Even public-listed companies can struggle with reporting and dashboarding at the right level of granularity to inform strategic decisions, leading to an overworked data or BI team. Creating automated reporting and dashboards at the right level of abstraction for management will pay dividends in the long term and lead to more focused enquiries and discussions.

Growth Team Development

Creating autonomy and providing ring-fenced engineering and data analysis resources often allows growth teams to run more autonomously. For this reason, Growth Team Development has a place in the Strategic Management layer.

There are various approaches to structuring and resourcing an effective growth team. For a great primer, Andrew Chen provides a fantastic overview of growth team development and structuring.

KPI Target Setting & Tracking

Sometimes an increase in one metric might lead to a decline in others. Showing more adverts for example, might increase ad revenue while reducing overall app engagement, especially when taken to extremes. This article on the Reforge blog explores such complexities and makes the case for a more nuanced approach to metrics optimization, highlighting limitations of the North Star Metric concept (powerful as it is). Such trade-offs need to be managed decisively by senior leadership and informed by up-to-date insights.

Roadmaps

Aligning roadmaps across the four pillars of Product, Tech, Marketing and Content is a key leadership challenge. Many of the organizational failures or missed opportunities that we see in the companies we consult stem from misaligned roadmaps, leading to marketing teams planning launches or campaigns that are under-supported by the technical, product and content streams and vice versa.

At first glance, roadmaps might seem too obvious or basic to include in a growth framework. From a growth-centric perspective, certain initiatives seem obvious and simple enough to deliver. However, many ‘quick wins’ and ‘low-hanging fruit’ (let alone bigger bets) fall flat or roll out unreasonably slowly due to lack of alignment with other teams’ roadmaps and priorities. This is particularly true of engineering, where expensive development resources are invariably assigned to critical work, much of it vital just to keep the product running smoothly.

At the business level, growth is important but rightly competes for priority with essential maintenance, bug-fixes, new feature development and numerous other initiatives.

“Growth will not always be top priority, and rightly so.”

Consideration of planned growth initiatives in the context of other teams’ roadmaps is therefore essential. Acknowledgement of this in the Mobile Growth Stack is a nod to the fact that businesses thrive when teams pull together and face external competition in the marketplace with a united and co-ordinated approach.

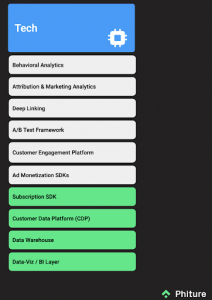

Evolving the Tech layer

Analytics recategorized

The Tech layer has been expanded to differentiate between Attribution & Marketing Analytics (typically comprising solutions that show the effectiveness of user acquisition campaigns) and Behavioral Analytics (aka Product Analytics), which delivers a more granular understanding of user behavior within the app.

There exists some overlap between, but certainly the third-party mobile analytics landscape could be crudely bifurcated into these two camps. For Marketing Analytics, we can consider solutions such as Appsflyer, Adjust, Singular, Tenjin, etc. whereas for Behavioral Analytics, platforms like Amplitude and Mixpanel provide the ability to slice and dice user behavior data to investigate screen flows, engagement and conversion funnels, cohort retention, etc.

Customer Engagement Platforms

This isn’t necessarily a new addition; the previous version of the Stack included Marketing Automation SDK in the Tech layer to refer to platforms that provide CRM capabilities like push notifications, emails and in-app messages. The 2022 Stack updates the name to align with how most of the popular platforms such as Braze, Leanplum, OneSignal, CleverTap, Airship, etc. tend to describe themselves these days.

Subscription SDK

This new addition has sprung up for app developers to deploy, manage and measure subscription products. Platforms like Adapty, RevenueCat, Purchasely, Superwall and Qonversion are helping even small apps to build and optimize subscription products, without having to build all of the plumbing, reporting and paywall tech manually.

Customer Data Platform (CDP)

All Tech components — both in-house and third party — have data inputs and outputs and often benefit from integration with each other at various points. For example, by pairing Attribution Analytics with Behavioral Analytics, you can break down user engagement by acquisition source, campaign or creative. It’s necessary to note however, that this kind of precision is decreasingly possible on iOS with the advent of SKAdNetwork. For a detailed overview of what Apple’s privacy changes mean for publishers, check out Eric Seufert’s excellent article and other resources on his MobileDevMemo blog.

While it is almost always possible to implement data integrations directly between two or more tools, Customer Data Platforms such as Segment, mParticle and Tealium promise to simplify and future-proof such connections, while providing a unified view of the user. CDPs facilitate the orchestration of data flows between internal and external systems, so that users and audiences can be more effectively segmented, targeted and engaged at all points in their individual and collective journeys.

CDPs also facilitate increased data integrity, governance and flexibility, as well as to make the right data more available and actionable across the rest of the Tech and Analytics Stack. CDPs provide capabilities to enrich user profiles through a combination of data from multiple sources and provide a central control point for data-governance (including privacy controls).

CDPs also often include functionality to compute compound metrics, event counts and apply pre-processing functions or filters on data flowing through the system. This includes aggregation, validation, scoring, etc. that would otherwise have to be applied in a separate dedicated system rather than centrally.

Growth is never complete (and neither is the Mobile Growth Stack)

In this 2022 revision, the Mobile Growth Stack framework has been thoroughly updated to reflect and encompass the key developments and trends in the mobile app industry and the maturation of the field of mobile growth.

This edition has increased the amount of information in what was already a pretty extensive framework. In all significant endeavors, trade-offs must be made: in this update, we have consciously leaned in favor of capturing new elements that can help growth practitioners succeed, while ordering elements in the Stack in a way that hopefully makes it more intuitive to navigate, despite the increased density.

As always, we welcome any feedback, critique and commentary on the framework and its usefulness to growth practitioners in this dynamic and rapidly-evolving space. Join the discussion in our Mobile Growth Stack slack community of growth professionals from across the industry.

Table of Contents